As we navigate the opening days of 2026, the UAE’s enterprise panorama is present process a basic shift. For years, we’ve mentioned a digital-first future, however 2026 marks the Nice Transition – the second the place back-office compliance and front-end buyer expertise lastly converge.

To my advertising, progress, and retail enterprise leaders within the UAE: For those who nonetheless view an bill as a static PDF connected to an electronic mail, you might be lacking probably the most vital information goldmine of the last decade. The UAE’s necessary e-invoicing rollout is not only a tax division requirement; it’s the last bridge throughout the online-offline hole.

The UAE has transitioned to a Decentralized Steady Transaction Management (CTC) mannequin, leveraging the worldwide Peppol community. Below this mandate, each transaction should be structured in a selected XML format (PINT-AE) and transmitted by an Accredited Service Supplier (ASP).

This ASP not solely delivers the invoice but in addition stories the transaction to the Federal Tax Authority (FTA) in close to real-time. Whereas finance groups concentrate on the 50+ necessary information fields now required for compliance, savvy entrepreneurs acknowledge this as the ultimate piece of the omnichannel puzzle.

On this first deep dive of 2026, we look at how the e-invoicing mandate and different vital developments this 12 months are reshaping buyer engagement within the Center East.

1. Activating “Darkish” Offline Knowledge: From Ghosts to Company

Traditionally, the second a buyer walked out of a bodily boutique in Dubai Mall or a hypermarket in Abu Dhabi, they turned a ghost to the digital advertising workforce. This led to the final word advertising fail: retargeting a loyal buyer with adverts for a premium watch or a set of trainers they actually simply purchased in-store twenty minutes in the past.

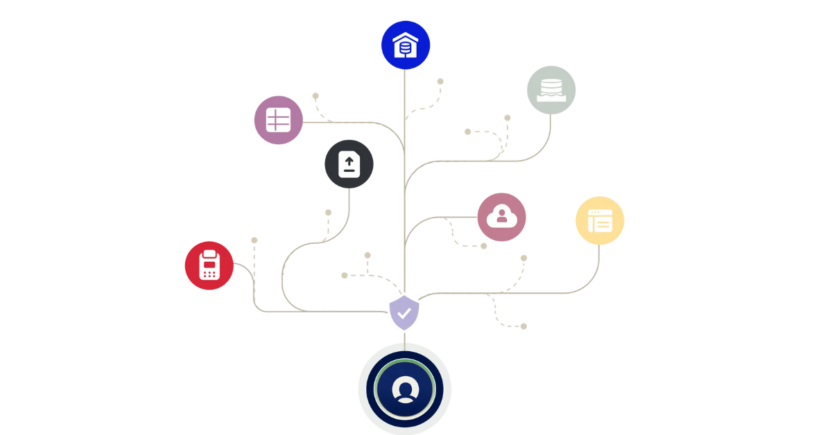

- Deterministic Certainty: Beforehand, we relied on probabilistic guessing – making an attempt to hyperlink a browser cookie to an individual. By flowing PINT-AE information immediately into the MoEngage Knowledge Administration hub, we transfer to deterministic certainty.

- The Technique: We now not view a purchase order as the tip of a funnel. As an alternative, the system treats the FTA-validated transaction as a real-time set off.

- Retail Trade Instance: Take a Leaf Out of the Azadea Group’s Playbook. If a buyer buys high-end trainers offline, the system can immediately suppress introductory adverts and as an alternative set off a customized invitation to an area marathon or a Luxurious Care Information tailor-made to their particular buy, all inside milliseconds.

2. The “WhatsApp-First” Service Structure

Within the Gulf, WhatsApp is the digital majlis the place enterprise occurs. By 2026, shoppers could have formally misplaced persistence for clunky buyer portals or logging into web sites to discover a receipt.

-

Contextual Comfort:

At MoEngage, we imagine in embedding the e-invoice as a wealthy media occasion immediately inside a conversational thread.

-

Merlin AI & The Engagement Window:

Utilizing Merlin AI to research historic patterns, the system doesn’t simply blast a message; it identifies the particular engagement window – the time of day a buyer is almost definitely to work together with their telephone.

-

Retail Trade Instance:

Mirroring the success of Mashreq Neo, a retailer can rework a dry tax doc right into a premium concierge service. Throughout the identical WhatsApp thread the place they acquired their bill, a buyer can provoke a return, observe a supply, or browse a curated “full the look” gallery tailor-made to their just-purchased merchandise.

3. Excessive-Octane Segmentation by Warehouse Syncing

The brand new tax rules are forcing companies to wash their information rooms. This isn’t nearly staying out of hassle; it’s about lastly understanding who your prospects really are.

-

Behavioral Affinities:

Relatively than letting transaction information sit in a siloed finance ERP, the successful technique is Warehouse Syncing.

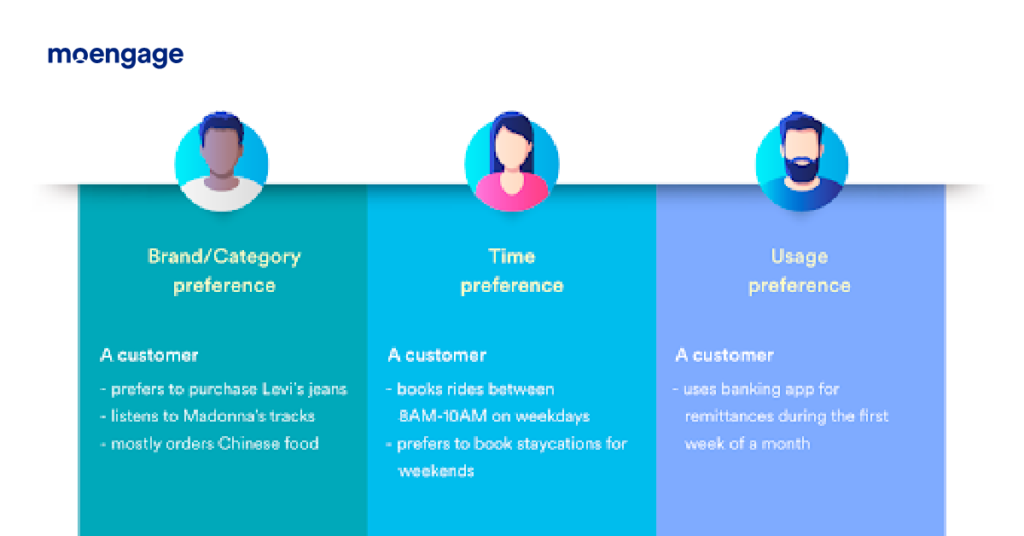

Flowing machine-readable XML information right into a centralized platform lets you create “Behavioral Affinities” primarily based on verified wallet-share, not simply web site clicks.

Flowing machine-readable XML information right into a centralized platform lets you create “Behavioral Affinities” primarily based on verified wallet-share, not simply web site clicks. -

Retail Trade Instance:

If precisely what a buyer purchased offline, you possibly can construct lookalike audiences on your digital adverts rooted in actual income. You may determine “Excessive-Worth Gourmand Buyers” preferring looking on Friday mornings and goal them with bespoke gives earlier than they even plan their subsequent journey to the shop.

4. Knowledge Sovereignty as a Aggressive Benefit

With the UAE’s Private Knowledge Safety Legislation (PDPL) now in impact, “The place is my information?” has change into a normal buyer query. E-invoicing information is very delicate, containing detailed transaction historical past and private identifiers.

-

Compliant Orchestration:

MoEngage ensures safety by native UAE-based information facilities. By aligning with FTA requirements and PDPL mandates, you rework compliance right into a basis of belief that permits deeper information sharing and extra intimate buyer relationships.

Adapting to the Change: Your 3-Step Playbook for 2026

- Join Your Corners: Don’t anticipate the necessary July deadline. Begin integrating your ERP and POS methods along with your Buyer Knowledge and Engagement Platform (CDEP) now in order that your information flows immediately into engagement journeys.

- Transfer to Behavioral Affinities: Shift past fundamental demographics like “Feminine, 28, Dubai”. Use verified transaction information to know true habits and lifelong worth (LTV).

- Localize the Automated Expertise: The UAE is a singular mix of world luxurious and deep-rooted traditions. Guarantee your AI understands regional nuances, from cultural events like Ramadan to native buying habits.

The MoEngage Perspective: Your Knowledge is Your Dialogue

The 2026 e-invoicing mandate isn’t a hurdle – it’s a bridge. By unifying your on-line and offline information, you possibly can lastly see the 360-degree view of the buyer that was as soon as a fable.

The UAE is shifting quick. The companies that can dominate the late 2020s are people who see 2026 not as a 12 months of compliance, however because the 12 months they lastly really meet their prospects.