From bleeding hundreds of thousands to producing $44+ billion in income – Uber’s exceptional transformation from a startup burning money to a worthwhile tech big is fascinating. When Uber launched, they actually provided rides for a track!! That wasn’t a slip, however a ploy that may ultimately reshape your complete transportation {industry}.

Figuring out how Uber makes income or deciphering Uber’s income mannequin isn’t simply tutorial curiosity. For entrepreneurs trying to enter the ride-hailing market, particularly in underserved Tier 2 and three cities, Uber’s journey provides plethora of insights into constructing a sustainable, scalable transportation platform.

Our weblog breaks down precisely how Uber generates its huge income, the psychology behind their pricing methods, and what wannabe entrepreneurs can be taught from their path to profitability.

What Is Uber? A Fast Enterprise Overview

Uber Applied sciences, Inc. revolutionized transportation when Garrett Camp and Travis Kalanick based it in March 2009. What began as “UberCab” in SFO developed into the world’s largest mobility platform, intrinsically altering how individuals understand transportation.

In the present day’s Uber operates at unprecedented scale – over 130 million month-to-month energetic platform customers and seven.8 million energetic drivers worldwide. The corporate has transcended its ride-hailing origins, increasing into meals supply (Uber Eats), freight logistics (Uber Freight), and rising applied sciences like autonomous automobiles by way of partnerships with Waymo and different AV firms.

The platform facilitates over 21 million journeys day by day throughout 70+ international locations, making it not only a transportation firm however a complete mobility ecosystem. Uber’s evolution from a luxurious black automobile service to an important utility, demonstrates the facility of tech-driven market disruption and strategic enterprise mannequin enlargement.

Uber’s Core Income Streams: Breaking Down the $44 Billion

1. Trip-Hailing Commissions (Main Income Driver)

| Income Stream | 2024 Income | Market Share | Development Price (YoY) |

| Trip-Hailing (Mobility) | $25.0 billion | 57% | 24.2% |

| Meals Supply (Uber Eats) | $13.7 billion | 31% | 21.3% |

| Freight Logistics | $5.24 billion | 12% | 8.7% |

| Complete Income | $43.9 billion | 100% | 18.1% |

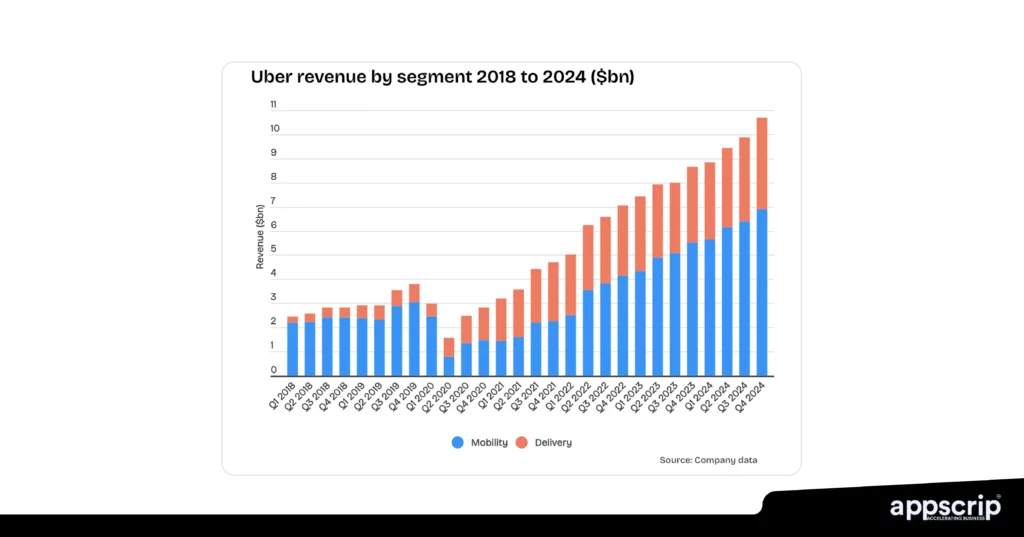

Uber’s mobility phase stays the cornerstone of its enterprise, producing roughly $25 billion in 2024. The commission-based mannequin works as follows:

Income Break up Construction:

• Uber Fee: 20-25% of complete fare

• Driver Earnings: 75-80% of complete fare

• Instance: $20 journey = $4-5 to Uber, $15-16 to driver

Geographic Fee Variations:

• Established Markets (San Francisco, NYC): 18-22% fee

• Rising Markets (Tier 2/3 cities): 25-30% fee

• Reasoning: Larger charges offset operational prices and decrease journey volumes

The 2024 figures present exceptional resilience, with mobility income rising 25% YoY in This fall 2024, demonstrating that ride-hailing demand has not solely recovered from pandemic lows however exceeded pre-2020 ranges throughout most markets.

2. Uber Eats Supply Income

Meals supply has turn out to be Uber’s second-largest income generator, contributing $13.7 billion in 2024. The income mannequin operates on a number of streams:

Uber Eats Income Sources:

• Restaurant Commissions: 15-30% per order

• Buyer Supply Charges: $1.50-$5.99 per supply

• Service Charges: 2-5% of order worth

• Promoting Income: Restaurant promotion placements

Key Efficiency Metrics:

• World Attain: 6,000+ cities worldwide

• Development Price: 21% year-over-year (This fall 2024)

• Strategic Position: Entry level for brand new geographic markets

• Market Place: Typically outperforms ride-hailing in worldwide markets

3. Uber Freight Logistics

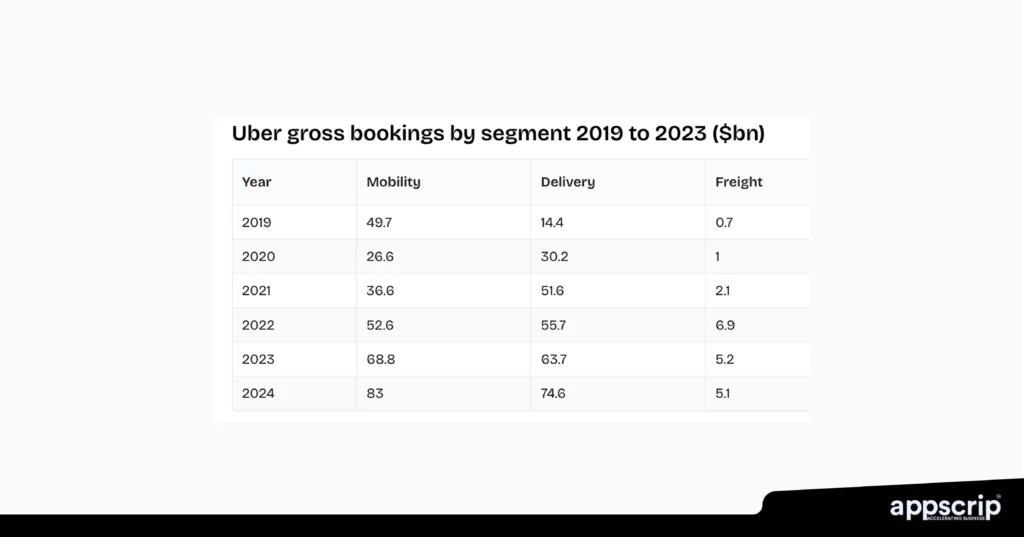

Uber Freight represents the corporate’s bold enlargement into the $800 billion world freight market, producing $5.24 billion in 2024. This B2B platform connects shippers with carriers, making use of Uber’s know-how experience to optimize truck utilization and scale back empty miles.

Freight Income Mechanisms:

• Transaction Charges: Fee on accomplished shipments

• Logistics Markup: Premium on service charges

• Premium Providers: Specific supply and specialised cargo

• Know-how Providers: Route optimization and fleet administration instruments

Strategic significance extends past present income – freight operations present priceless information insights and technological capabilities that strengthen Uber’s total platform ecosystem.

4. Extra Income Streams

| Income Supply | Description | Income Impression |

| Uber One Subscriptions | Month-to-month membership ($9.99) | 25M+ subscribers, recurring income |

| Surge Pricing | Dynamic fare multipliers (1.2x-8x) | 15-25% of complete mobility income |

| Promoting Income | Restaurant promotions in app | Rising phase, $100M+ yearly |

| Cancellation Charges | Late cancellation penalties | Reduces driver downtime, ~2% of income |

The Psychology Behind Uber’s Pricing Technique

Dynamic Surge Pricing Defined

Uber’s surge pricing algorithm represents refined demand-supply economics in real-time. When demand exceeds obtainable drivers, multipliers starting from 1.2x to 8x+ improve fares routinely. This isn’t arbitrary worth gouging – it’s behavioral economics designed to attain market equilibrium.

The algorithm considers a number of variables: energetic riders requesting journeys, obtainable drivers, historic demand patterns, native occasions, climate circumstances, and competing transportation availability. Larger costs serve two functions: incentivizing extra drivers to come back on-line and inspiring some riders to delay journeys or select options.

Buyer habits evaluation reveals that surge pricing, regardless of complaints, truly improves total consumer satisfaction by guaranteeing journey availability when wanted most. Income impression is important – surge durations can generate 2-3x regular income per hour, contributing considerably to each driver earnings and Uber’s fee income.

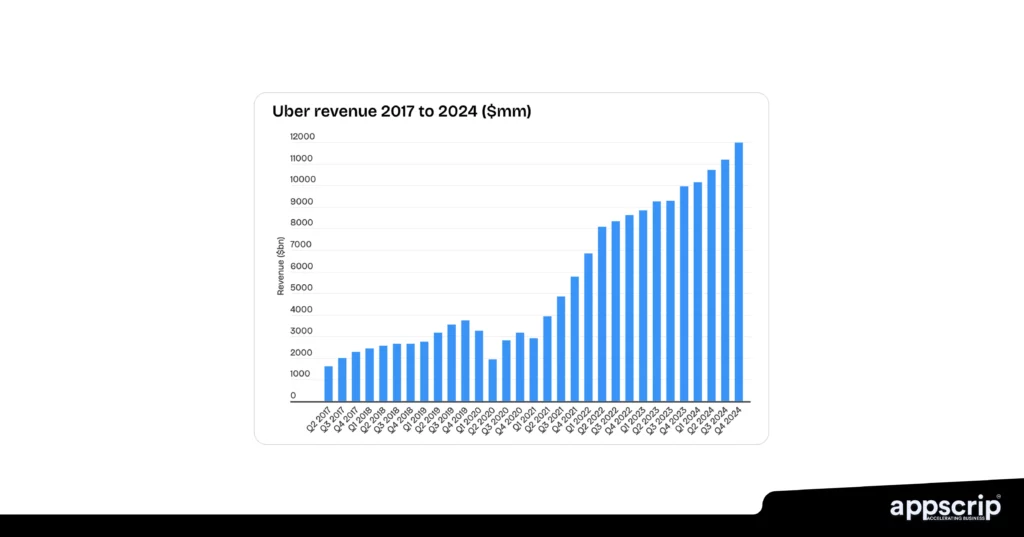

From Sponsored Rides to Profitability

Uber’s journey from loss-leader to profitability required a masterful transition. From 2009-2022, the corporate backed rides closely, usually dropping cash on each journey to construct market share and get rid of conventional taxi competitors. This wasn’t sustainable long-term, however it achieved market penetration.

The transition part (2022-2024) concerned steadily elevating costs whereas sustaining market share by way of improved service high quality and community results. Uber efficiently conditioned prospects to worth comfort and reliability over rock-bottom costs. The 2024 breakthrough – consecutive worthwhile quarters – validates this technique.

Market penetration ways included driver incentives, rider promotions, and below-cost pricing that collectively burned billions in investor capital. Nonetheless, this funding created insurmountable aggressive moats by way of community results, model recognition, and operational scale that new entrants can’t simply replicate.

How The Uber Enterprise Mannequin Disrupted Conventional Transportation

The Aggregator Benefit

Uber pioneered the asset-light aggregator mannequin in transportation – proudly owning no automobiles whereas controlling your complete buyer expertise. This method offers large benefits: speedy scalability, decreased capital necessities, and suppleness to adapt to native market circumstances with out huge infrastructure investments.

Know-how differentiation proved essential – the app-based reserving system, real-time monitoring, clear pricing, and cashless funds created vastly superior consumer expertise in comparison with conventional taxi providers. High quality management by way of ranking methods and standardization created consistency that fragmented taxi industries couldn’t match.

The aggregator mannequin additionally permits refined information assortment and evaluation, permitting Uber to optimize routes, predict demand, set dynamic pricing, and repeatedly enhance service supply – aggressive benefits that conventional transportation suppliers lack.

Aggressive Moats

Community results create Uber’s strongest aggressive protection. Extra riders entice extra drivers, which improves service high quality (shorter wait instances, higher protection), which attracts extra riders in a virtuous cycle. This two-sided market turns into more and more tough for opponents to penetrate as Uber’s community density will increase.

Knowledge benefits compound over time – billions of journeys generate insights into site visitors patterns, demand forecasting, optimum pricing, and operational effectivity that new entrants can’t shortly replicate. Model recognition reworked “uber” right into a verb synonymous with ride-hailing, creating psychological switching prices for opponents to beat.

Uber’s Path to Profitability: Classes for Entrepreneurs

The Strategic Timeline

Part 1 (2009-2015): Market Penetration

• Main Focus: Consumer acquisition and market share progress

• Technique: Sponsored rides to construct essential mass

• Funding: Large capital necessities for enlargement

• End result: Market management established in key cities

Part 2 (2016-2022): Diversification & Growth

• Geographic Development: Worldwide enlargement to 70+ international locations

• Service Growth: Launch of Uber Eats, Uber Freight, premium providers

• Income Diversification: Lowered dependence on ride-hailing alone

• Problem: Balancing progress investments with path to profitability

Part 3 (2023+): Profitability & Optimization

• Operational Focus: Streamlined operations and value effectivity

• Pricing Optimization: Positive-tuned pricing for sustainable margins

• Know-how Integration: AI-driven demand forecasting and route optimization

• Achievement: First consecutive worthwhile quarters in firm historical past

Key Turning Factors

Strategic Selections That Enabled Profitability:

• R&D Value Discount: Bought autonomous car division to Aurora, eliminating $2B+ annual bills

• Operational Effectivity: Streamlined company construction and decreased redundant operations

• Sensible Partnerships: Collaborated with AV firms as an alternative of constructing in-house know-how

• Value Optimization: Subtle testing to stability affordability with profitability

• Pandemic Adaptation: Accelerated Uber Eats progress whereas sustaining core ride-hailing operations

What This Means for Aspiring Entrepreneurs

Market Validation Insights:

• Confirmed Demand: World urge for food for handy transportation providers continues rising

• Native Alternatives: Tier 2/3 cities usually underserved by main platforms

• Know-how Accessibility: Cloud infrastructure and APIs now reasonably priced for startups

• Capital Effectivity: Fashionable options allow quicker launches with decrease preliminary funding

Success Components for New Entrants:

• Native Market Focus: Deep understanding of regional preferences and laws

• Operational Self-discipline: Construct sustainable unit economics from day one

• Know-how Leverage: Use confirmed platforms slightly than constructing from scratch

• Strategic Partnerships: Collaborate with native companies and authorities entities

Key Statistics On How Uber Makes Income

Listed below are key statistics and figures concerning Uber’s consumer base and income:

- Annual Income (2023): Uber reported over $31 billion in annual income, pushed by its numerous vary of providers like ride-hailing, Uber Eats, and Uber Freight.

- Month-to-month Energetic Customers: Uber has over 130 million month-to-month energetic customers globally throughout its platforms, together with ride-hailing and meals supply providers.

- Journeys Per Day: Uber facilitates 21 million journeys per day on common, showcasing the platform’s world attain and excessive demand.

- Driver Companions: Uber works with roughly 5 million driver companions, serving to to keep up its large-scale operations and meet rider demand worldwide.

- UberEats Income Share: UberEats contributes about 33% of complete income, indicating the numerous position meals supply performs in Uber’s total enterprise technique.

- Market Presence: Uber operates in over 10,000 cities throughout 70+ international locations, reflecting its huge world footprint and enlargement technique.

- Uber Freight Development: Uber Freight, the logistics arm, continues to increase quickly, contributing over $1 billion yearly to Uber’s total income.

Execs and Cons of How Uber Makes Income

| Execs | Cons |

| Diversified Income Streams: Uber generates revenue from a number of sources—ride-hailing, meals supply, freight, and company providers—making it much less depending on a single enterprise space. | Driver-Associated Challenges: Uber depends closely on its driver community, however drivers are unbiased contractors, resulting in points similar to turnover, dissatisfaction over wages, and regulatory scrutiny. |

| Scalability and Flexibility: Uber can scale quickly in new markets with minimal upfront funding in bodily infrastructure, because of its platform mannequin. | Regulatory and Authorized Dangers: Uber operates in extremely regulated markets worldwide. Its income mannequin is susceptible to modifications in native legal guidelines. |

| Low Capital Expenditure: Since Uber doesn’t personal its automobiles, it avoids the excessive capital prices related to sustaining a fleet. | Low Revenue Margins: Regardless of its excessive income, Uber has traditionally struggled to show a revenue as a consequence of excessive operational prices, advertising bills, and driver incentives. |

| Recurring Subscription Income: Providers like Uber Cross and Uber One generate recurring income, selling buyer loyalty. | Intense Competitors: Uber faces intense competitors from different ride-hailing providers, meals supply platforms. |

Constructing Your Personal Uber-Like Platform: Income Concerns

Income Mannequin Adaptation for Native Markets

| Market Sort | Fee Construction | Pricing Technique | Success Components |

| Rising Markets | 25-30% fee | Affordability focus, versatile funds | Driver revenue premiums, money integration |

| Mature Markets | 18-22% fee | Premium providers, subscriptions | Service high quality, model differentiation |

| Hybrid Markets | Variable charges | Dynamic pricing fashions | Native partnerships, regulatory compliance |

Fee Construction Concerns:

• Driver Retention: Stability profitability with aggressive driver earnings

• Market Situations: Alter charges based mostly on native financial elements

• Competitors: Monitor competitor charges and worth propositions

• Regulation: Adjust to native pricing and fee restrictions

Various Income Fashions:

• Flat Charge Construction: Fastened per-ride fees as an alternative of share commissions

• Subscription Fashions: Month-to-month driver or rider memberships

• Hybrid Approaches: Mix base charges with efficiency incentives

• Worth-Added Providers: Premium options, insurance coverage, car financing

Know-how and Time-to-Market

Growth Value Comparability:

| Strategy | Value Vary | Timeline | Benefits | Disadvantages |

| Customized Growth | $500K – $2M+ | 12-24 months | Full customization | Excessive price, gradual launch |

| White-Label Options | $15K – $50K | 7-10 days | Fast deployment | Restricted customization |

| Hybrid Strategy | $100K – $300K | 3-6 months | Balanced resolution | Reasonable complexity |

Scaling Infrastructure Necessities:

• Fee Processing: Multi-currency, a number of fee strategies

• Driver Onboarding: Background checks, doc verification, coaching methods

• Buyer Help: 24/7 help throughout a number of channels and languages

• Analytics Platform: Actual-time dashboards, efficiency monitoring, enterprise intelligence

The Appscrip Benefit:

Appscrip provides entrepreneurs a complete resolution that addresses the important thing challenges of platform improvement:

• Confirmed Know-how: Battle-tested options based mostly on Uber’s profitable mannequin

• Speedy Deployment: 4-6 weeks launch timeline versus months of customized improvement

• Value Effectivity: $15,000 beginning funding in comparison with $500K+ customized builds

• Scalable Structure: Constructed-in capability for progress with out main rebuilds

• Income Optimization: Built-in monetization options and analytics dashboards

• Market Focus: Designed particularly for Tier 2/3 metropolis alternatives

Way forward for Trip-Hailing Income Fashions

Rising Tendencies

Subscription fashions works for frequent riders, month-to-month plans with discounted charges can generate predictable income whereas growing buyer LTV. Early pilots in choose markets exhibit robust adoption amongst commuter segments.

AVs will essentially alter price constructions and income fashions. Whereas nonetheless years away from widespread deployment, partnerships like Uber’s collaboration with Waymo in Austin preview future income alternatives with probably increased margins as a consequence of eradicated driver prices.

Multi-modal transportation integration represents vital alternative – combining ride-hailing with public transit, bike-sharing, and different transportation choices creates complete mobility options with increased income potential.

Alternatives for New Entrants

Area of interest markets supply substantial alternatives – specialised providers for luxurious transportation, eco-friendly automobiles, accessibility-focused rides, or industry-specific options (medical transport, senior providers) can command premium pricing whereas serving underserved segments.

Regional focus permits deep native market understanding and customization that world gamers usually can’t match. Profitable regional gamers continuously turn out to be acquisition targets for bigger platforms searching for market entry or native experience.

Know-how innovation continues creating new prospects – AI optimization, EV integration, and enhanced security options present aggressive differentiation alternatives for modern entrepreneurs keen to put money into next-generation platform capabilities.

Autonomous Automobile Partnerships: The Future Income Stream

Strategic AV Collaborations

Uber’s AV technique has developed from pricey inside improvement to strategic partnerships that decrease threat whereas maximizing alternative. Their collaboration with Waymo in Austin, Texas represents a brand new income mannequin the place Uber offers the platform and buyer base whereas AV firms provide the know-how and automobiles.

In Austin, Waymo automobiles working by way of Uber’s platform are “busier than 99% of all drivers” when it comes to accomplished journeys per day. This efficiency demonstrates the potential for AV partnerships to generate increased utilization charges than human drivers, translating to elevated income per car.

The partnership mannequin permits Uber to seize fee income from AV rides with out the large R&D investments that beforehand price billions yearly. Extra partnerships with Avride, Could Mobility, and Aurora for freight providers increase this technique throughout a number of service classes and geographic markets.

Income implications are vital – AV rides can function 24/7 with out driver fatigue limitations, probably doubling or tripling day by day journey capability per car. Whereas AV know-how stays costly, the fee curve is declining quickly, making worthwhile AV operations more and more viable in dense city markets.

Aggressive Positioning in AV Market

Tesla’s entry into robotaxi providers creates each competitors and validation for the AV market alternative. Tesla began testing a robotaxi service in Austin utilizing Mannequin Y automobiles with human security supervisors, taking a extra cautious method than Waymo’s absolutely autonomous operations.

Uber’s platform-agnostic technique offers aggressive benefits – slightly than creating proprietary AV know-how, Uber can associate with a number of AV suppliers, providing customers alternative whereas decreasing technological threat. This method additionally permits quicker market entry as AV know-how matures in several areas.

The trillion-dollar AV market alternative validates Uber’s strategic pivot towards partnerships slightly than inside improvement. Whereas commercialization will take “many, a few years” in line with CEO Dara Khosrowshahi, early partnerships place Uber to seize vital market share as AV adoption accelerates.

World Market Penetration Technique

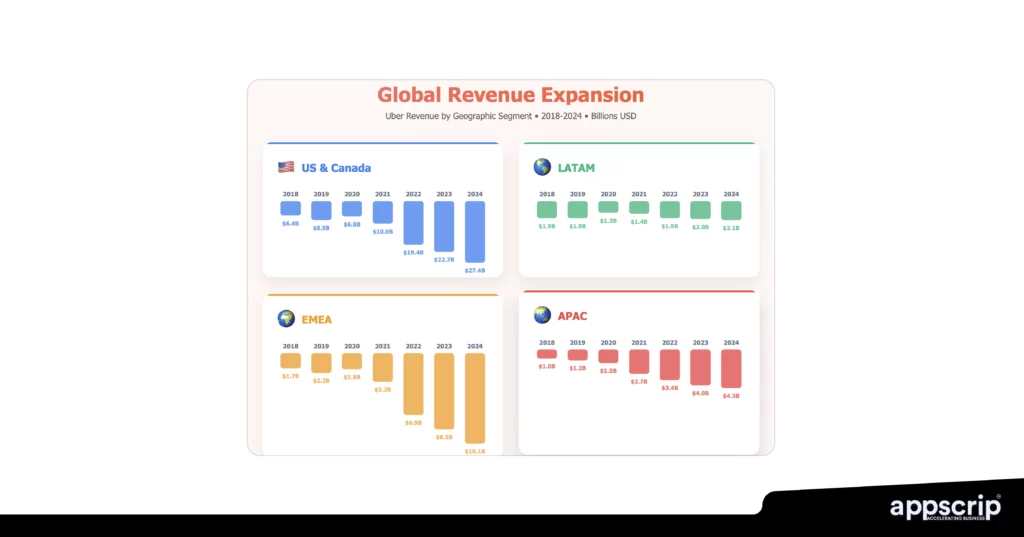

Regional Income Optimization

Uber’s world enlargement demonstrates how income fashions should adapt to native market circumstances. In India, auto-rickshaw integration (Uber Auto) addresses native transportation preferences whereas producing fee income from lower-cost journeys. Center Japanese markets see increased luxurious service adoption, enabling premium pricing methods.

Latin American markets current distinctive alternatives for entrepreneurs – many cities lack environment friendly public transportation, creating substantial demand for dependable ride-hailing providers. Native laws usually favor home firms, offering benefits for regional gamers over world platforms.

Income optimization varies considerably by area. Developed markets give attention to premium providers and subscription fashions, whereas rising markets emphasize affordability and fee flexibility. Understanding these dynamics is essential for entrepreneurs concentrating on particular geographic areas.

Market Entry Concerns

Regulatory navigation stays essential for worldwide enlargement. Some markets require native partnerships, particular insurance coverage protection, or authorities approvals that may delay entry considerably. Nonetheless, these regulatory limitations additionally create protecting moats for early entrants who efficiently navigate native necessities.

Cultural adaptation impacts income potential considerably. Markets with robust money economies require totally different fee methods than cashless societies. Security issues, gender preferences, and car kind expectations all affect service design and pricing methods.

Aggressive panorama evaluation helps establish market alternatives. Cities dominated by conventional taxi providers usually current simpler entry paths than markets with established ride-hailing opponents. First-mover benefits in underserved markets can create sustainable aggressive positions.

Conclusion: How Uber Makes Income

Uber’s transformation from a cash-burning startup to a income churning big provides priceless classes for entrepreneurs. Their journey demonstrates sustainable enterprise fashions require balancing progress with profitability, adapting to native market circumstances, and steady innovation to remain forward of competitors.

Uber makes cash by way of diversified income streams – ride-hailing commissions (57%), meals supply (31%), freight providers (12%) – whereas leveraging know-how and community results to keep up aggressive benefits.

For entrepreneurs, the important thing perception is that trendy ride-hailing success require extra than simply copying Uber’s mannequin; it calls for native market understanding, operational effectivity, and strategic use of confirmed know-how platforms.

Key Takeaways for Entrepreneurs

Essentially the most vital alternative for brand new entrants lies in underserved Tier 2 and three cities the place established gamers have restricted presence.

With confirmed white-label options like Appscrip’s Uber clone providing complete performance at $15,000 beginning prices, entrepreneurs can launch refined platforms in days slightly than years, focusing sources on market penetration and buyer acquisition slightly than technical improvement.

Uber’s path to profitability took over a decade and billions in losses – trendy entrepreneurs have the benefit of studying from these experiences whereas leveraging extra environment friendly know-how options to attain profitability quicker and with much less capital funding.

Able to launch your individual ride-hailing platform? Discover how Appscrip’s confirmed Uber clone resolution may help you enter the transportation market shortly and cost-effectively.