The monetary expertise panorama in 2025 displays a brand new period formed by innovation and rising shopper expectations. Fintech apps and cost apps have moved past primary transactions. As complete ecosystems, they now present safety, personalization, and seamless integration into each day monetary actions.

With improvements in AI, blockchain, biometrics, and cross-border funds, fintech apps are reworking how folks and companies handle their funds. Customers now count on seamless experiences, robust fraud safety, and regulatory compliance. On this dynamic panorama, builders and shoppers should acknowledge the options that encourage belief and adoption.

On this weblog, we are going to discover key fintech app functionalities that may proceed reworking monetary companies within the years forward.

Seamless and Intuitive UX is a Should-Have for Fintech Apps

A Morning Seek the advice of survey for the American Bankers Affiliation highlights the significance of seamless experiences in digital finance. Greater than half of US shoppers now depend on cell apps over some other methodology. With 55% selecting apps as their major banking device, intuitive design clearly drives widespread adoption.

The success of fintech and cost apps largely is dependent upon delivering a seamless and intuitive consumer expertise. Customers count on interfaces that aren’t solely visually interesting but additionally straightforward to navigate, with minimal steps to finish transactions. Options equivalent to one-click funds, AI-driven personalization, and simplified onboarding improve consumer satisfaction and retention.

Actual-time notifications, contextual steering, and adaptive dashboards additional enhance engagement by offering customers with well timed, related info. Accessibility options, equivalent to voice instructions and customizable interfaces, guarantee inclusivity for all customers. By prioritizing seamless UX, fintech apps can foster loyalty, encourage frequent use, and in the end improve transaction volumes.

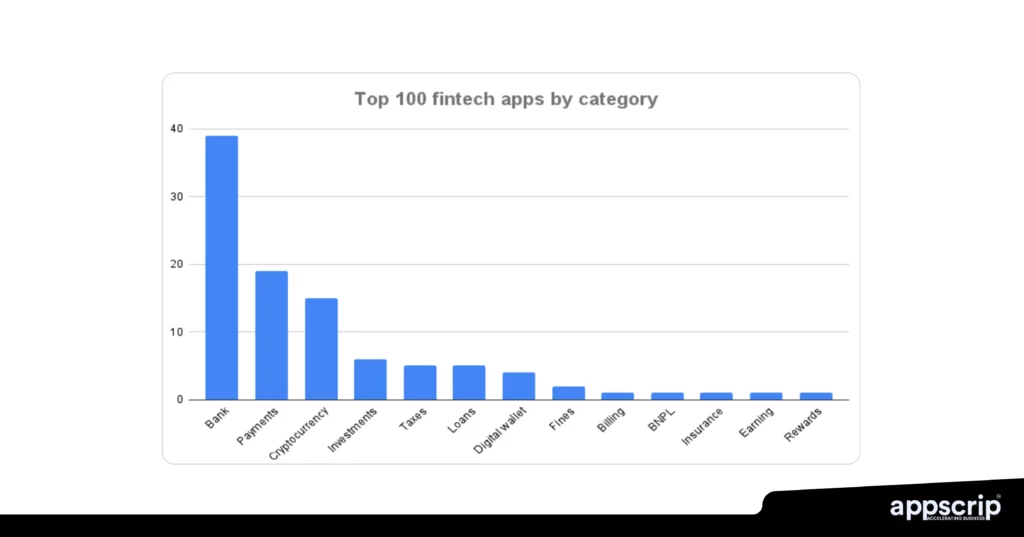

High Fintech Apps worldwide with the class and nation

Sturdy Safety Protocols and Information Encryption

With cyber threats rising extra subtle, customers demand assurance that their private and monetary info is totally protected. Superior encryption requirements, multi-factor authentication, and real-time fraud detection are actually thought of baseline necessities. Many main apps additionally combine biometric verification and AI-powered anomaly monitoring to safeguard transactions.

Based on an IBM research, the worldwide common price of an information breach is $4.4 million. Nevertheless, organizations leveraging AI in safety reported price financial savings of $1.9 million in comparison with these with out such instruments. This highlights how superior expertise strengthens safety protocols and reduces monetary dangers considerably.

Furthermore, regulatory compliance frameworks, equivalent to PCI DSS for cost knowledge and GDPR for private info, reinforce safety practices and construct consumer belief. Finish-to-end encryption throughout knowledge transmission and storage additional minimizes publicity to breaches.

Steady monitoring and automatic alerts enable fintech suppliers to reply immediately to suspicious exercise, guaranteeing customers’ monetary belongings stay safe.

Id Verification for Safe Transactions

In at this time’s digital economic system, id verification is important for shielding shoppers and monetary establishments. Fintech apps depend on strong ID checks to satisfy KYC compliance, forestall fraud, and construct belief. Trendy options validate paperwork, biometrics, and private knowledge, guaranteeing accuracy and pace in confirming identities.

AU10TIX states that superior id verification ought to embrace good seize, automated knowledge extraction, and prompt outcomes. It must also help proof of tackle, multi-layered age verification, and complete ID credential protection. As well as, it ought to present a regulatory toolbox with versatile choices equivalent to parental consent, disclaimers, and voice or video approvals.

For corporations managing delicate monetary operations, an ID verification service for companies provides essential safety whereas simplifying onboarding. It reduces dangers tied to pretend accounts, cash laundering, and regulatory breaches. Sturdy ID verification creates belief and ensures safer, extra dependable digital transactions for shoppers and companies.

Immediate Fee Processing and Actual-Time Notifications

As we speak’s customers count on prompt cost processing, not simply quick transfers. Techniques equivalent to FedNow (U.S.) and UPI (India) have made 24/7 real-time fund transfers the brand new norm.

Core Necessities for Fintech Platforms

- Fixed Uptime:

Backend methods should keep operational across the clock to help steady transactions. - Excessive Transaction Dealing with:

Able to processing 1000’s of transactions per second with out failures. - Low Latency:

Important throughout peak hours to make sure near-instant processing.

| Efficiency Issue | Description | Impression on Customers |

| Uptime Reliability | Steady availability | Permits 24/7 transaction processing |

| Scalability | Handles excessive transaction volumes | Prevents delays and system overloads |

| Low Latency | Millisecond-level processing pace | Ensures seamless cost expertise |

Actual-Time Notifications

- Immediate Alerts:

Push notifications inform customers of accomplished, failed, or suspicious transactions inside seconds. - Transparency and Management:

Retains customers knowledgeable about each monetary exercise in actual time. - Superior APIs:

Trendy APIs combine simply with cell methods to set off real-time alerts.

Personalization with AI

- Clever Prioritization:

AI classifies notifications by significance (e.g., high-value or worldwide transfers). - Enhanced Safety:

Built-in biometric authentication or one-click verification ensures secure affirmation. - Improved Consumer Expertise:

Personalised alerts scale back friction and strengthen belief.

Abstract Desk

| Characteristic | Perform | Profit |

| Immediate Funds | Speedy fund switch 24/7 | Aggressive benchmark in fintech |

| Actual-Time Notifications | Immediate transaction updates | Builds consumer transparency and confidence |

| AI-Pushed Personalization | Good prioritization and alerts | Boosts safety and engagement |

| Biometric Verification | One-click or fingerprint affirmation | Strengthens fraud prevention |

Backside Line:

In a world of prompt digital funds, real-time processing and good notifications are important. They set up transparency, improve reliability, and outline what customers count on from a reliable fintech app.

AI-Powered Insights and Personalised Monetary Instruments

By 2025, synthetic intelligence (AI) is redefining fintech by smarter, data-driven personalization.

AI in Monetary Intelligence

- Conduct Evaluation:

AI analyzes consumer spending patterns and monetary habits. - Sensible Insights:

Generates actionable suggestions equivalent to:- Saving and budgeting ideas

- Expense categorization

- Personalised funding ideas

- Empowered Determination-Making:

Enhances monetary literacy, enabling customers to make assured monetary decisions.

| AI Performance | Instance Use Case | Consumer Profit |

| Conduct Evaluation | Tracks revenue and spending patterns | Identifies saving alternatives |

| Funds Optimization | Supplies tailor-made monetary objectives | Improves cash administration |

| Funding Suggestions | Suggests portfolios primarily based on consumer danger stage | Encourages smarter funding choices |

The Function of Personalization

- Consumer Expectations:

- 72% of shoppers (Zendesk) view personalization as important in monetary companies.

- 77% of enterprise leaders say personalization improves retention.

- Buyer Loyalty:

Personalised insights foster stronger engagement and belief over time.

Predictive and Steady Studying

- Forecasting Wants:

AI predicts occasions like overdrafts, invoice due dates, or market shifts. - Adaptive Intelligence:

Machine studying fashions refine suggestions with each interplay. - Proactive Steering:

Notifies customers about upcoming bills or potential funding alternatives.

| AI Characteristic | Perform | Outcome |

| Predictive Evaluation | Anticipates future monetary wants | Prevents overdrafts and missed funds |

| Market Pattern Monitoring | Detects favorable funding situations | Suggests well timed alternatives |

| Machine Studying Evolution | Constantly improves insights | Will increase accuracy and personalization |

General Impression:

AI-powered fintech instruments rework passive apps into interactive monetary advisors — selling smarter cash administration, greater retention, and long-term buyer satisfaction.

Cross-Border Fee Capabilities

Each companies and people require fast, low-cost, and clear worldwide transfers that keep away from conventional banking delays. Trendy apps leverage blockchain expertise, real-time settlement methods, and partnerships with native suppliers to allow seamless world transactions. This innovation not solely boosts monetary inclusion but additionally helps worldwide commerce and distant work economies.

Fintech apps have revolutionized world finance by simplifying cross-border funds. In 2023, remittance flows to low and middle-income nations (LMICs) hit an estimated $669 billion. This was supported by strong labor markets in superior and GCC economies. These apps guarantee migrants can ship cash dwelling effectively, which highlights their essential position.

Enhanced regulatory compliance and fraud detection additional improve belief for worldwide transfers. As globalization accelerates, cross-border cost options will stay a essential differentiator for fintech apps looking for broad adoption.

Blockchain Integration for Transparency and Effectivity

Blockchain is quick changing into the muse of contemporary fintech methods because of its skill to reinforce transparency, safety, and operational effectivity.

Key Advantages

- Immutable Ledger:

Transactions are saved on an unchangeable blockchain ledger, eliminating intermediaries and minimizing dangers of fraud or knowledge manipulation. - Sooner Settlements:

Settlement occasions are considerably diminished—important for high-volume and cross-border transactions. - Enhanced Compliance:

Actual-time auditing and verifiable transaction histories simplify adherence to monetary rules. - Good Contracts:

Automate cost triggers primarily based on predefined situations, lowering handbook errors and administrative prices. - Hybrid Integration:

Main cost processors are creating fashions that join blockchain networks with conventional methods, sustaining scalability and pace. - Personal Blockchains:

Companies can defend transaction privateness whereas benefiting from decentralized safety and effectivity.

| Side | Profit | Impression |

| Transaction Storage | Immutable ledger | Removes intermediaries, prevents manipulation |

| Compliance | Actual-time auditing | Simplifies regulatory adherence |

| Automation | Good contracts | Cuts handbook errors and overhead |

| Scalability | Hybrid blockchain-traditional fashions | Ensures pace and efficiency |

| Privateness | Personal blockchain networks | Maintains confidentiality and belief |

Integration with Rising Applied sciences

Fintech apps are evolving into ecosystem-driven platforms that interconnect with a number of next-gen applied sciences.

Key Integrations

- Central Financial institution Digital Currencies (CBDCs):

Allow prompt, government-backed settlements inside fintech ecosystems. - Decentralized Finance (DeFi):

Gives direct incomes alternatives from wallets, lowering dependency on conventional banks. - Web of Issues (IoT):

Facilitates context-aware transactions—e.g., a related automotive paying for tolls or charging robotically. - Synthetic Intelligence (AI):

- Predicts consumer wants.

- Optimizes transaction timing.

- Detects anomalies to stop fraud.

- Augmented Actuality (AR):

Supplies visible monetary insights for higher engagement and decision-making.

| Expertise | Integration in Fintech | End result/Profit |

| CBDCs | Permits prompt, safe settlements | Improves transaction pace and reliability |

| DeFi | Pockets-based incomes and staking | Enhances consumer empowerment and autonomy |

| IoT | Context-aware transactions (e.g., good funds) | Expands usability in related environments |

| AI | Predictive analytics and fraud detection | Enhances personalization and safety |

| AR | Visible monetary dashboards and simulations | Improves consumer understanding and engagement |

Collective Impression:

These applied sciences rework fintech apps from standalone instruments into good monetary gateways that provide customers enhanced entry, management, and comfort.

Regulatory Compliance and Open Banking Assist

As fintech expands globally, regulatory adherence and open banking capabilities have develop into important.

Regulatory Necessities

- Compliance Requirements:

- Should adhere to AML (Anti-Cash Laundering) and KYC (Know Your Buyer) tips.

- Observe knowledge safety legal guidelines equivalent to GDPR (EU) and CCPA (US).

- Dangers of Non-Compliance:

Hefty fines, reputational injury, or operational restrictions. - Automated Compliance Instruments:

- Monitor transactions in actual time.

- Flag suspicious exercise.

- Generate audit-ready stories.

Open Banking Framework

- Definition:

Mandates banks and fintechs to share buyer knowledge securely with licensed third events by way of APIs. - Alternatives:

- Personalised monetary administration instruments.

- Cross-platform cost options.

- Automated budgeting and analytics.

- Buyer Advantages:

Consolidated account views, real-time insights, and seamless integration with a number of monetary companies.

| Compliance Space | Requirement | Implementation in Fintech |

| AML/KYC | Buyer id and transaction checks | Automated verification methods |

| Information Safety | GDPR, CCPA compliance | Encryption and consent administration |

| Open Banking APIs | Safe knowledge sharing | Licensed third-party integration |

| Transaction Monitoring | Steady monitoring | AI-driven danger detection and reporting |

Safety Integration:

APIs should adjust to strict authentication, encrypted transfers, and granular consent to make sure safe and clear knowledge dealing with.

Shaping the Way forward for Digital Finance

As fintech and cost apps evolve in 2025, success depends on combining innovation with belief. Integrating rising applied sciences whereas sustaining compliance empowers secure and environment friendly interactions. Customers and companies alike profit from personalised, dependable monetary experiences.

Apps that emphasize adaptability and user-focused design will outline the subsequent digital finance period. Collectively, these important options create the muse for a wiser, globally related monetary ecosystem.