Black Friday and the vacation season flip the Procuring class on the App Retailer into one of the vital aggressive arenas of the 12 months. As customers seek for offers, presents, and last-minute necessities, thousands and thousands of advert impressions and search queries are up for grabs. For app entrepreneurs, that is the second when each rating place, each impression, and each faucet issues.

That can assist you put together for the upcoming season, we seemed again at how Procuring apps carried out in This autumn 2024. Utilizing MobileAction’s knowledge, we analyzed apps within the Procuring class within the US between October 1, 2024, and December 31, 2024. As a substitute of solely installs or income, we centered on what entrepreneurs can management straight: consumer acquisition visibility throughout natural and paid channels.

Our aim is to focus on the methods behind leaders’ visibility so as to apply comparable techniques to your individual app. We’ll deal with the methods of the highest 5 apps within the high 10 listing:

- AliExpress – Procuring App

- Chewy – Pet Care & Pharmacy

- Poshmark: Purchase & Promote Trend

- SHEIN – Procuring On-line

- e.l.f. Cosmetics and Skincare

- Whatnot: Store, Promote, Join

- Nike: Sneakers, Attire, Tales

- The House Depot

- Goal

- Temu: Store Like a Billionaire

All knowledge used on this article is sourced from MobileAction’s merchandise and displays the desired timeframe. The rankings are supposed to spotlight patterns and methods, to not present a full efficiency audit of every app.

The best way to learn the rankings

The rankings on this article aren’t a income chart or set up leaderboard. They replicate consumer acquisition visibility for Procuring apps on the US App Retailer in This autumn 2024, primarily based on MobileAction knowledge.

Apps that carry out effectively listed here are those that repeatedly present up in entrance of high-intent customers throughout natural outcomes, Apple Advertisements, and different paid channels. Some apps lean extra on ASO, others on Apple Advertisements or broader paid campaigns. When studying every profile, take into consideration the combination, not simply the place, and search for patterns that match your individual class and progress stage.

AliExpress is among the most recognizable world marketplaces on the App Retailer, connecting customers with 1000’s of sellers and an unlimited catalog of low-priced merchandise. From electronics and residential decor to vogue and equipment, the app leans closely on time-limited offers, coupons, and flash gross sales that match completely with Black Friday and vacation procuring habits.

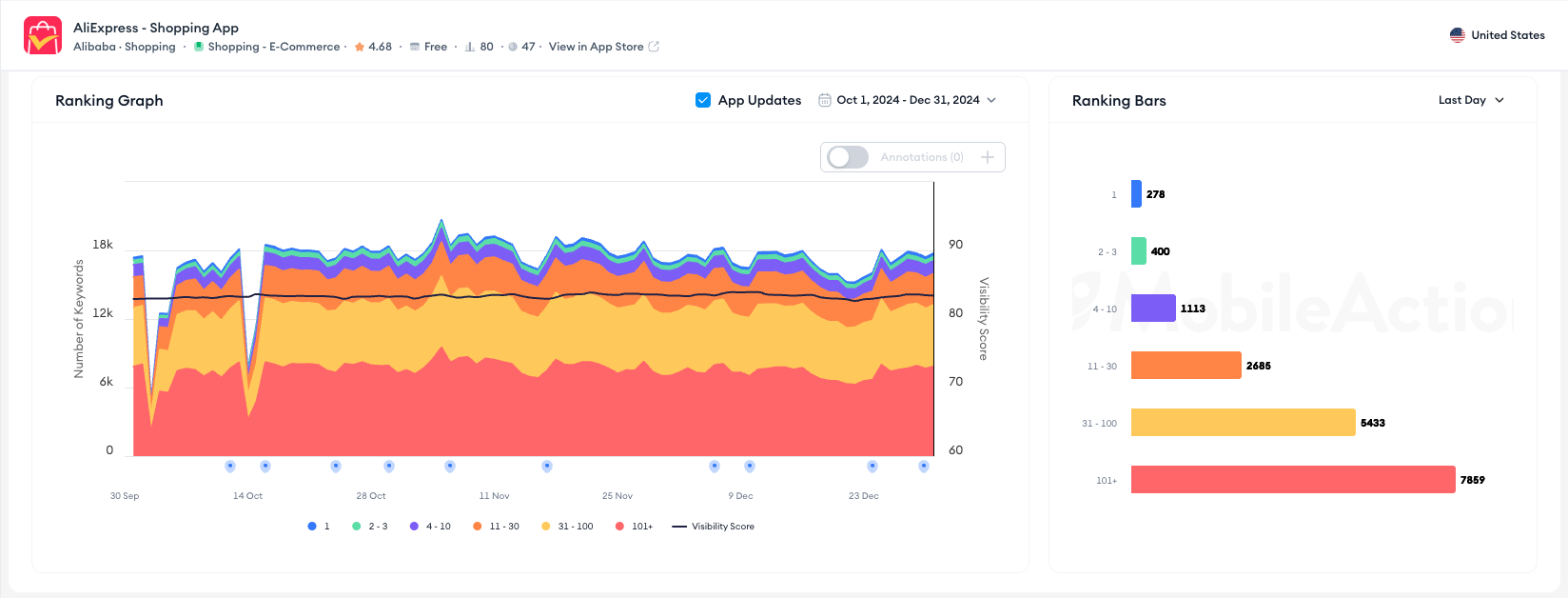

AliExpress – Procuring App’ natural rating distribution graph ASO Report by MobileAction

The rating graph for November and December reveals a constant visibility rating with solely small fluctuations, whilst competitors intensified round Black Friday and the vacation rush. Quick peaks in early November and the ultimate days of December recommend focused optimization and promotional exercise round key procuring moments, fairly than a single spike that fades away. AliExpress is an effective instance of how sustained key phrase distrubition and early seasonal preparation can shield visibility when class strain is at its highest.

Impression share of AliExpress – Procuring App analyzed with Search by App by MobileAction

On the Apple Advertisements aspect, AliExpress focuses closely on proudly owning its model whereas neatly increasing into adjoining demand. SearchAds.com by MobileAction’s knowledge reveals that the app holds a really robust impression share for its core branded queries, making certain that customers looking out straight for AliExpress virtually all the time see it within the advert placements.

Customized product pages key phrases of AliExpress – Procuring App by MobileAction Natural CPP Outcomes

AliExpress makes use of its customized product pages to compete on a large set of high-intent procuring and market queries, not solely its personal title. The identical customized product web page seems for generic phrases like “procuring” and “store”, in addition to for searches that embody different giant retail and market manufacturers.

Advert inventive insights of AliExpress – Procuring App analyzed with Artistic Evaluation by MobileAction

Advert Intelligence reveals that AliExpress runs campaigns with a big inventive library and a broad community of publishers, putting it among the many higher-ranking advertisers within the Procuring class. This scale means that AliExpress treats creatives as a efficiency lever, continuously rotating codecs, ideas, and provides fairly than counting on a small set of evergreen advertisements.

2. Chewy – Pet Care & Pharmacy

Chewy focuses on a really particular viewers and has constructed a robust cell expertise round that area of interest. The app brings collectively pet meals, toys, equipment, and pharmacy providers in a single place, with subscription choices and personalised suggestions that encourage repeated utilization.

Chewy – Pet Care & Pharmacy’s natural rating distribution graph ASO Report by MobileAction

The rating graph for November and December reveals a stable visibility baseline with clear lifts across the peak vacation weeks. Quick spikes close to key dates recommend that Chewy layers seasonal optimizations on high of an already robust core, fairly than relying solely on non permanent techniques. For entrepreneurs in area of interest verticals, Chewy is an effective instance of how centered key phrase protection and constant class presence can compete with a lot bigger Procuring gamers throughout This autumn.

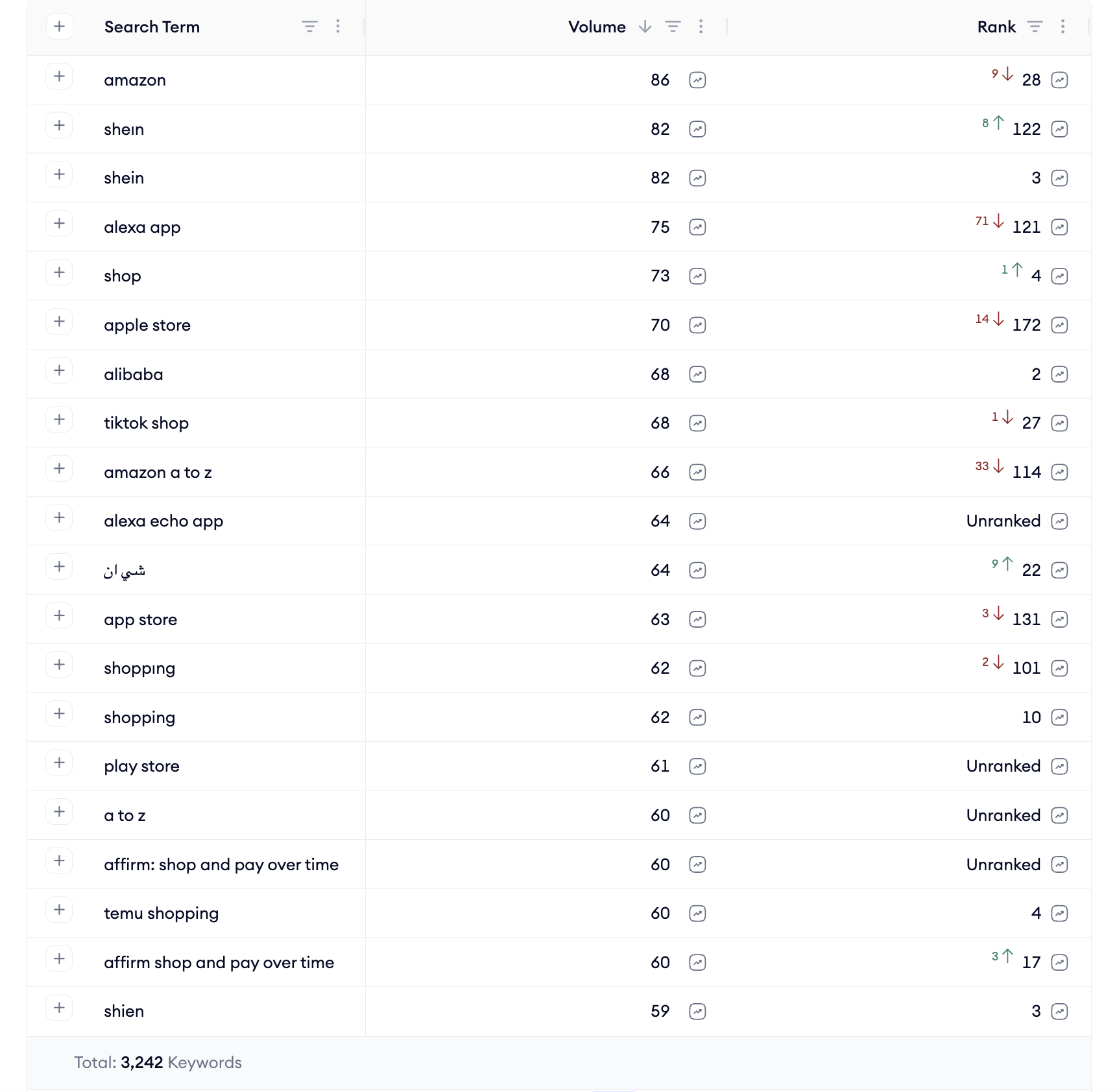

Impression share of Chewy – Pet Care & Pharmacy analyzed with Search by App by MobileAction

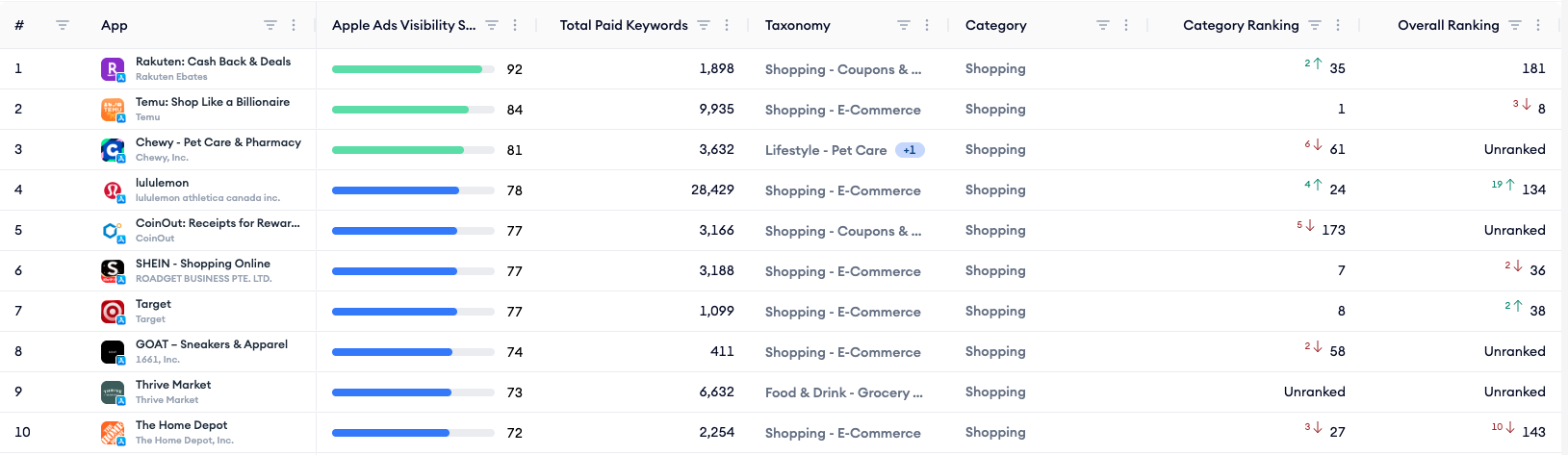

SearchAds.com by MobileAction’s Apple Advertisements knowledge reveals that Chewy additionally takes a selective however intelligent method to key phrase shopping for. As a substitute of chasing each high-volume retail question, the app seems on a mixture of pet-related, service-oriented, and retailer-focused phrases the place it might probably keep highly-visible with a comparatively small group of opponents.

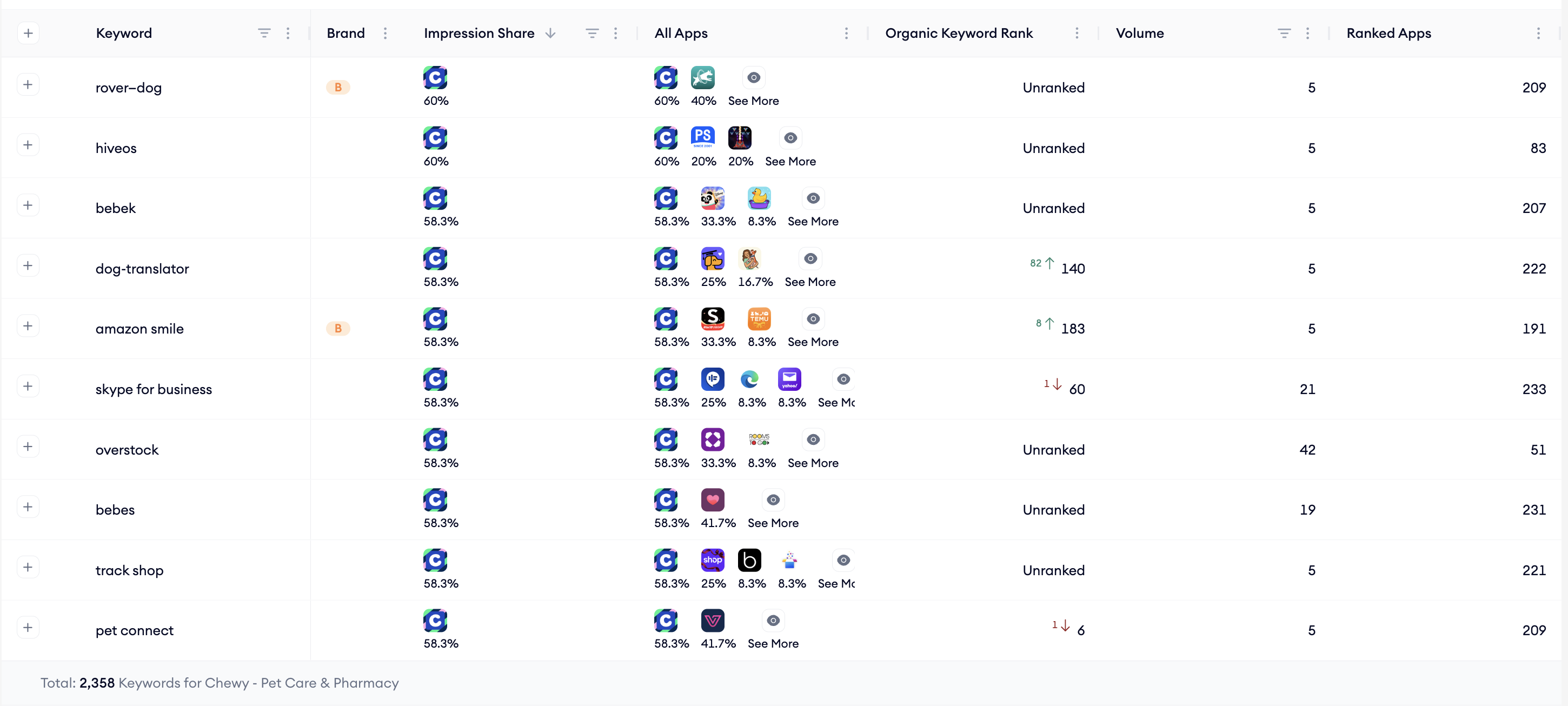

Apple Advertisements high advertisers evaluation of the Procuring class within the US by SearchAds.com by MobileAction

Chewy’s place in Apple Advertisements can also be notable whenever you zoom out to the broader Procuring class. In Apple Advertisements rankings, the app sits alongside giants like Temu, Rakuten and main attire manufacturers by way of Apple Advertisements visibility, although it serves a way more particular area of interest.

Advert inventive insights of Chewy – Pet Care & Pharmacy analyzed with Artistic Evaluation by MobileAction

As a substitute of flooding each stock supply, Chewy seems to deal with a tighter set of placements and messages that talk on to pet dad and mom, then retains these creatives refreshed sufficient to remain related by way of This autumn. It’s a good illustration of how a vertical app can nonetheless attain significant scale throughout Black Friday with a leaner inventive stack, so long as ASO and Apple Advertisements are doing a lot of the heavy lifting on high-intent visitors.

3. Poshmark: Purchase & Promote Trend

Poshmark combines market dynamics with a social really feel, permitting customers to purchase and promote vogue gadgets from each people and types. The app positions itself as a spot to find distinctive items, second-hand offers, and restricted collections, which aligns effectively with customers who’re on the lookout for model and financial savings on the similar time.

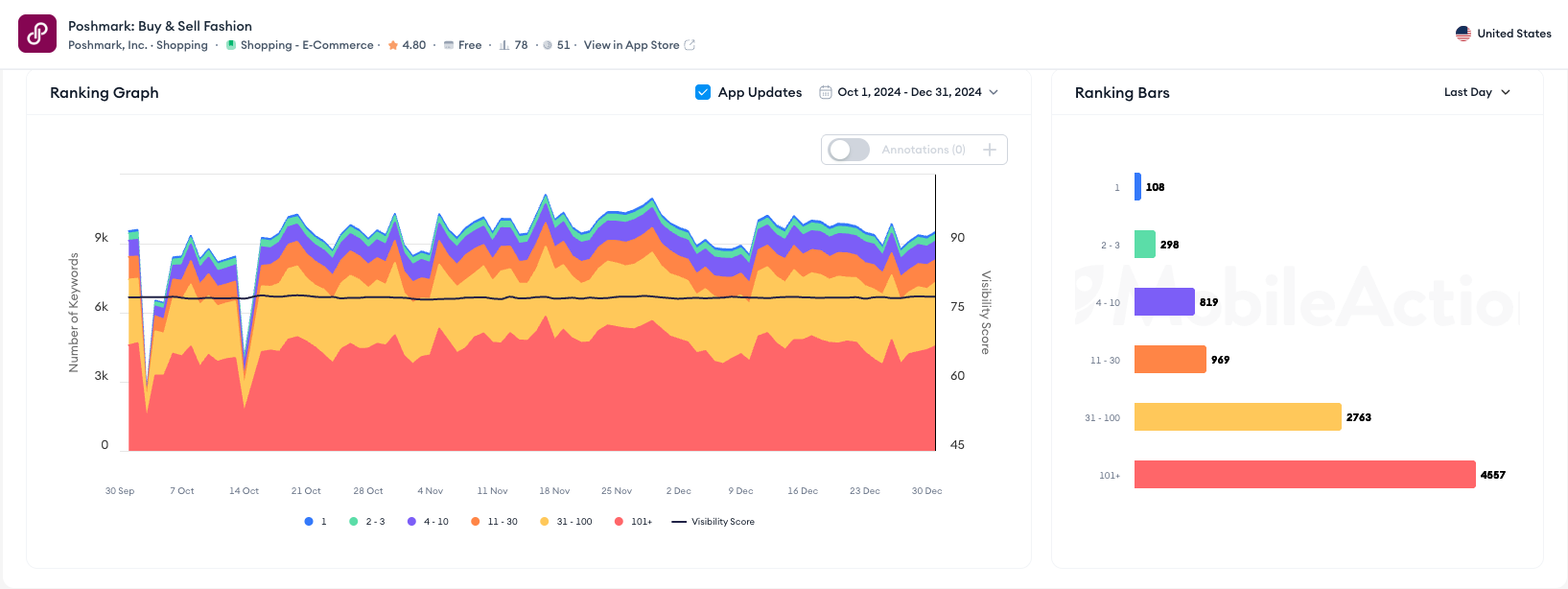

Poshmark: Purchase & Promote Trend’s natural rating distribution graph ASO Report by MobileAction

For Poshmark, This autumn natural efficiency reveals a really secure and mature ASO setup constructed round vogue and resale intent. All through November and December, the visibility rating stays persistently excessive with solely mild peaks round key procuring weeks. That sample means that Poshmark depends on a robust evergreen key phrase set that already aligns effectively with how customers seek for second-hand vogue, manufacturers, and particular product sorts, then layers seasonal tweaks on high for Black Friday and vacation demand.

Impression share of Poshmark: Purchase & Promote Trend analyzed with Search by App by MobileAction

MobileAction’s Apple Advertisements knowledge reveals that Poshmark makes use of paid search to place itself proper subsequent to different resale and vogue marketplaces. The app seems on competitor model queries resembling “mercari,” “depop purchase promote clothes” and “vinted store classic clothes,” in addition to mixture phrases like “poshmark purchase promote vogue” and broader phrases like “outfitters.” On many of those searches, Poshmark secures a significant impression share even when it isn’t the highest natural end result, which helps it intercept customers who’re already contemplating comparable platforms.

Metadata modifications of Poshmark: Purchase & Promote Trend analyzed by App Replace Timeline

Poshmark’s November replace additionally reveals how intently its product and advertising groups take into consideration seasonality. Round mid-November, the “What’s New” part in its App Retailer itemizing shifted from a generic message about itemizing gadgets to very particular holiday-focused copy. The replace invitations customers to browse “sweater climate” finds on Posh Reveals and encourages sellers to “prepare for the vacation rush” by itemizing now to spice up their seasonal gross sales.

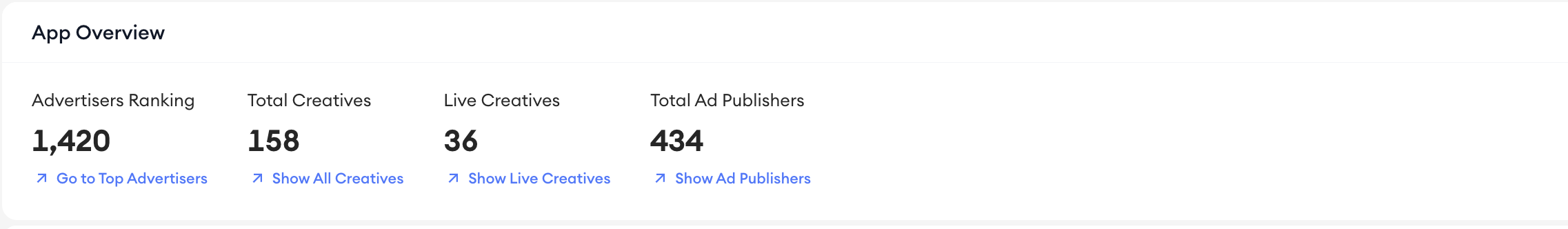

Advert inventive insights of Poshmark: Purchase & Promote Trend analyzed with Artistic Evaluation by MobileAction

From a inventive standpoint, Poshmark sits in the course of the pack by way of scale, however makes use of its property in a really centered manner. For a market that depends closely on model and neighborhood, this method is smart. Poshmark can hold its visible language constant throughout channels whereas nonetheless refreshing ideas round key moments like Black Friday.

SHEIN has change into a significant participant in fast-fashion on cell, providing an enormous assortment of clothes, equipment, and life-style merchandise at aggressive value factors. The app leans on frequent new arrivals, themed collections, and seasonal campaigns that encourage customers to browse and buy usually.

SHEIN – Procuring On-line’s natural rating distribution graph ASO Report by MobileAction

SHEIN’s natural footprint in This autumn 2024 is among the largest within the Procuring class. MobileAction’s ASO Intelligence reveals the app rating for tens of 1000’s of key phrases on the US App Retailer, with a really broad base of phrases within the Prime 100 and a stable layer of high-ranking queries within the Prime 30, Prime 10, and Prime 3. The visibility rating sits at a persistently excessive degree all through the complete October to December interval, with solely reasonable fluctuations as new campaigns and app updates roll out.

Metadata modifications of SHEIN – Procuring On-line analyzed by App Replace Timeline

SHEIN’s replace timeline reveals how tightly it aligns its retailer presence with world procuring festivals. In early This autumn, the “What’s New” copy and marketing campaign title had been tied to Singles Day, then shifted to the broader #SHEINBigSalesDay theme whereas conserving the identical robust worth proposition round “500k+ sizzling gadgets” and year-end markdowns. That small however seen change retains the marketing campaign versatile throughout areas and dates, whereas nonetheless anchoring all the pieces round a recognizable hashtag.

Their product web page additionally highlights an equally coordinated visible technique. Each earlier than and after the replace, the gallery is absolutely themed round Black Friday, with crimson and black sale visuals, as much as 90 % off messaging, and clear class playing cards for vogue and residential.

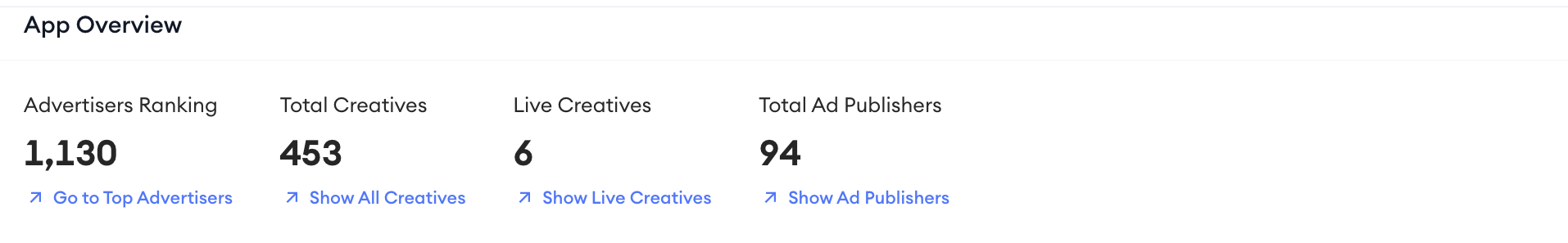

5. e.l.f. Cosmetics and Skincare

e.l.f. brings its reasonably priced, cruelty-free cosmetics and skincare traces right into a devoted procuring app that serves each loyal model followers and new customers discovering its merchandise for the primary time. The app expertise helps discovery with curated collections, product suggestions, and restricted version drops that play effectively with seasonal demand.

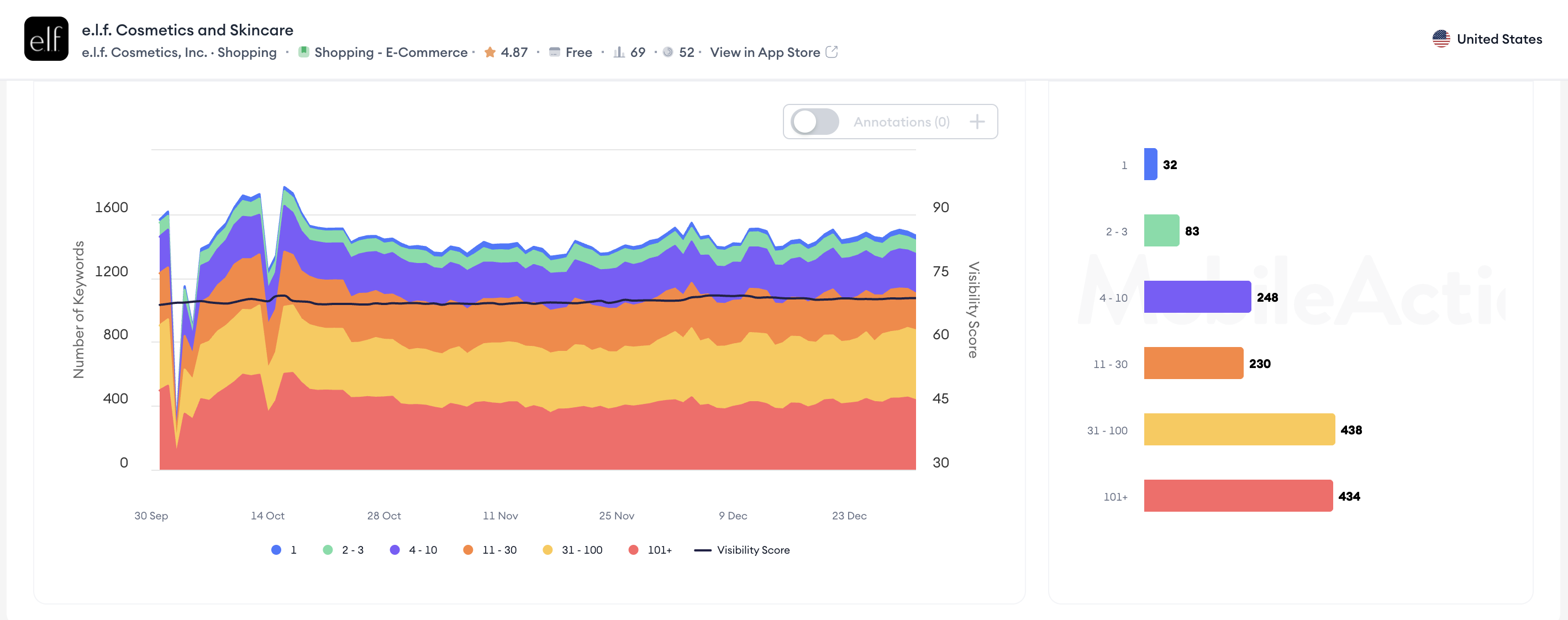

e.l.f. Cosmetics and Skincare’s natural rating distribution graph ASO Report by MobileAction

For e.l.f. Cosmetics and Skincare, This autumn 2024, seems like a really stable season for natural visibility. MobileAction’s ASO Intelligence reveals the app rating for greater than a thousand key phrases on the US App Retailer, with a wholesome unfold throughout the Prime 100 and a robust cluster within the Prime 30 and Prime 10. The visibility rating holds regular by way of October, November, and December, which suggests e.l.f. is just not counting on quick bursts of optimization, however on a well-structured key phrase set that persistently displays how customers seek for make-up, skincare, and wonder offers.

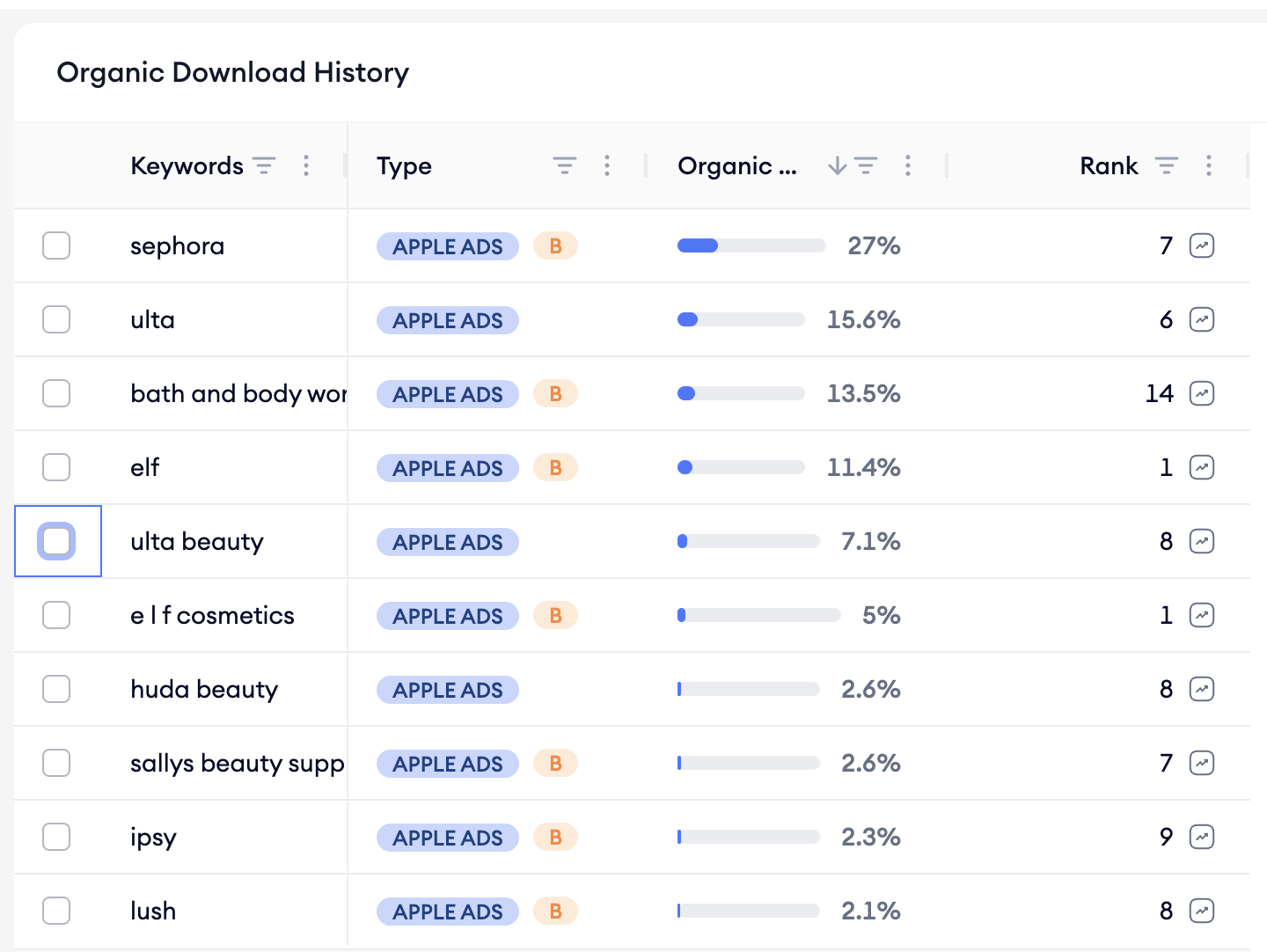

The natural obtain historical past of e.l.f. Cosmetics and Skincare analyzed with Key phrase Intelligence by MobileAction

Within the Natural Obtain Historical past, e.l.f. captures significant natural share on excessive intent magnificence phrases resembling “sephora,” “ulta,” “bathtub and physique works,” and “huda magnificence,” whereas rating within the high positions for its personal model key phrases like “elf” and “e l f cosmetics.” Many of those searches are already supported by Apple Advertisements exercise, which suggests customers who faucet on the natural end result usually see e.l.f. greater than as soon as in the identical journey.

#Notable point out: Nike: Sneakers, Attire, Tales

For Black Friday and the vacation interval, Nike makes use of the app to attach product discovery with editorial content material and member-only perks. Restricted releases, present guides, and promotion-driven collections assist the app seize intent from each loyal followers following particular traces and informal buyers on the lookout for high quality sportswear. Regardless that it doesn’t seem within the Prime 5 of our listing, Nike is a notable instance of how a strong model app can translate storytelling, neighborhood, and product launches into sustained App Retailer visibility throughout This autumn.

Nike: Sneakers, Attire, Tales’ natural rating distribution graph ASO Report by MobileAction

MobileAction’s ASO Intelligence reveals Nike rating for tens of 1000’s of key phrases on the US App Retailer, with a deep base of phrases within the Prime 100 and a wholesome layer of extremely ranked queries on high. There are a whole bunch of key phrases sitting within the Prime 10 and a stable cluster within the Prime 3, which displays how strongly customers search straight for Nike and for its product traces, collections, and collaborations.

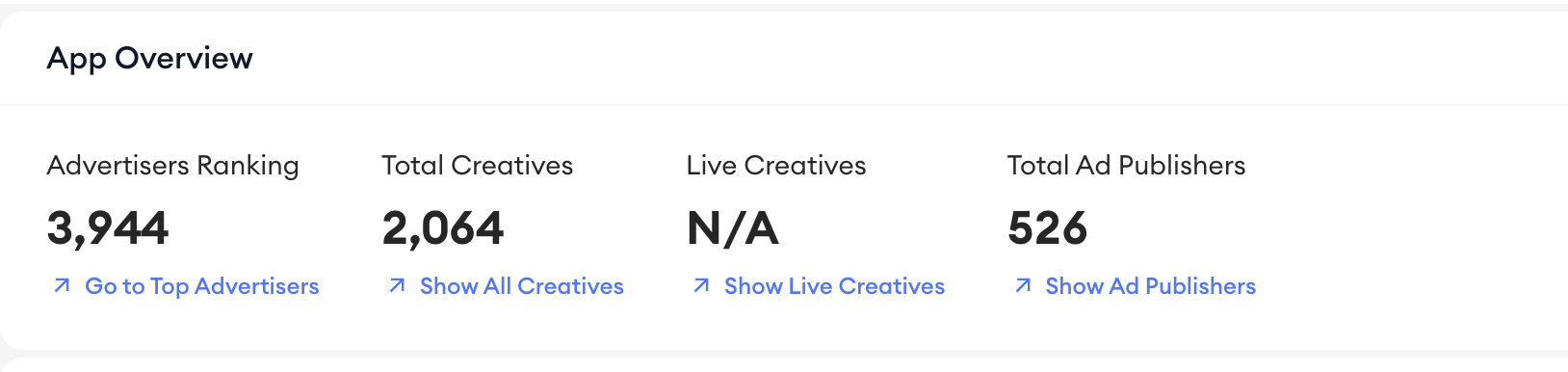

Advert inventive insights of Nike: Sneakers, Attire, Tales analyzed with Artistic Evaluation by MobileAction

MobileAction’s Advert Intelligence reveals greater than 2,000 distinctive creatives served throughout over 500 publishers throughout that quarter. That quantity factors to a marketing campaign method constructed round waves of exercise fairly than always-on efficiency alone. Nike seems to check many variations round product drops, seasonal promos, and model storytelling, then distribute them broadly throughout completely different placements. For a Procuring app, it’s a good instance of how a robust model can use a big however time-bound inventive library to dominate key moments in This autumn, whereas letting evergreen ASO carry a lot of the year-round visibility.

Key takeaways and how you can flip them into your subsequent Black Friday technique

First, leaders steadiness model and class protection. The strongest performers shield their branded searches, then prolong into generic and competitor phrases that match actual procuring journeys, supported by related customized product pages and seasonal retailer creatives.

Second, seasonality is deliberate, not improvised. Apps like AliExpress, SHEIN, Poshmark, and e.l.f. alter messaging, screenshots, and key phrase focus forward of the vacation interval. They deal with This autumn as a marketing campaign with clear phases, not a single gross sales day.

Third, scale is just not all the pieces. Chewy and e.l.f. present that centered vertical apps can stand beside broad marketplaces by proudly owning a distinct segment, selecting their key phrases fastidiously, and utilizing a lean however disciplined inventive stack. What issues is how effectively your ASO, Apple Advertisements, and creatives line up with a selected consumer drawback, not what number of property you launch.

Use this This autumn 2024 snapshot in your personal playbook. Begin by benchmarking your ASO visibility towards the apps on this listing, establish which key phrase teams you might be lacking, and map the place customized product pages may aid you communicate extra on to high-intent searches.

Then evaluation your Apple Advertisements setup. Are you solely bidding in your model phrases, or are you additionally current on fastidiously chosen class and competitor key phrases, like the highest performers right here? Mix that with a inventive plan that features each evergreen ideas and seasonal variants for key weeks.

Prepared to arrange in your subsequent Black Friday season with a clearer view of the market? E book a demo with MobileAction and switch these insights into an actionable consumer acquisition plan.