Studying Time: 9 minutes

The monetary providers trade in India is racing by means of a once-in-a-generation transformation. After years of incremental upgrades, banks and fintechs now face an pressing mandate: transfer past legacy infrastructure and ship seamless, real-time buyer experiences. The strain is coming from each path, like rising shopper expectations, regulatory shifts, and the fast progress of digital-first rivals.

But this isn’t merely a narrative of know-how adoption. It’s about constructing a contemporary stack that mixes information, agility, and customer-first considering right into a single engine of progress. Some corporations that had been late to start out have ended up shifting the quickest. They’re catching up by constructing unified information layers and engagement platforms that may scale.

To discover how this shift is unfolding, MoEngage lately hosted a panel that includes Saurabh Chandra, Associate at EY, and Yash Reddy, Chief Enterprise Officer at MoEngage. The dialog examined the arduous realities of modernization: from the complicated journeys of public-sector banks to the fast-moving fintechs which can be rewriting the foundations.

Their insights reveal a transparent message for monetary providers leaders, and the takeaway was simple: a digital basis that may deal with fixed change issues greater than any single platform. Leaders who get that proper can be prepared for the subsequent wave, each time it comes.

1. Late Begin, Sooner Trajectory

India didn’t rush into digital banking the best way some Western markets did. However as soon as the shift started, it gathered velocity that’s arduous to disregard. Over the previous couple of years, digital funds have gone from a aspect story to the principle engine of on a regular basis transactions. Fintech adoption continues to develop, monetary inclusion reaches deeper every quarter, and huge banks that had been as soon as hesitant at the moment are experimenting at almost the identical tempo as startups.

Listed below are the stats that again up this:

- Digital funds in India have elevated by over 129 occasions when it comes to transaction quantity between FY 2012-13 and FY 2023-24.

- In FY 2023-24, India’s digital funds by worth rose from ₹1,370 lakh crore in FY 2017-18 to ₹2,428 lakh crore.

- In keeping with Deloitte’s 2024 Digital Banking Maturity survey, the Digital Banking Maturity (DBM) Index amongst main Indian banks jumped from 43% in 2022 to 59% in 2024 — an enchancment that places Indian banks forward of many international friends in customer-facing digital capabilities.

This fast progress, nonetheless, isn’t unfolding in a single, uniform means. India’s monetary ecosystem is huge and numerous, and the trail to modernization varies broadly relying on the kind of establishment. Fintechs, private-sector banks, and public-sector giants every face their very own distinctive mixture of alternatives and constraints, starting from the liberty of a clear slate to the complexity of decades-old programs and the problem of scale.

As Saurabh Chandra of EY highlighted in the course of the panel, understanding these variations is important to understanding the place the trade is headed. His easy however highly effective framework breaks the market into three distinct archetypes, every by itself journey towards a contemporary digital stack.

2. Three Archetypes, Three Journeys

India’s monetary providers sector isn’t shifting in a straight line. Every establishment has a novel start line, distinct constraints, and ranging pressures. The velocity of change and the strategy to digital adoption rely considerably on legacy programs and the out there room for experimentation. On the MoEngage–EY panel, Saurabh Chandra sketched three broad archetypes to make sense of this.

- Nimble Fintechs

Fintechs born within the cloud period begin with nearly no baggage. They’ll deploy fashionable stacks, equivalent to information lakes, AI instruments, and real-time analytics, with out worrying about unwinding many years of legacy programs. Buyer engagement tends to be instant: notifications, gives, and insights attain customers nearly earlier than they ask for them. That agility allows them to maneuver shortly with new merchandise and set the bar for easy, seamless experiences. Nevertheless, that velocity can include trade-offs; governance and scaling aren’t at all times absolutely baked from the outset.

- Massive Personal Banks

Personal banks carry many years of historical past of their programs. Core banking platforms, previous databases, batch processes—these aren’t straightforward to exchange. Modernization right here is methodical. Information pipelines require cleansing, datasets want governance, and migrations to hybrid or open-source programs happen slowly. The goal is to maneuver shortly sufficient to fulfill buyer expectations with out compromising the reliability and belief that the model has established. It’s a cautious balancing act.

- Public-Sector Giants (PSUs)

India’s public-sector banks and insurers function at a unprecedented scale; some rank among the many world’s largest. That scale brings a unique actuality: each know-how determination carries systemic affect. Platformization is the brand new buzzword, however warning drives its tempo. For them, digital transformation is a marathon, requiring meticulous planning and regulatory alignment to make sure stability whereas introducing new capabilities.

As Chandra summed it up in the course of the dialogue, “To vary the entire shifting ship is troublesome… there’s a humongous room for platformization and alter.”

Collectively, these three archetypes illustrate why India’s monetary providers sector is each complicated and filled with potential. Every group’s journey is exclusive, but all share a typical vacation spot: a contemporary stack able to real-time engagement and data-driven progress.

Whereas the journeys of those three archetypes differ, one theme is common: adopting a contemporary stack isn’t nearly upgrading programs; it requires a elementary shift in mindset, processes, and organizational readiness.

3. Modernization Is Extra Than Know-how

Digital transformation isn’t nearly choosing the most recent instruments. It’s about altering how a corporation thinks, the way it operates, and the way it delivers worth to clients. The panel made it clear that even essentially the most superior know-how gained’t create affect if individuals, processes, and technique aren’t aligned.

Challenges know-how alone can’t repair:

- Groups are struggling to behave on insights shortly

- Siloed processes throughout departments

- Management with no clear imaginative and prescient for transformation

Yash Reddy from MoEngage put it this manner:

“It feels prefer it’s simply greater than a know-how shift—it’s a change within the methods of working, it’s a change within the operational readiness of the banks and the FS establishments, and it’s a change in strategic mindset as effectively.”

What helps modernization really work:

- Streamlined decision-making: Breaking hierarchical bottlenecks to reply quicker

- Empowered groups: Giving workers actionable information for close to real-time choices

- Unified collaboration: Aligning advertising and marketing, operations, and buyer expertise towards the identical purpose

For giant banks and PSUs, this mindset shift is important due to legacy buildings and sophisticated hierarchies. Even nimble fintechs profit from operational self-discipline to scale successfully.

Whereas mindset and operational readiness set the stage, the actual problem lies within the spine of any transformation: information. How establishments handle, clear, and unify their information determines whether or not modernization efforts succeed or stall.

4. Information: The Basis and the Friction

All the things in modernization comes again to at least one factor: information. With out clear, accessible, and well-governed information, even the perfect know-how and methods stumble.

Challenges monetary establishments face with information:

- Fragmented programs: Legacy databases, a number of platforms, and disconnected processes create silos

- Information high quality points: Inconsistent, incomplete, or outdated info undermines decision-making

- Scalability constraints: Dealing with massive volumes of transactions and buyer interactions in close to real-time is troublesome with no sturdy structure

As Saurabh Chandra from EY noticed in the course of the panel:

“Massive banks are catching up when it comes to information engineering, metadata administration, and information high quality checks. The facility of digital advertising and marketing—and broader transformation—relies upon closely on getting these fundamentals proper.”

Why fixing the information problem is essential:

- Permits real-time personalization and engagement throughout channels

- Helps quicker decision-making and operational agility

- Supplies a single supply of reality for analytics, compliance, and buyer insights

In essence, information is each the spine of transformation and its greatest stumbling block. Fixing it successfully requires a unified platform that brings collectively buyer information, insights, and engagement capabilities. With out that, even robust methods can fall quick.

5. Why an Built-in Stack Issues

As soon as mindset, operations, and information foundations are set, the subsequent hurdle is integration. With out a unified system, even robust methods and fashionable instruments can fall in need of their potential. Fragmented platforms, siloed departments, and disconnected information hinder decision-making, result in errors, and end in an inconsistent buyer expertise.

The important thing benefits of an built-in stack:

- Unified Buyer View: Combining information from a number of sources, equivalent to transaction programs, CRM platforms, and engagement channels, supplies a single, complete view of every buyer. Insights develop into actionable, campaigns are higher focused, and messaging stays constant throughout touchpoints.

- Seamless Cross-Channel Engagement: Clients work together throughout a number of channels, together with cellular, net, e-mail, and social media. A linked platform allows the administration of those journeys in real-time, permitting for scalable personalization with out compromising management.

- Operational Effectivity and Agility: Integration reduces handbook handoffs, repetitive duties, and dependency on a number of distributors. Groups can concentrate on technique and innovation quite than reconciling fragmented information and programs.

- Scalability and Flexibility: As establishments develop, launch new merchandise, or enter new markets, a unified platform can deal with an rising variety of transactions and sophisticated buyer journeys with out including complexity.

Throughout the panel, Saurabh Chandra from EY famous:

“For PSUs and huge banks, platformization will not be elective. To inject new capabilities and attain clients effectively, you want a unified system that may scale throughout the group.”

Saurabh Chandra from EY defined on the panel:

“For PSUs and huge banks, platformization will not be elective. To inject new capabilities and attain clients effectively, you want a unified system that may scale throughout the group.”

Integration is greater than a technical repair. It connects know-how to enterprise technique. When insights, operations, and buyer interactions are linked, establishments can transfer extra shortly, innovate constantly, and ship experiences that really matter. Due to this fact, a contemporary built-in stack serves as the muse that permits monetary establishments to transition from fragmented efforts to a coordinated, data-driven strategy. That’s the place actual progress begins.

With the significance of an built-in stack clear, the subsequent query turns into: how can monetary establishments carry information, engagement, and personalization collectively seamlessly? That is the place a unified Buyer Information and Engagement Platform performs a pivotal function.

6. MoEngage because the Fashionable Engagement Spine

Digital transformation in monetary providers is not only about adopting the most recent know-how; additionally it is about leveraging it successfully. It’s about bringing information, insights, and buyer engagement collectively to create experiences that really matter. MoEngage, as a Buyer Information and Engagement Platform (CDEP), helps establishments obtain this by unifying programs, personalizing interactions, and making each buyer touchpoint significant.

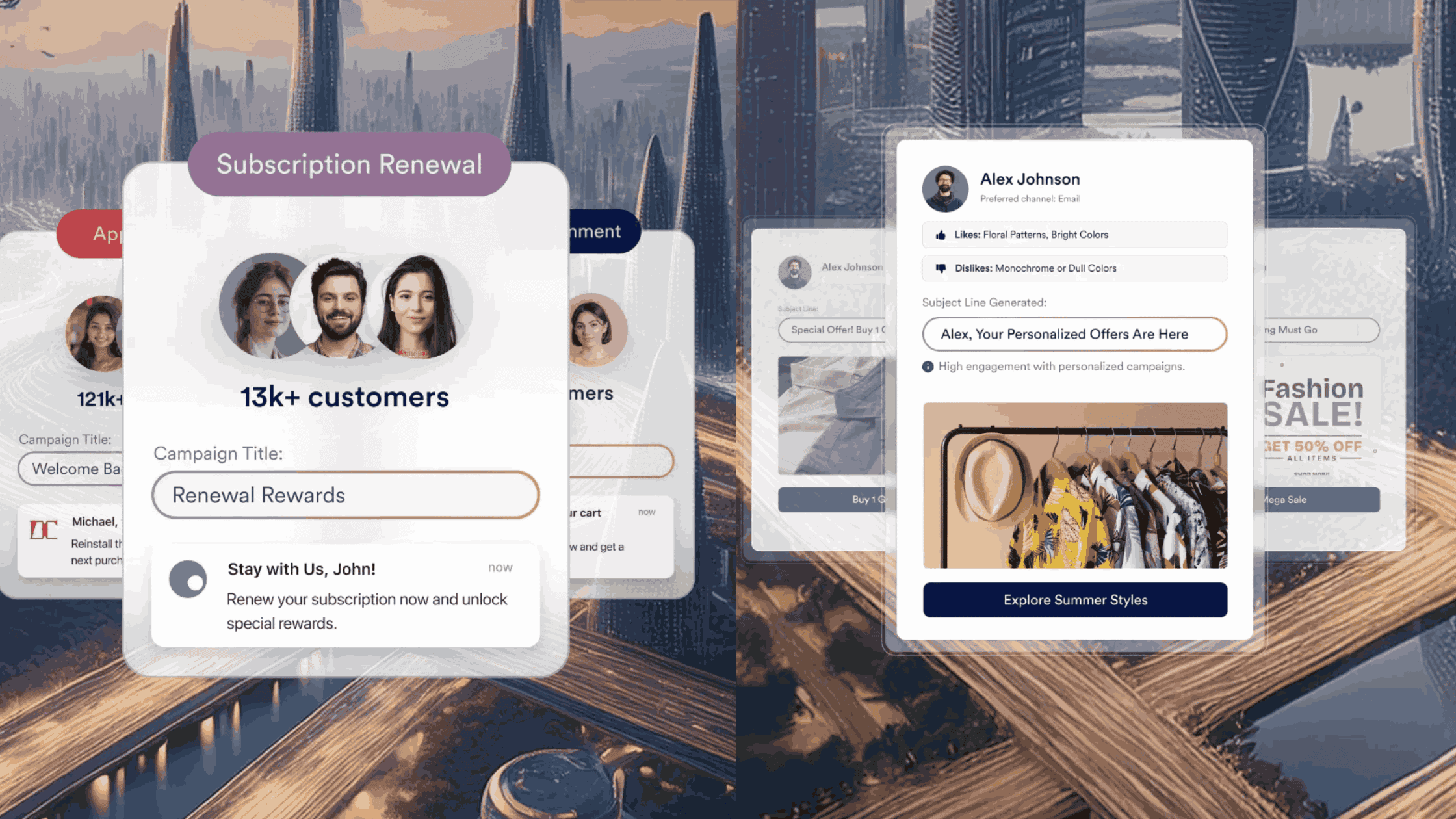

Unified Buyer Profiles for 360° Insights

One of many greatest challenges banks and monetary establishments face is the fragmentation of knowledge. MoEngage addresses this by consolidating buyer info from cellular apps, web sites, CRM programs, and even offline channels right into a single, complete profile. With this, groups can:

- Perceive every buyer’s behaviors, preferences, and previous interactions

- Make smarter, data-driven choices for campaigns and product launches

- Ship customized messages and gives that really resonate

- Keep away from the frustration of working throughout a number of disconnected programs

By making a complete image of every buyer, monetary establishments can transfer away from reactive advertising and marketing to proactive, insight-driven engagement.

AI-Pushed Personalization at Scale

MoEngage makes use of AI to ship customized communication past generic messaging. It helps establishments predict what clients need and ship it on the proper second. This implies:

- Recommending services which can be really related to every individual

- Triggering messages and notifications primarily based on real-time habits

- Growing engagement and conversion by anticipating buyer wants

- Shifting away from one-size-fits-all advertising and marketing towards customized journeys at scale

This AI-driven personalization ensures that monetary establishments are now not speaking by means of generic, one-size-fits-all campaigns; as an alternative, they’re constructing relationships at scale.

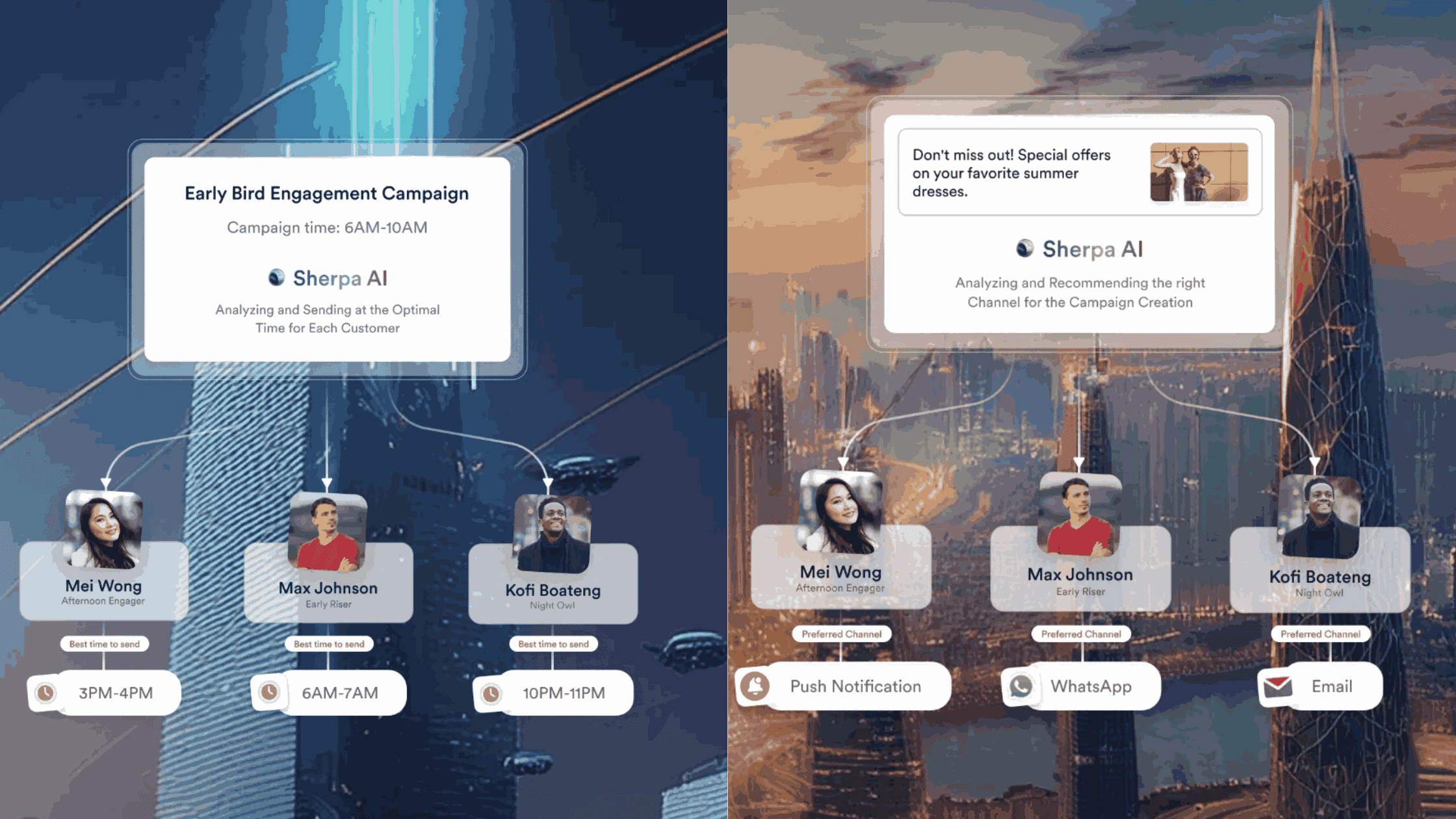

Cross-Channel Orchestration for Seamless Engagement

Clients don’t stick to at least one channel, so neither ought to establishments. MoEngage makes it straightforward to have interaction throughout push notifications, e-mail, SMS, in-app messages, net push, and WhatsApp. With this, groups can:

- Plan constant buyer journeys throughout each channel

- Run campaigns from a single platform, reducing down on handbook work

- Ship well timed and related messages that really feel private

- Construct belief and loyalty by means of seamless experiences

Bringing all channels collectively helps keep away from fragmented messaging and ensures buyer interactions stay related.

Actual-Time Analytics for Smarter Choices

Realizing how campaigns are performing is essential. MoEngage gives real-time analytics and reporting, serving to groups shortly see what works and what doesn’t:

- Monitor consumer habits, funnel efficiency, and engagement traits

- Run A/B checks and optimize campaigns on the fly

- Acquire actionable insights to enhance retention and lifelong worth

- Make knowledgeable, well timed choices as an alternative of guessing

With these analytics, monetary establishments can transition from intuition-based choices to evidence-driven methods, making certain that each engagement drives a measurable affect.

Scalable Infrastructure for Rising Wants

Finally, MoEngage is designed to scale as establishments develop their operations. It could actually deal with billions of messages every month and thousands and thousands of energetic customers, making certain groups can:

- Increase services or products with out worrying about tech limits

- Deal with technique and innovation as an alternative of infrastructure complications

- Preserve easy efficiency throughout peak occasions

- Cut back dependency on a number of instruments by having every part below one platform

This scalability ensures that MoEngage grows consistent with the group, supporting each present operations and long-term transformation objectives.

By combining unified profiles, AI personalization, cross-channel orchestration, analytics, and scalable structure, MoEngage acts because the spine for contemporary engagement. It strikes establishments past previous programs, fragmented information, and siloed operations.

MoEngage is greater than a platform. It’s a strategic enabler. It turns insights into motion, improves operational effectivity, and helps create clients who’re engaged, loyal, and model advocates. It’s not good. Implementation takes work. Nevertheless, it demonstrates how fashionable engagement can really perform when every part is linked and sensible.

7. Conclusion

MoEngage allows monetary establishments to attach information, insights, and engagement seamlessly, eliminating the necessity to juggle a number of instruments. From unified buyer profiles to AI-driven personalization and real-time analytics, it allows banks and fintechs to know what clients want, reply in real-time, and preserve that connection as they scale.

In the event you’re exploring find out how to exchange scattered programs with one engagement spine, it’s value seeing in motion. Schedule a demo with the MoEngage staff to stroll by means of actual use instances and perceive the way it can match into your digital transformation plans.