![]() Trusted Sensible Chain fails to offer possession or govt info on its web site.

Trusted Sensible Chain fails to offer possession or govt info on its web site.

I got here throughout Trusted Sensible Chain when an IN8 advertising video linked to in one in every of BehindMLM’s articles was flagged as deleted.

The video was uploaded by Travis Flaherty. To substantiate I visited Flaherty’s YouTube channel and located the movies had been deleted.

IN8 began off as an NFT grift spinoff of iX International, an unregistered funding scheme sued by the SEC and topic of two felony investigations by Indian authorities.

Flaherty was a named defendant within the SEC’s $110 million iX International fraud lawsuit;

Flaherty is an iX International “Model Ambassador” and, as such, has solicited traders to buy DEBT Field crypto asset securities.

Flaherty can be the Registered Agent for Reduction Defendant Flaherty Enterprises, LLC.

After IN8 collapsed just a few months after launch, proprietor and wished fugitive Joe Martinez rebooted it as a failed DAO mission.

Getting again to Flaherty’s YouTube channel, after IN8 Flaherty uploaded advertising promo movies for Shoply and Nuway Healthcare.

Neither of these appear to have panned out, with Flaherty importing movies on “TSC” from late 2024.

“TSC” stands for Trusted Sensible Chain. Within the video description of “TSC Overview 12-28”, uploaded on December twenty ninth, 2024, Flaherty confirms he’s a Trusted Sensible Chain co-founder.

I’m thrilled to formally announce my acceptance as Co-Founder and Chief Advertising Officer of Trusted Sensible Chain (TSC).

The thumbnail of Flaherty’s video cites Billy Seaside as Trusted Sensible Chain’s different co-founder:

Billy Seaside, aka Mark Williams Schuler, was additionally a named defendant within the SEC’s iX International fraud lawsuit.

Schuler is an iX International “Model Ambassador” and, as such, has solicited traders to buy DEBT Field crypto asset securities.

Together with Defendant Benjamin Daniels, Schuler is the co-founder and a member of Defendant Core 1 Crypto, an entity that partnered with DEBT Field to solicit DEBT Field traders.

As well as, together with Defendants Alton Parker and Benjamin Daniels, Schuler is a co-founder of the FAIR Venture, and has solicited traders to buy crypto belongings provided by the FAIR Venture.

Whether or not there are different Trusted Sensible Chain co-founders is unclear. Given each Flaherty and Schuler have been lately named defendants in a US regulatory fraud lawsuit, this non-disclosure is a major pink flag.

Trusted Sensible Chain’s web site area (“trustedsmartchain.com”), was privately registered on October 2nd, 2024. Trusted Sensible Chain’s web site was put collectively in November 2024.

As all the time, if an MLM firm is just not brazenly upfront about who’s operating or owns it, assume lengthy and exhausting about becoming a member of and/or handing over any cash.

Trusted Sensible Chain’s Merchandise

Trusted Sensible Chain has no retailable services or products.

Associates are solely capable of market Trusted Sensible Chain affiliate membership itself.

Trusted Sensible Chain’s Compensation Plan

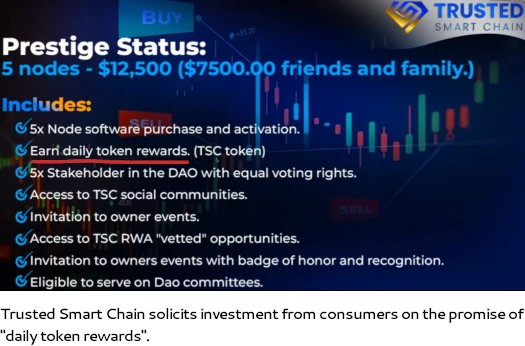

Trusted Sensible Chain associates make investments $1500 to $125,000 in TSC tokens.

- Founding Member positions are $1500 for “family and friends” and $2500 for everybody else

- Status Standing positions are $7500 for “family and friends” and $12,500 for everybody else

- Luminary Standing positions are $30,000 for “family and friends” and $50,000 for everybody else

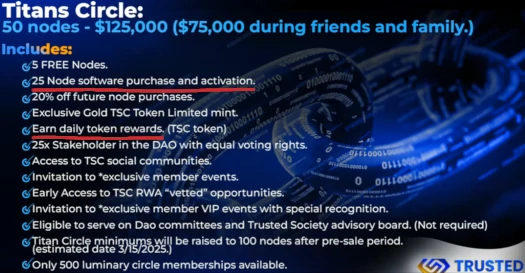

- Titans Circle positions are $75,000 for “family and friends” and $125,000 for everybody else

Funding in TSC tokens is completed on the promise of “each day token rewards”. Notice that particular TSC token quantities per funding made are usually not disclosed.

That mentioned:

- Status Standing returns are represented to be 5 instances that of Founding Member funding positions

- Luminary Circle returns are represented to be a twenty-two instances multiplier

- Titans Circle returns are represented to be a twenty-five instances multiplier

Trusted Sensible Chain associates are capable of take part in a “staking” funding scheme, purportedly funded by 20% of each day returns paid out to affiliate traders.

Trusted Sensible Chain affords further passive returns by “vetted alternatives” (particular particulars are usually not disclosed).

The MLM facet of Trusted Sensible Chain sees it pay referral commissions on invested funds down two ranges of recruitment (unilevel):

- degree 1 (personally recruited associates) – 10%

- degree 2 – 5%

Becoming a member of Trusted Sensible Chain

Trusted Sensible Chain affiliate membership is tied to a $1500 to $125,000 funding.

The extra a Trusted Sensible Chain affiliate invests the upper their earnings potential.

Trusted Sensible Chain Conclusion

Trusted Sensible Chain is a continuation of the fraudulent funding scheme Travis Flaherty and Billy Seaside promoted by iX International.

It’s the identical node funding place setup with a special identify (in iX International the positions have been “x-nodes”).

It ought to be famous that what made the iX International and Debt Field node funding scheme unlawful was securities fraud. Particularly the scheme not being registered with the SEC and claims about exterior income technology to fund withdrawals being bogus.

It’s price noting that in an effort to justify mentioned fraud, Flaherty mischaracterizes the result of the SEC’s iX International lawsuit.

[14:56] So we fought this battle with the SEC and we gained. We truly gained our case, the case was dismissed.

Not solely was the case dismissed however the attorneys, the SEC was fined tens of millions of {dollars} by the Decide, and the attorneys that introduced the case ahead in opposition to us, the precise attorneys have been fired and so they closed the Salt Lake Metropolis Workplace that introduced the case in opposition to us.

Extra importantly, this was very public and there was vindication within the public’s eye as a result of individuals noticed that this was a witch hunt.

The SEC’s lawsuit in opposition to iX International and Flaherty was voluntarily dismissed and the SEC attorneys concerned resigned. However this wasn’t as a result of iX International and Flaherty gained the case.

The SEC attorneys concerned obtained some dates mistaken after which didn’t adequately treatment the error. This was picked up on by the protection’s authorized staff who introduced it earlier than the Decide.

That led to the case being voluntarily dismissed by the SEC on procedural grounds. It had nothing to do with the deserves of the SEC’s allegations.

In actual fact when iX International proprietor Joe Martinez discovered the SEC meant to refile the case, he shut down iX International.

Why?

As a result of regulation of securities fraud within the US is and has been materially the identical since 1933. It’s a well-established space of economic legislation with a selected path anybody can comply with to verify fraud.

As with iX International, in an effort to function its node place funding scheme legally Trusted Sensible Chain must be registered with the SEC.

Together with registration, Trusted Sensible Chain must be submitting periodic audited monetary stories. That is essential as it’s the solely strategy to confirm any exterior income technology claims Trusted Sensible Chain makes.

A search of the SEC’s public EDGAR database reveals that, as at time of publication, neither Trusted Sensible Chain, Travis Flaherty, Mark Williams Schuler or his alias Billy Seaside are registered with the SEC.

That is verifiable securities fraud and a repeat of iX International.

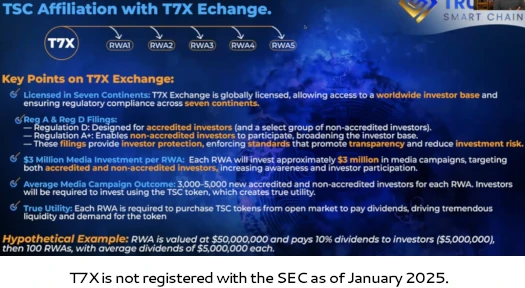

It’s famous that Trusted Sensible Chain seems to attempt to palm of regulatory compliance onto T7X. As per the FAQ part on Trusted Sensible Chain’s web site;

Will TSC Be Listed on Exchanges?

As a community-driven blockchain, choices concerning the itemizing of TSC tokens on exchanges are decided by the TSC neighborhood.

Whereas there is no such thing as a assure that TSC can be listed on any particular alternate, it’s price noting that the founders that launched the TSC Blockchain additionally based T7X.io, an alternate specializing in Actual-World Belongings (RWAs).

The TSC neighborhood will play a key position in shaping the way forward for the TSC blockchain, together with potential alternate listings.

What Is the Relationship Between T7X and TSC?

The founding father of T7X additionally established and launched the Trusted Sensible Chain (TSC) blockchain. TSC was developed to help regulatory compliance for Actual-World Asset (RWA) buying and selling throughout a number of platforms.

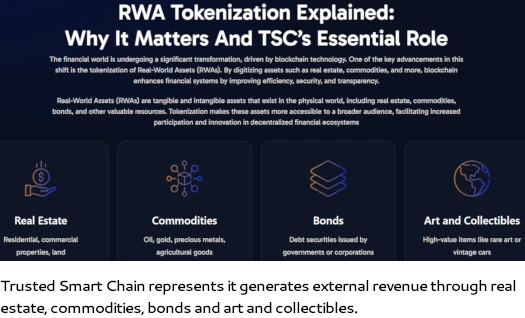

Placing apart failing to reveal who “the founder” is being a Securities and Trade Act violation in and of itself, the introduced ruse is “actual world belongings” are funding Trusted Sensible Chain TSC ROI withdrawals.

I need to firstly notice that T7X isn’t registered with the SEC both. After which even when it was, that doesn’t exempt Trusted Sensible Chain from SEC registration necessities.

Taken at face worth, Trusted Sensible Chain is soliciting as much as $125,000 from customers on the promise of passive returns. This requires Trusted Sensible Chain to register mentioned funding scheme with the SEC (two funding schemes if you happen to embrace the TSC “staking” scheme).

This hasn’t occurred and one want solely take a look at the underlying (and legally unresolved) allegations within the SEC’s iX International lawsuit to verify securities fraud.

To spell it out afresh although, underneath US monetary legislation a securities providing is recognized by confirming the existent of an funding contract.

That is carried out by making use of the Howey Check, which states;

An funding contract exists if there may be an “funding of cash in a typical enterprise with an affordable expectation of earnings to be derived from the efforts of others.”

With respect to Trusted Sensible Chain; customers are investing as much as $125,000 (an funding of cash”) into Trusted Sensible Chain (a typical enterprise), with an affordable expectation of earnings (see passive returns advertising slides), derived from the efforts of others (purported “real-world belongings”).

There isn’t a exemption for cryptocurrency funding schemes within the Securities Trade Act.

I need to stress there is no such thing as a cause for Trusted Sensible Chain to be committing securities fraud, except they aren’t doing what they declare to be. That’s, paying out TSC returns with exterior income.

The SEC warns customers that securities fraud and Ponzi schemes go hand-in-hand.

Any funding in securities within the U.s. stays topic to the jurisdiction of the SEC.

We’re involved that the rising use of digital currencies within the world market could entice fraudsters to lure traders into Ponzi and different schemes.

Ponzi schemes sometimes contain investments that haven’t been registered with the SEC or with state securities regulators.

Because it stands the one verifiable income getting into Trusted Sensible Chain is new funding.

Utilizing new funding to pay TSC ROI withdrawals would make Trusted Sensible Chain a Ponzi scheme.

As with all MLM Ponzi schemes, as soon as affiliate recruitment dries up so too will new funding.

This can starve Trusted Sensible Chain of ROI income, ultimately prompting a collapse.

The maths behind Ponzi schemes ensures that once they collapse, nearly all of individuals lose cash.

It ought to be famous that iX International and Debt Field sufferer losses stay unaccounted for. Previous to dismissing their case, the SEC pegged mentioned losses at $110 million.

Final we heard Debt Field’s homeowners, who’re believed to have misappropriated nearly all of invested funds, had, because the SEC predicted they might in authorized filings, fled to Dubai.

Joe Martinez continues to be within the US nevertheless it wished by Indian authorities in two separate iX International felony instances.