Switzerland presents distinctive alternatives for app-powered companies, combining Europe’s highest family revenue ranges with a tech-savvy inhabitants that embraces digital innovation.

Switzerland’s financial system continues to display exceptional resilience within the face of worldwide uncertainties, recording an enviable progress in 2024. Swiss startups raised CHF 1,473.7 million throughout 124 financing rounds within the first half of 2025—marking it the strongest half-year efficiency since 2021.

Probably the most worthwhile enterprise concepts in Switzerland mix the nation’s premium market positioning with digital-first approaches, requiring investments from CHF 10,000 to CHF 200,000+.

Why Make investments In Switzerland

In 2024, greater than 22% of funding rounds had been into AI-related enterprise fashions, demonstrating buyers’ confidence in tech-driven ventures. Switzerland’s multilingual market (German 62%, French 23%, Italian 8%) creates alternatives for apps that may scale throughout language obstacles.

Whether or not you’re an aspiring Swiss founder, an expat skilled with company financial savings, or a advisor advising SMEs on digital transformation, this information reveals 20 confirmed enterprise fashions the place cell apps and digital options drive profitability.

Understanding the Swiss Enterprise Panorama: Why App-Centric Ventures Thrive

A Premium Market with Digital Urge for food

The Swiss client market demonstrates distinctive traits for digital companies. With median family incomes exceeding CHF 83,000 yearly, Swiss customers persistently prioritize high quality over value, creating alternatives for premium app-based providers.

This quality-first mindset extends to their know-how adoption—Swiss customers anticipate refined, well-designed purposes and are keen to pay subscription charges that will be thought of premium in different European markets.

Digital Transformation Acceleration

The post-2024 interval has witnessed unprecedented digital transformation throughout Swiss industries. Conventional companies—from banking to healthcare to tourism—are actively in search of digital options to modernize their operations and meet evolving buyer expectations. This creates important alternatives for B2B app builders and SaaS platforms.

Regulatory Surroundings Advantages

Switzerland’s regulatory framework offers important benefits for app-based companies. The nation’s knowledge safety legal guidelines (FADP) create aggressive moats for compliant apps, as companies prioritize platforms that guarantee regulatory adherence. In a rustic the place privateness is paramount, cybersecurity providers are indispensable, extending this precept to all digital enterprise fashions.

Funding Framework: How We Categorize Swiss App Alternatives

Our three-tier funding framework helps entrepreneurs match their accessible capital with sensible enterprise alternatives whereas maximizing their probabilities of market success.

Tier 1: Low Funding (CHF 10k-50k) – Easy Apps & MVPs

These alternatives give attention to validating enterprise ideas with minimal upfront funding. Typical tasks embody market apps, reserving platforms, and content-driven purposes that may be constructed utilizing established frameworks and current APIs.

Traits:

- 3-6 month growth timeline

- Single-platform launch (iOS or Android)

- Fundamental backend infrastructure

- Normal cost integration (Twint, bank cards)

- Minimal regulatory complexity

Success metrics: Break-even inside 12-18 months, CHF 100,000-500,000 annual income potential by Yr 2.

Tier 2: Medium Funding (CHF 50k-150k) – Complicated Apps & Superior Options

This tier targets established market wants with refined technical options. Tasks sometimes contain a number of integrations, superior consumer interfaces, and specialised performance that creates aggressive benefits.

Traits:

- 6-12 month growth timeline

- Cross-platform growth (iOS, Android, net)

- Complicated API integrations (banking, healthcare, authorities)

- Superior options (AI/ML, real-time knowledge, analytics)

- Average regulatory necessities

Success metrics: Break-even inside 18-30 months, CHF 500,000-2,000,000 annual income potential by Yr 3.

Tier 3: Excessive Funding (CHF 150k+) – Enterprise Apps & Refined Platforms

These alternatives tackle giant market inefficiencies with enterprise-grade options. Tasks require important technical experience, regulatory compliance, and longer growth cycles however supply the best income potential.

Traits:

- 12-24 month growth timeline

- Enterprise-grade safety and scalability

- Regulatory compliance (FINMA, medical gadget certification)

- Superior AI/ML capabilities

- Multi-stakeholder integration necessities

Success metrics: Break-even inside 24-42 months, CHF 1,000,000+ annual income potential by Yr 3.

Swiss Market Particular Issues

Fee Integration Necessities: All Swiss apps should assist Twint (Switzerland’s nationwide cell cost system) alongside conventional cost strategies. This provides CHF 5,000-15,000 to growth prices however is crucial for market acceptance.

Multi-language Help: Success in Switzerland sometimes requires German language assist at the least, with French and Italian increasing market attain by 31%. Funds CHF 8,000-20,000 for complete localization.

Information Residency: Swiss companies more and more desire apps with native knowledge storage. This requirement provides CHF 10,000-30,000 in infrastructure prices however offers aggressive benefits in B2B gross sales.

Worthwhile Enterprise Concepts In Switzerland

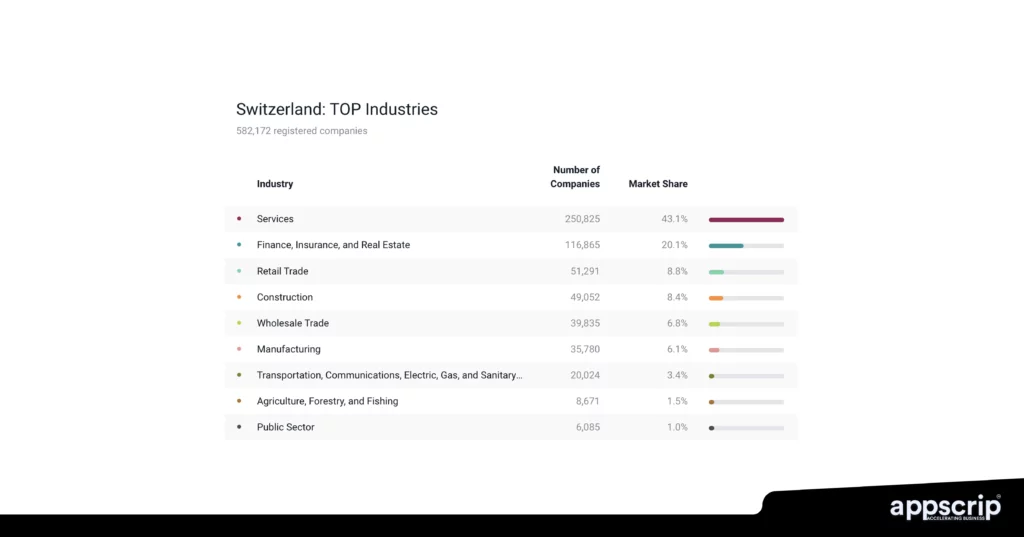

Switzerland is famend for the expert labour it homes and an enviable per capita GDP. Switzerland cradles a thriving finance sector that’s aided by Low Company taxes that contribute to its booming financial system.

We’ve got listed right here for you companies that may be launched with out excessive preliminary prices. Beneath are a number of worthwhile enterprise concepts in Switzerland.

Tier 1: Low Funding (CHF 10k-50k) – Easy Apps & MVPs

Enterprise Concept #1: Swiss Mountain climbing Path Discovery App

- Switzerland boasts 65,000 km of marked climbing trails, but digital options for planning are fragmented. An app that gives curated path info, real-time climate, issue scores, and GPS mapping will discover favour with each locals and vacationers. With 70% of Swiss residents actively climbing and over 40M vacationer in a single day stays in 2024, there’s sturdy demand for a Swiss-centric, premium outside planning device.

- Built-in with MeteoSwiss for climate, SBB for transport, and native tourism boards, it presents exact planning unmatched by generic climbing apps. Offline maps and elevation-aware timing estimates cater to critical hikers. Technical stack contains React Native, Mapbox, and Firebase.

- Funding: CHF 35,000–54,000 (MVP, APIs, internet hosting, advertising and marketing)

- Income: Freemium + CHF 9.90–19.90/month subscriptions, tourism partnerships, model campaigns

- Break-even: Month 16

Enterprise Concept #2: Native Artisan Market App

- Switzerland’s CHF 2.8B artisan sector lacks digital visibility. A cell market connecting verified native artisans—chocolatiers, watchmakers, and textile creators—to customers and vacationers in search of genuine Swiss-made items is a good concept. Swiss merchandise command a 30–60% premium globally, providing sturdy e-commerce upside.

- The app options AR product previews, multi-language UI, and safe Swiss cost strategies (Twint, PostFinance). Constructed with Node.js and React Native, it presents artisans a Shopify-style portal for stock and orders.

- Funding: CHF 40,000–63,000

- Income: 8–12% commissions, CHF 299/month vendor plans, vacationer information referrals, bulk gifting packages

- Break-even: Month 14

Enterprise Concept #3: Swiss Language Trade Platform

- With 4 official languages and rising demand for multilingual professionals, this platform connects Swiss residents for peer-to-peer language change. In contrast to international apps, it focuses on Swiss dialects, {industry} vocabulary, and real-time cultural context—excellent for professionals and expats.

- Options embody video chat with translation instruments, gamified progress monitoring, industry-specific vocabulary, and auto-scheduling synced with Swiss holidays. Constructed with Agora.io and hosted on Swiss servers for low latency and knowledge compliance.

- Funding: CHF 34,500–63,000

- Income: CHF 29.90/month particular person, CHF 199/month company, CHF 299 certifications, B2B coaching

- Break-even: Month 13

Enterprise Concept #4: Swiss Occasion Planning & Coordination App

- Switzerland’s CHF 8B occasions market calls for precision. This app centralizes vendor discovery, funds monitoring, visitor administration, and compliance for company and luxurious occasions. Occasion planners and firms profit from FADP-compliant, multi-language instruments constructed for Swiss requirements.

- The platform connects verified native distributors and automates timelines, bookings, and funds. Integrations embody Swiss enterprise calendars, cost techniques, and cantonal occasion laws. Superb for weddings, conferences, and festivals.

- Funding: CHF 50,000–75,000

- Income: Vendor commissions (5–8%), premium instruments (CHF 49–999/month), occasion insurance coverage and pictures commissions

- Break-even: Month 15

Enterprise Concept #5: Swiss Pet Care Companies App

- Almost half of Swiss households personal pets, with homeowners spending CHF 1,800–2,400 yearly. This app connects pet mother and father with background-verified caregivers providing canine strolling, pet sitting, grooming, and emergency vet scheduling. City professionals and frequent vacationers are key customers.

- App options embody GPS monitoring, digital well being information, in-app funds, and pet insurance coverage integration. Excessive service reliability and transparency are priorities within the Swiss market.

- Funding: CHF 35,000–57,000

- Income: 15–20% fee, CHF 19.90/month for homeowners, CHF 79/month for suppliers, insurance coverage and product affiliate income

- Break-even: Month 12

Enterprise Concept #6: Swiss Renewable Vitality Session App

- This platform simplifies photo voltaic and geothermal planning for Swiss owners and SMEs. With federal subsidies as much as CHF 15,000 and rising vitality prices, customers want steerage on feasibility, ROI, and installer choice—particularly with complicated cantonal packages.

- The app offers roof evaluation utilizing satellite tv for pc imagery, localized ROI calculators, and an authorized installer market. Constructed with correct Swiss climate and vitality knowledge, the platform ensures clear, actionable insights.

- Funding: CHF 59,000–80,000

- Income: CHF 500–2,000 referral charges, CHF 199/month SaaS for installers, CHF 299 consults, vitality monitoring subscriptions

- Break-even: Month 11

Tier 2: Medium Funding Enterprise Concepts (CHF 50k-150k)

This tier represents the candy spot for skilled entrepreneurs trying to capitalize on Switzerland’s premium market whereas leveraging superior know-how. This tier focuses on refined platforms that require substantial technical infrastructure however supply distinctive income potential.

The Software program & Analytics sector secured 397 million Swiss Francs in 2024, attaining the second-highest funding quantity after-Well being sector, validating the sturdy investor urge for food for technology-driven options.

Enterprise Concept #7: Swiss Fintech Funding Advisory Platform

Overview:

AI-powered robo-advisor platform particularly engineered for Swiss buyers, seamlessly integrating native banking APIs, Swiss pension techniques (2nd/third pillar optimization), and complex tax-loss harvesting methods.

Why It Works in Switzerland:

The robo-advisor market in Switzerland has grown with established gamers like TrueWealth, Selma Finance, and Finpension main digital wealth administration transformation. Complicated Swiss tax optimization alternatives throughout 26 cantons. Fintech/Insurtech sector secured 193 million Swiss Francs in 2024 funding, demonstrating sturdy investor confidence.

Key Options:

- Superior API integrations with main Swiss banks (UBS, Credit score Suisse, Raiffeisen)

- Automated tax-loss harvesting with Swiss-specific compliance, following profitable fashions like Finpension’s 0.39% base price construction

- Machine learning-powered pension optimization calculators for 2nd/third pillar

- Actual-time portfolio rebalancing with Swiss tax implications

Funding Necessities:

- CHF 80,000-120,000 for FINMA-compliant platform growth

- 8-12 month growth timeline together with regulatory approval course of

- FINMA authorization prices (CHF 25,000-40,000)

Income Potential:

- Belongings beneath administration charges: 0.5-1.5% yearly ({industry} customary)

- Premium advisory providers: CHF 299-499/month for high-net-worth purchasers

- Tax optimization session charges: CHF 500-2,000 per session

Annual Income: CHF 500,000-2,000,000 by Yr 2

Enterprise Concept #8: Swiss Healthcare Appointment Orchestration Platform

Overview:

An AI-powered healthcare coordination platform for Switzerland’s complicated medical panorama. It integrates multilingual providers, real-time insurance coverage checks, and sensible scheduling throughout cantonal networks.

Why Switzerland:

In 2024, Swiss well being startups secured CHF 1,039 million in funding (45% of complete). Fragmented suppliers throughout 26 cantons and twin insurance coverage layers (primary + supplementary) create coordination ache factors. Sufferers anticipate excessive service requirements and are keen to pay for comfort.

Key Options:

- AI-driven diagnostic assist (impressed by dEEGtal Perception)

- Actual-time insurance coverage verification

- Automated specialist referrals & scheduling

- FADP-compliant medical file entry

- Telehealth + multilingual interfaces

Funding:

CHF 100,000–150,000

Timeline: 10–15 months (incl. compliance & integration)

Income Streams:

- Reserving charges: CHF 15–25

- Insurance coverage income share: 2–5%

- Telemedicine subscriptions: CHF 49–99/month

- Supplier licenses: CHF 299–999/month

Annual Potential: CHF 600,000–1,200,000

Enterprise Concept #9: Swiss Provide Chain Transparency Platform

Overview:

A blockchain-powered B2B platform providing provide chain traceability and EU compliance, capitalizing on Switzerland’s export quantity and authenticity requirements.

Why Switzerland:

Swiss-made manufacturers face rising strain for traceability. With CHF 350B+ in exports, companies want immutable, compliant provide chain knowledge. Swiss companies like Authena lead in traceability tech.

Key Options:

- Good contract-based compliance

- CO₂ footprint and sustainability scoring

- IoT-linked real-time monitoring

- EU export doc automation

- QR codes for end-user entry

Funding:

CHF 90,000–140,000

Timeline: 8–12 months

Income Streams:

- SaaS: CHF 999–4,999/month

- Consulting: CHF 15,000–50,000/venture

- Verification charges: CHF 0.50–2.00/transaction

Annual Potential: CHF 800,000–1,800,000

Enterprise Concept #10: Swiss Tourism Expertise Personalization Engine

Overview:

An AI platform producing dynamic, hyper-personalized Swiss journey itineraries based mostly on climate, transport, and occasion knowledge.

Why Switzerland:

Tourism is a CHF 16.7B sector. Vacationers crave personalization throughout seasons and areas. Platforms like Albatross and GetYourGuide show sturdy demand and scalability.

Key Options:

- AI-driven itinerary engine

- Integration with SBB transport & MeteoSwiss

- Native bookings & dynamic pricing

- Person-generated content material sharing

Funding:

CHF 70,000–130,000

Timeline: 6–10 months

Income Streams:

- Reserving commissions: 10–15%

- Premium itineraries: CHF 299–499

- White-label licensing to tourism boards

Annual Potential: CHF 400,000–900,000

Enterprise Concept #11: Swiss Actual Property Funding Evaluation Platform

Overview:

A PropTech platform analyzing actual property investments with valuation instruments, tax optimization, and yield forecasts tailor-made for Swiss cantonal complexity.

Why Switzerland:

Switzerland’s CHF 2.5T property market and startups like PriceHubble spotlight demand for data-driven instruments. Cantonal tax legal guidelines and overseas possession guidelines create obstacles needing tech options.

Key Options:

- Property worth & yield calculators

- Tax optimization throughout 26 cantons

- Funding portfolio monitoring

- Market comparisons throughout areas

Funding:

CHF 85,000–125,000

Timeline: 8–10 months

Income Streams:

- Subscriptions: CHF 199–999/month

- Transaction consulting: CHF 1,000–5,000

- White-label: CHF 5,000–15,000/month

Annual Potential: CHF 500,000–1,100,000

Enterprise Concept #12: Swiss Company Wellness Platform

Overview:

A digital wellness suite for Swiss employers, providing HR dashboards, health integration, gamified challenges, and FADP-compliant well being monitoring.

Why Switzerland:

Wellness budgets run CHF 1,000–3,000/worker. Excessive office stress and distant work have elevated demand for digital well being options. Compliance is remitted beneath labor regulation.

Key Options:

- Well being metrics dashboard

- Health & psychological well being integrations

- Gamification with rewards

- Insurance coverage-linked incentives

Funding:

CHF 75,000–120,000

Timeline: 6–9 months

Income Streams:

- Per-employee charges: CHF 15–45/month

- Company onboarding: CHF 10,000–25,000

- Superior analytics: CHF 2,000–5,000/month

Annual Potential: CHF 400,000–800,000

Enterprise Concept #13: Swiss Cross-Border E-commerce Optimization Platform

Overview:

An automation suite for Swiss SMEs promoting to the EU, simplifying VAT, customs, and logistics for cross-border success.

Why Switzerland:

60% of Swiss SMEs export to the EU. Brexit and EU digital tax reforms have made compliance more durable. SMEs search automation to scale back regulatory complexity.

Key Options:

- EU VAT calculator

- Good customs documentation

- Delivery value optimizer

- Accounting integration (Bexio, SAP)

Funding:

CHF 95,000–145,000

Timeline: 10–12 months

Income Streams:

- SaaS: CHF 299–1,999/month

- Transaction charges: 0.5–2%

- Compliance consulting: CHF 200–500/hour

Annual Potential: CHF 600,000–1,400,000

Enterprise Concept #14: Swiss Educational Analysis Collaboration Community

Overview:

A digital community connecting Swiss universities (ETH Zurich, EPFL) with {industry} for joint analysis, funding, and IP commercialization.

Why Switzerland:

ETH ranks amongst international leaders. DeepTech funding hit €1.5B in 2022. Startups like Zuriq thrive by linking academia and enterprise. Innosuisse promotes utilized analysis.

Key Options:

- AI-based research-industry matchmaking

- Patent/IP administration instruments

- Safe collaboration workflows

- Funding assistant with grant database

Funding:

CHF 80,000–130,000

Timeline: 8–10 months

Income Streams:

- Success charges: 5–10% of secured funding

- College subscriptions: CHF 2,000–8,000/month

- IP transaction charges: 2–5%

Annual Potential: CHF 500,000–1,200,000

Tier 3: Excessive Funding Enterprise Concepts (CHF 150k+)

Enterprise Apps & Refined Platforms

Enterprise Concept #15: Swiss Digital Banking Platform for SMEs

Enterprise Overview:

A neobank tailor-made to Swiss SMEs, integrating full-stack banking with accounting, multi-currency instruments, and compliance automation.

Why It Works in Switzerland:

- 630,000+ SMEs demand versatile digital monetary providers

- Swiss SMEs typically function internationally—multi-currency assist is important

- Excessive regulatory complexity creates alternatives for automation

- Legacy banks are gradual to satisfy area of interest SME wants

App/Digital Element:

- FINMA-compliant core banking system

- Constructed-in accounting (e.g., Swissdec licensed)

- FX buying and selling instruments for CHF/EUR/USD/GBP

- SME monetary well being dashboard

Funding Necessities:

- CHF 200,000–500,000 for growth

- CHF 100,000+ for FINMA licensing

- Safety and KYC/AML infrastructure

- Authorized & regulatory advisory prices

Income Potential:

- Subscription (CHF 99–499/month)

- FX and transaction charges

- Premium providers (e.g., bill financing)

- Estimated income: CHF 2–8 million/12 months

Enterprise Concept #16: Swiss MedTech Affected person Information Integration Platform

Enterprise Overview:

A safe, FADP-compliant system that allows clean knowledge change between clinics, sufferers, and insurers.

Why It Works in Switzerland:

- CHF 80B+ healthcare market

- Fragmented knowledge silos hinder care coordination

- FADP emphasizes affected person knowledge possession

- Excessive belief in privacy-focused MedTech

App/Digital Element:

- Blockchain-based affected person knowledge vault

- Supplier and insurer integration APIs

- Affected person-facing well being knowledge management portal

- Automated insurance coverage declare circulation

Funding Necessities:

- CHF 250,000–400,000 platform construct

- Medical integration protocols (HL7, FHIR)

- Certification & compliance (Swissmedic)

- Partnership onboarding

Income Potential:

- CHF 5–15/affected person/month SaaS

- Hospital/clinic licensing

- Insurance coverage API utilization charges

- Income: CHF 1.5–5 million/12 months

Enterprise Concept #17: Swiss Good Metropolis Infrastructure Platform

Enterprise Overview:

A unified platform enabling cantons to run IoT-powered providers: mobility, vitality, waste, and civic engagement.

Why It Works in Switzerland:

- CHF 500M+ earmarked for sensible cities

- Federal construction: 26 cantons, 2,200+ communes

- Eco-conscious society values effectivity

- City digitization demand rising

App/Digital Element:

- Good municipal management middle

- Actual-time knowledge from site visitors, climate, utilities

- Predictive planning instruments

- Cellular citizen app for situation reporting

Funding Necessities:

- CHF 300,000–600,000 for full-stack IoT integration

- Municipality tenders & approvals

- Sensor {hardware} partnerships

- Cybersecurity for civic infrastructure

Income Potential:

- Month-to-month licensing (CHF 10k–50k/metropolis)

- Setup, coaching, analytics providers

- CHF 2–10 million annual potential

Enterprise Concept #18: Swiss Luxurious Model Authentication Platform

Enterprise Overview:

A blockchain-based system providing product verification for high-end Swiss exports like watches and jewellery.

Why It Works in Switzerland:

- CHF 21B luxurious export {industry}

- Manufacturers want anti-counterfeiting tech

- Swiss-made label instructions international belief

- Shopper curiosity in authenticity verification

App/Digital Element:

- Cellular app for product verification

- Blockchain-backed certificates

- Dashboard for model monitoring

- NFC tag or QR-code integration

Funding Necessities:

- CHF 180,000–350,000 for platform

- Blockchain infrastructure & fuel charges

- Model accomplice acquisition

- Authorized safety providers

Income Potential:

- CHF 5–50/authentication

- Month-to-month model licensing

- Consulting for compliance & safety

- Annual income: CHF 1.2–4 million

Enterprise Concept #19: Swiss Agricultural Know-how Platform

Enterprise Overview:

A precision agriculture platform delivering analytics-driven insights to enhance yield and sustainability.

Why It Works in Switzerland:

- CHF 4.2B agri-sector with sturdy subsidies

- Mountainous terrain fits sensible optimization

- Local weather consciousness drives tech adoption

- Farmers search productiveness & compliance

App/Digital Element:

- Climate-integrated crop administration

- Soil well being by way of IoT sensors & satellite tv for pc imaging

- Digital subsidy software device

- E-commerce for agri-tech instruments

Funding Necessities:

- CHF 220,000–380,000 complete funding

- Information licensing (ESA, Copernicus)

- Agri R&D and pilot testing

- Compliance system setup

Income Potential:

- CHF 99–499/month/farm

- Fee on market instruments

- Subsidy consulting income

- Annual: CHF 800,000–2.5 million

Enterprise Concept #20: Swiss Blockchain Identification Verification System

Enterprise Overview:

A decentralized digital ID resolution for residents and companies, enabling safe interactions throughout sectors.

Why It Works in Switzerland:

- Privateness-centric inhabitants

- Want for unified digital identification

- Cross-border compliance (EU, Liechtenstein)

- Authorities push for e-ID adoption

App/Digital Element:

- DID pockets for residents

- Cross-sector KYC/AML APIs

- B2B verification platform

- Integration with authorities providers

Funding Necessities:

- CHF 350,000–500,000 for full-stack DLT

- Authorities collaboration (e.g., eID+ pilot)

- Superior encryption and biometric techniques

- Authorized compliance and advocacy

Income Potential:

- CHF 2–10 per ID verification

- Company KYC subscriptions

- B2G licensing agreements

- Annual returns: CHF 2.5–8 million

Swiss Market Success Components

A. Regulatory Navigation Methods

- FINMA Sandbox for Fintechs: Use this framework to check banking and finance improvements with out full licensing early on.

- FADP Compliance: Leverage Switzerland’s sturdy knowledge privateness guidelines (FADP) as a trust-building USP.

- Cantonal Registration Optimization: Incorporate in cantons like Zug (crypto-friendly) or Vaud (startup grants) for authorized and tax advantages.

- EU Market Gateway: Swiss startups can entry EU markets by Bilateral Agreements or by EU-domiciled entities.

B. Technical Implementation Greatest Practices

- Multi-language Improvement: Construct apps with assist for German, French, Italian, and English to succeed in all Swiss areas.

- Swiss Fee Integration: Add Twint, PostFinance, Swiss QR invoices, and SEPA to satisfy home monetary expectations.

- Use of Native APIs: Faucet into SBB (mobility), MeteoSwiss (climate), and authorities APIs for wealthy localization.

- Swiss Information Internet hosting: Use Swiss-based cloud providers (e.g., Exoscale, Swisscom) to satisfy knowledge residency and FADP norms.

C. Market Entry and Scaling Approaches

- Pilot with Cantons: Begin in 1–2 cantons for regulatory ease and suggestions earlier than nationwide rollout.

- Partnerships: Collaborate with Swiss corporates, universities, or accelerators (e.g., Kickstart Innovation) to achieve traction.

- Buyer Acquisition: Concentrate on product excellence, Swiss reliability, and localized advertising and marketing.

- Premium Positioning: Swiss customers affiliate excessive costs with top quality—keep away from underpricing.

D. Widespread Pitfalls and Find out how to Keep away from Them

- Ignoring Compliance Delays: FINMA, FOPH, and cantonal approval timelines can stretch 6–18 months—plan accordingly.

- Neglecting Cantonal Variance: Authorized and regulatory nuances differ throughout cantons—get native authorized counsel.

- Overlooking Language/Tradition: Launching solely in English or utilizing German in French cantons can alienate customers.

- Undervaluing Swiss Premium Tradition: Underpricing can hurt credibility; align pricing with perceived worth.

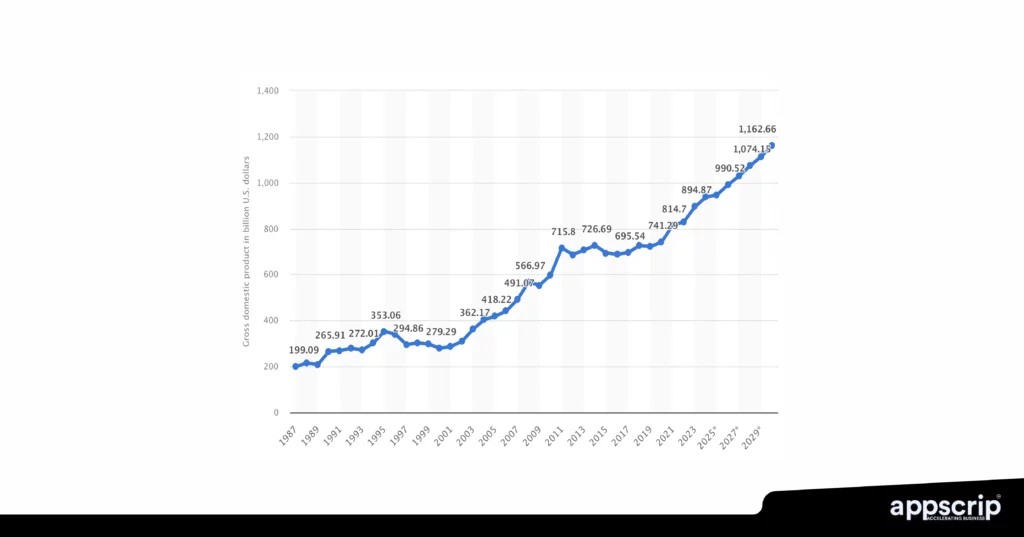

Switzerland GDP through the years

Funding and Funding Panorama

A. Swiss Startup Funding Sources

- Cantonal Applications & Grants: Zurich, Vaud, and Basel supply grants, workplace areas, and tax assist.

- Angel Networks: Enterprise Angels Switzerland and Go Past present early-stage capital and mentorship.

- Enterprise Capital: Redalpine, Lakestar, Swisscom Ventures again tech-focused startups with scalable fashions.

- Innosuisse: Switzerland’s innovation company presents funding, teaching, and internationalization packages.

B. App Improvement Value Realities in Switzerland

- MVPs: Anticipate CHF 30,000–100,000 for primary apps constructed regionally or nearshore.

- Enterprise Platforms: Full-stack enterprise-grade options sometimes vary CHF 150,000–500,000+.

- Improvement Timeline: 3–6 months for MVPs, 12–24 months for platforms with safety/compliance layers.

- Submit-Launch Prices: Function iterations, consumer assist, localization, and regulatory updates add 10–20% yearly.

C. Return on Funding Expectations

- Break-even Factors: SaaS and subscription fashions sometimes break even in 12–24 months; regulated sectors might take longer.

- Income Scaling: B2B platforms scale sooner by way of licensing, whereas B2C requires excessive buyer acquisition spend.

- Market Measurement Limitations: Scale nationally (CH = 8.8M) earlier than increasing to EU or Liechtenstein for prolonged progress.

Exit Panorama: Swiss exits typically happen by way of company acquisition (e.g., Swisscom, UBS) or cross-border VC buyouts.