The worldwide courting app market development and alternatives has by no means been extra crucial for entrepreneurs coming into digital matchmaking. The web courting trade is experiencing unprecedented enlargement, pushed by technological innovation and large smartphone adoption worldwide.

With over 350 million lively customers and income exceeding $10 billion in 2024, the market presents compelling alternatives for savvy companies.

This information explores market dynamics, rising traits, regional alternatives, and confirmed monetization methods. Whether or not you’re contemplating customized courting app growth or exploring white-label options, you’ll uncover actionable insights for coming into this thriving trade.

The Present State of the International Relationship App Market

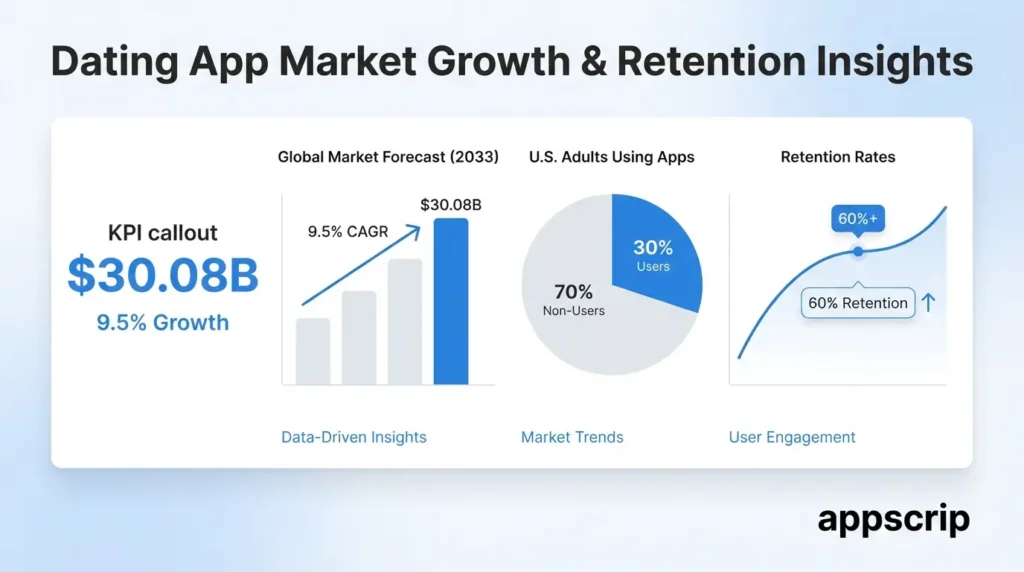

The worldwide courting app market reached a valuation of $10.28 billion in 2024, with projections indicating development to $19.33 billion by 2033. This represents a compound annual development price of seven.27%, signaling strong and sustained enlargement pushed by elementary shifts in relationship formation.

Lively customers reached roughly 360 million globally in 2024, marking a 15 million improve from the earlier 12 months. This consumer base is anticipated to exceed 390 million by 2026, demonstrating continued mainstream adoption.

Key market indicators embrace:

- Common income per consumer (ARPU) at $7.90 with regional variations

- Cellular units accounting for 87% of courting app interactions

- Premium subscriptions producing 70% of complete income

- Smartphone penetration reaching 7.4 billion units globally

- Micro-transactions rising at 15.07% CAGR as quickest income stream

The aggressive panorama options giants like Tinder, Bumble, and Hinge alongside rising area of interest gamers. Tinder generated roughly $1 billion in income in 2024, sustaining market management.

Regional Market Distribution

Key Drivers Behind Relationship App Market Progress

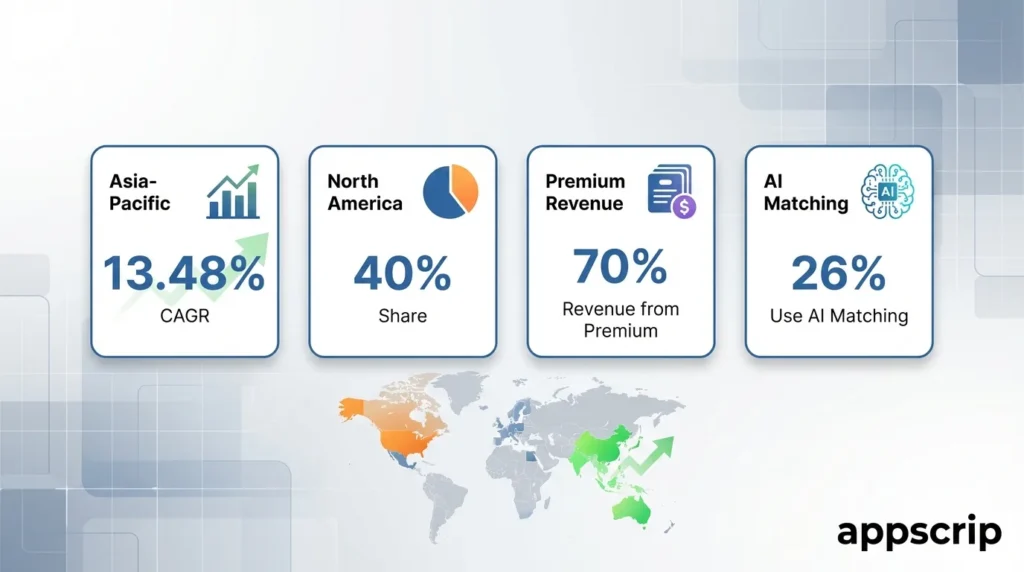

| Area | Market Share 2024 | CAGR | Key Traits |

| North America | 40%+ | 8.18% | Highest ARPU, mature market, premium tier dominance |

| Asia-Pacific | 35% | 13.48% | Quickest development, mobile-first customers, tier-2 metropolis adoption |

| Europe | 23% | 7.50% | Privateness-focused, GDPR compliance, balanced development |

| MENA & Latin America | 7% | 7.4-7.7% | Rising markets, cultural customization wanted |

A number of highly effective forces propel market development. Smartphone proliferation stands as the first enabler, with 7.4 billion units in use worldwide. This infrastructure helps subtle options like real-time messaging, video calls, and location-based matching.

Generational shifts have essentially modified attitudes towards on-line courting. Technology Z contains 53% of U.S. courting app customers, bringing expectations for authenticity and video-centric interactions.

Main development drivers reworking the trade:

- Pandemic acceleration creating everlasting behavioral shifts towards digital courting

- Rising web penetration increasing addressable audiences in rising markets

- Urbanization making apps important for time-constrained professionals

- Social acceptance eliminating stigma with 30% of U.S. adults utilizing apps

- Location-based options enabling environment friendly close by match discovery

The pandemic accelerated adoption by necessitating digital connection strategies. Whereas development has normalized, behavioral adjustments stay everlasting.

Consumer Demographics and Spending Patterns

| Age Group | Market Share | Avg. Spending/Yr | Key Behaviors |

| Gen Z (18-24) | 53% | $45-65 | Authenticity-focused, video choice |

| Millennials (25-34) | 35% | $85-120 | Excessive conversion to paid, lengthy classes |

| Gen X (35-44) | 10% | $95-140 | Critical intent, decrease churn |

| Boomers (45+) | 2% | $70-100 | Privateness-conscious, desktop customers |

Rising Alternatives: Area of interest, AI, and Video-Based mostly Relationship Apps

The evolution towards specialised platforms represents vital alternative. Whereas mainstream apps serve broad audiences, area of interest platforms focusing on particular pursuits expertise explosive development with greater engagement and superior monetization.

Area of interest apps cater to underserved demographics in search of neighborhood alignment. Religion-based platforms like Muzz serve single Muslims in search of marriage.

Benefits of area of interest courting platforms:

- Greater ARPU resulting from deeper consumer engagement and neighborhood loyalty

- Decrease buyer acquisition prices via exact focusing on

- Diminished churn charges as customers discover real neighborhood match

- Validated success with Grindr’s 25% Q1 2025 income improve

- Skill to serve underserved markets ignored by mainstream opponents

AI matching algorithms remodel how apps establish appropriate matches. Trendy programs analyze behavioral patterns, communication types, and engagement historical past somewhat than relying solely on said preferences.

AI-powered chatbots now help customers in profile optimization and dialog starters. Roughly 26% of U.S. singles used AI to boost courting in 2024, a 333% improve from the earlier 12 months.

AI improvements reshaping consumer experiences:

- Behavioral evaluation monitoring response instances and engagement patterns

- Predictive compatibility scoring primarily based on dialog high quality

- Customized icebreaker options tailor-made to each profiles

- Profile optimization instruments bettering match high quality and response charges

- Sentiment evaluation detecting real curiosity versus superficial engagement

Video-first platforms handle rising demand for authenticity. About 40% of customers tried video dates in 2024, discovering them efficient for establishing chemistry earlier than conferences. Apps like Bumble and Hinge built-in video chat straight into their platforms.

Platform Kind Comparability

Income Fashions and Monetization Methods

| Platform Kind | Consumer Engagement | ARPU | Market Saturation | Greatest For |

| Conventional Swipe | Excessive quantity | $65-85 | Excessive | Mass market attain |

| AI-Powered Matching | Medium-Top quality | $95-130 | Medium | High quality over amount |

| Area of interest/Neighborhood | Very Excessive | $110-160 | Low | Focused demographics |

| Video-First | Top quality | $85-115 | Low | Authenticity seekers |

Profitable monetization methods separate thriving courting apps from these struggling to realize profitability. The trade has advanced past easy subscriptions to embrace numerous income streams matching completely different consumer willingness to pay.

Premium subscriptions stay the dominant income supply, capturing 70% of complete trade income in 2024. These tiered choices sometimes embrace three to 4 ranges, every offering progressively extra options.

Confirmed monetization approaches driving income:

- Freemium fashions changing 5-10% of free customers to paid subscribers

- Tiered subscriptions providing primary, premium, and ultra-premium choices

- Match Group’s 26% income per payer improve demonstrating pricing energy

- Strategic characteristic gating incentivizing upgrades with out irritating customers

- Annual subscription reductions bettering retention and money move

Micro-transactions characterize the fastest-growing monetization channel, increasing at 15.07% CAGR. These small purchases let customers purchase profile boosts, tremendous likes, or digital presents with out subscribing. Tinder’s “Tremendous Likes” and Hinge’s “Roses” exemplify profitable implementations producing substantial income from informal customers.

In-app promoting supplies supplementary income, notably for free-tier customers. Profitable implementations use native promoting that feels built-in somewhat than disruptive.

Rising income alternatives embrace:

- Digital occasions and real-world mixer experiences

- Premium security options like background checks and identification verification

- Superior analytics displaying courting patterns and success metrics

- Hinge’s $1 million fund backing Gen Z social occasions in main cities

- Partnership applications with eating places and leisure venues

Regional Market Alternatives and Growth Methods

Geographic enlargement requires understanding regional nuances that affect adoption and monetization. Whereas digital matchmaking interprets globally, profitable platforms adapt options to native cultural contexts.

North America maintains the biggest market share at over 40%. This area demonstrates the very best ARPU, with customers displaying robust willingness to pay for premium options.

North American market traits:

- Mature market requiring innovation and area of interest differentiation

- Sturdy cultural acceptance with minimal stigma round on-line courting

- Excessive focus of paying subscribers and premium adoption

- Alternatives in underserved demographics and specialised communities

- Superior infrastructure supporting subtle AI and video options

Asia-Pacific emerges because the fastest-growing area with a 13.48% CAGR in keeping with trade evaluation, pushed by India, China, and Southeast Asian markets. India generated $398 million in income in 2024, anticipated to achieve $783 million by 2025.

Cultural customization proves crucial in APAC markets. Apps should navigate numerous relationship norms, from organized marriage traditions to liberal courting cultures. Tantan in China and Pairs in Japan dominate by understanding native preferences.

APAC enlargement success components:

- Localized options like parental dashboards assembly cultural expectations

- Tier-2 and tier-3 metropolis focus the place competitors stays restricted

- Cellular-first design addressing main web entry technique

- Culturally acceptable matching standards respecting native traditions

- Fee integration with regional most popular strategies

Europe presents balanced development tempered by strict regulatory necessities. GDPR compliance provides complexity, with violations leading to substantial fines.

Center East and North Africa characterize untapped potential for culturally acceptable options.

White-Label Options: Quick-Observe Your Relationship App Launch

White-label courting app options provide entrepreneurs a compelling different to customized growth, dramatically lowering time-to-market and capital necessities. These pre-built platforms present examined performance customizable with branding and distinctive options.

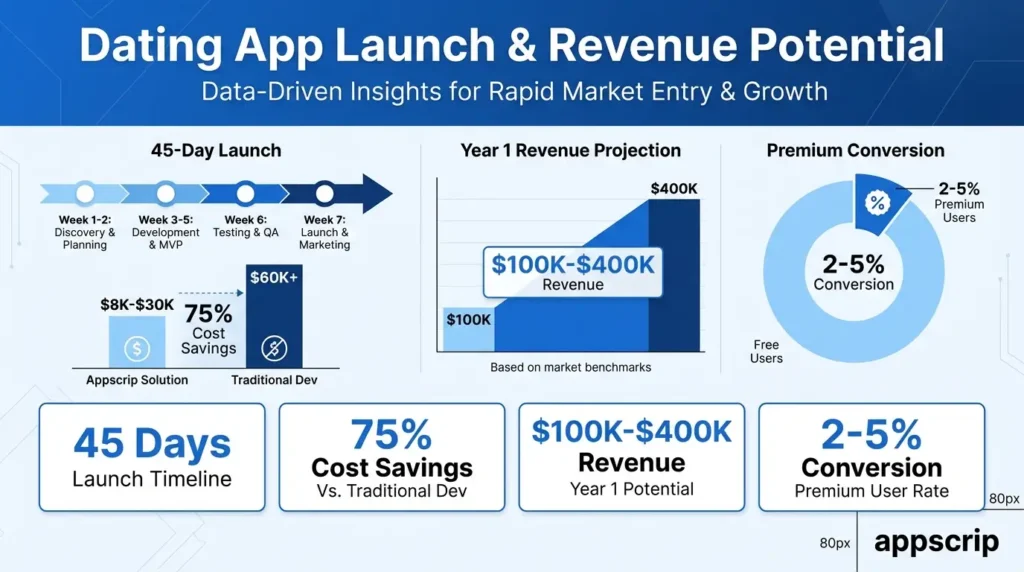

Customized growth requires 3-6 months minimal, whereas white-label platforms can launch shortly in 45 days or much less. This pace permits quicker market testing and income era.

Strategic benefits of white-label platforms:

- Confirmed technical infrastructure lowering deployment danger

- Pre-integrated important options like AI matching and video calling

- Scalable structure examined by hundreds of concurrent customers

- Focus assets on advertising and consumer acquisition as an alternative

- Sooner iteration cycles primarily based on actual consumer suggestions

- Decrease barrier to entry enabling lean startup methodology

Value efficiencies characterize one other main profit. Customized growth prices $48,000 to $200,000, whereas white-label options value a fraction, permitting capital allocation towards advertising as an alternative of infrastructure.

Technical capabilities in fashionable white-label platforms rival customized options. Main suppliers embrace AI-powered matching, video calling, superior safety, and scalable structure, lowering technical danger.

White-label platform capabilities embrace:

- Superior security measures and information safety compliance

- Multi-platform deployment for iOS, Android, and internet

- Customizable matching algorithms and consumer preferences

- Constructed-in monetization instruments for subscriptions and micro-transactions

- Analytics dashboards monitoring key efficiency metrics

Customization flexibility permits companies to distinguish regardless of utilizing pre-built foundations. Entrepreneurs can layer distinctive worth propositions on confirmed technical foundations.

Construct vs. Purchase Comparability

| Issue | Customized Improvement | White-Label Resolution |

| Time to Launch | 3-6 months | 45 days or much less |

| Preliminary Funding | $48K – $200K+ | $5K – $30K |

| Technical Threat | Excessive (untested) | Low (confirmed platform) |

| Ongoing Upkeep | Full accountability | Supplier-supported |

| Aggressive Pace | Slower iterations | Fast market testing |

ROI issues favor white-label options for entrepreneurs prioritizing pace and capital effectivity. The quicker market entry permits faster income era and consumer suggestions incorporation. Decrease upfront prices imply companies can obtain profitability with smaller consumer bases.

Suppliers like Appscrip provide complete courting software program options combining technical excellence with enterprise assist. Their platforms embrace important options like AI matching, video calling, safe messaging, and monetization instruments prepared for speedy deployment.

Conclusion: International Relationship App Market Progress and Alternatives

International courting app market development and alternatives reveals a dynamic trade poised for continued enlargement. With market valuations exceeding $10 billion and consumer bases approaching 400 million globally, the sector affords compelling alternatives for entrepreneurs able to serve evolving wants.

Success requires greater than replicating present platforms. Winners differentiate via superior know-how, real understanding of consumer wants, and aligned enterprise fashions.

Bottomline

White-label options democratize market entry by eradicating technical and capital boundaries. Companies can now launch subtle platforms in weeks somewhat than months, testing hypotheses whereas opponents wrestle via prolonged growth cycles.

The longer term factors towards elevated personalization, enhanced security, and hybrid digital-physical experiences. For entrepreneurs keen to grasp consumer wants deeply and execute with precision, the worldwide courting app market presents one of the crucial thrilling alternatives within the digital financial system.