A fee gateway is the ultimate piece in a puzzle that companies fill in to fulfill a buyer. For companies, it’s not nearly accepting funds — it’s extra about making the method simple, safe, and hassle-free.

Regardless that many companies depend on third-party gateways, some could select to construct their very own for much higher management, decrease transaction charges, and to supply clients a satisfying expertise.

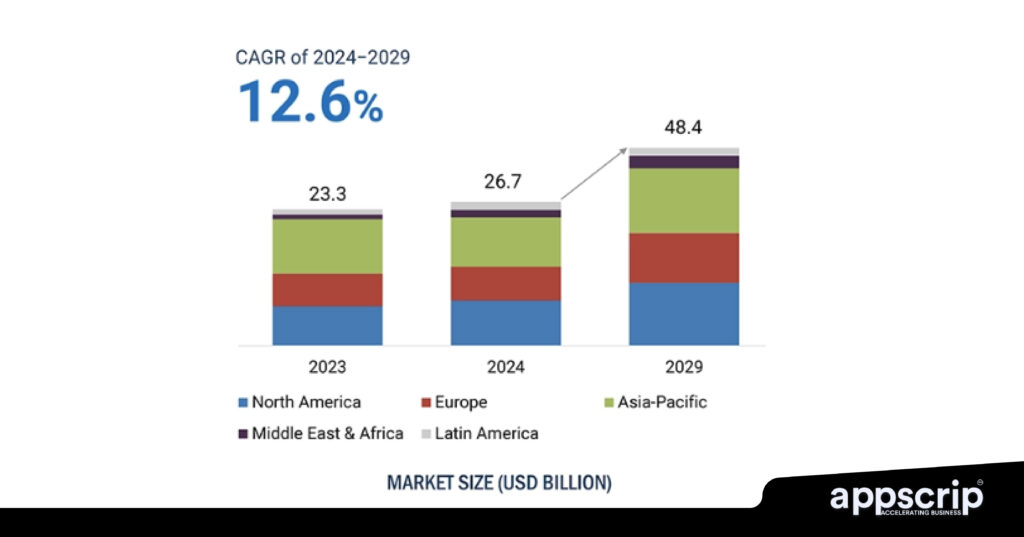

In 2024 the worldwide fee gateway market dimension was valued at $26.7 billion and it’s anticipated to develop at 12.6% CAGR to achieve $48.4 billion by 2029. A customized fee gateway lets companies help a number of fee strategies, streamline transactions, and improve safety.

Understanding Cost Gateway Improvement

What’s a Cost Gateway?

A fee gateway is a bridge between a buyer’s fiat and the service provider’s account. It’s the channel that facilitates on-line transactions. Cost gateways share the fee data from the shopper’s financial institution to the service provider’s financial institution to make sure a clean buy expertise.

Delicate data is encrypted to stop fraud, making funds safe and seamless.

Key elements of a fee gateway embrace:

- Cost Processor: Transaction is dealt with by forwarding knowledge.

- Service provider Account: The place funds have to be deposited.

- Buyer’s Financial institution: From the place the issuance of the fee happens.

How Does A Cost Gateway Work

After a purchase order, the fee gateway connects the shopper’s fee methodology to a enterprise’s fee processor. The client’s fee data is encrypted and forwarded to the enterprise’s financial institution.

The service provider’s financial institution responds to the shopper’s financial institution. If the whole lot checks out, the funds are transferred, and the transaction is full.

Key stakeholders on this course of:

Service provider: The enterprise receiving fee.

Buying Financial institution: The service provider’s financial institution.

Issuing Financial institution: The client’s financial institution.

Cost Processor: Facilitates communication between banks.

Forms of Cost Gateways

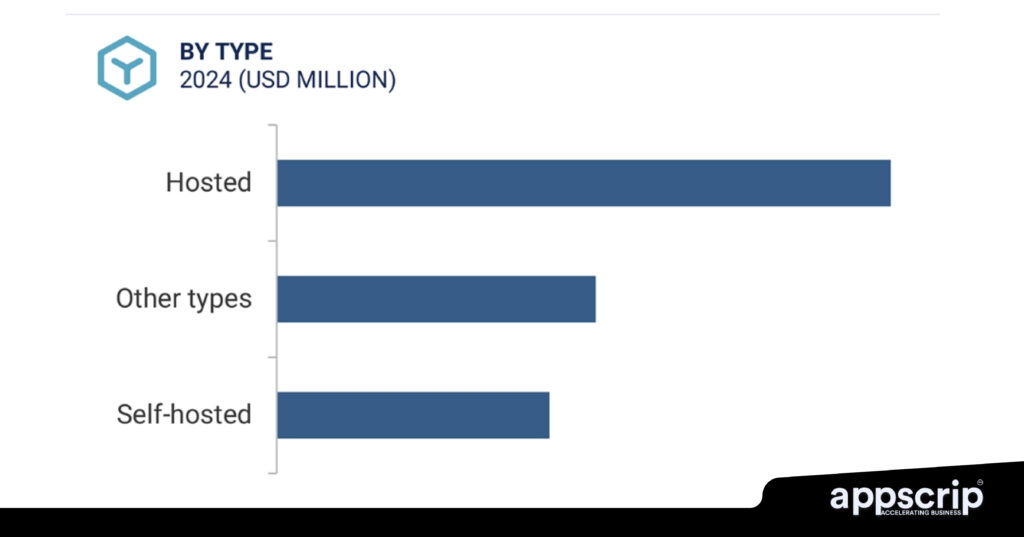

Hosted vs. Non-hosted Gateways

Hosted gateways redirect clients to a third-party website to finish fee. Non-hosted gateways enable funds immediately on the service provider’s web site.

API-based vs. Third-Get together Options

API-based gateways present extra management however require improvement work. Third-party options are plug-and-done choices, it saves time however limits customization.

Business-Particular Cost Gateways

The wants of assorted industries for fee processing are distinctive. For instance, Fintech requires layers of safety, E-commerce wants seamless integration with on-line shops, and subscription companies deal with recurring billing choices.

For fee gateways to perform successfully, they should fulfill the necessities of as many industries

Key Options of a Cost Gateway

Safety and Compliance Requirements

Safety is non-negotiable for fee gateways. PCI-DSS compliance is the baseline, because it ensures strict safety requirements. Encryption and tokenization are must-haves because it protects delicate knowledge. Fraud prevention instruments are equally crucial to cease dangerous influences.

Don’t overlook compliance with laws like GDPR (for Europe) or HIPAA (for healthcare). These are important for constructing belief and avoiding authorized hassles.

- PCI-DSS compliance for safe transactions.

- Encryption, tokenization, and fraud prevention mechanisms.

- Adherence to GDPR, HIPAA, and different regional compliance requirements.

Person Expertise and Interface Issues

A fee gateway ought to smoothen the fee course of. One-click checkout is what shoppers search as of late and it mitigates cart abandonment and retains companies comfortable. A flawless, intuitive interface is important. If the method is laborious, customers won’t full the sale.

Cell optimization is crucial as many individuals store on their telephones. A fee gateway should work flawlessly on any machine. Customized branding additionally must be taken care of, in order that clients take pleasure in a healthful expertise.

- One-click checkout for quicker funds.

- Seamless and intuitive consumer interface.

- Cell-friendly fee optimization.

- Customized branding enhances expertise.

Scalability and Future-Proofing

A fee gateway ought to be capable of deal with rising site visitors. It also needs to help a number of currencies and fee strategies, particularly when you’ve got international purchasers.

Additionally remember the longer term and developments like cryptocurrency funds or buy-now-pay-later choices. gateway ought to adapt to such modifications.

- Functionality to deal with growing transaction volumes.

- Assist for a number of currencies and fee strategies.

- Adaptability to rising developments like crypto.

Multi-Foreign money & Regional Assist

Manufacturers promoting internationally want multi-currency help. Prospects want the comfort to pay of their native forex, and an excellent gateway helps it. There needs to be no surprises whereas dealing with alternate charges.

Guidelines fluctuate from nation to nation, subsequently regional compliance is important for fee gateways. Thus you possibly can increase with out authorized / technical roadblocks.

- World fee processing key for worldwide clients.

- Environment friendly dealing with of alternate charges and regional laws is a should.

Fraud Detection & Danger Administration

Fraud is for actual, however an excellent fee gateway retains you from hurt. AI-powered fraud detection instruments are efficient, spot suspicious exercise in actual time to take evasive motion upfront.

Chargebacks and disputes are hassles that may hassle you. A robust gateway will handle these effectively, saving your time, cash and fame. Maintain the fee course of freed from glitches and reduce danger to your clients.

- AI-powered instruments are crucial for real-time fraud prevention.

- Have chargeback administration and dispute decision programs in place.

Steps to Construct a Cost Gateway

Constructing a fee gateway requires cautious planning, the proper expertise, and strict safety measures. We will break down every step in a transparent and sensible approach that can assist you navigate the method.

Step 1 – Market Analysis & Enterprise Mannequin Choice

Earlier than starting improvement, it’s essential to know the market.

- Establish Consumer Wants – Are you aiming for B2B companies, B2C or each? What particular issues you goal to unravel?

- Select A Enterprise Mannequin – Do need to undertake a flat-fee mannequin, transaction-based pricing, or a hybrid method.

- Aggressive Evaluation & Differentiation – Research PayPal, Stripe, and Sq.. Discover gaps you possibly can tackle, like decrease charges, higher safety, or distinctive options.

Step 2 – Selecting the Proper Know-how Stack

The tech stack will resolve the efficiency and scalability of you mannequin.

- Programming Languages – PHP, Java, Python, Ruby on Rails, or .NET are common.

- Database & Server Necessities – Sturdy databases like PostgreSQL or MySQL could be trusted. Go for scalable servers like AWS or Google Cloud.

- Cloud-Based mostly vs. On-Premise – Cloud options supply scalability, whereas on-premise options present extra management and safety.

Step 3 – Constructing Core Functionalities

Now begins the event, a fee gateway should deal with transactions easily and securely.

- Cost Processing & Authorization Stream – Implement safe fee processing and guarantee transactions are rightly licensed.

- Multi-Foreign money Assist & Dynamic Pricing – World transactions with real-time forex conversion are key.

- Integration with Banks & Third-Get together Companies – Banking APIs are key, additionally join with companies like Visa, Mastercard, and PayPal.

Step 4 – Guaranteeing Safety & Compliance

Safety is the identification of any fee processor. Compliance and fraud prevention have to be prioritised.

- Implement Fraud Detection – AI-based fraud detection instruments assist stop chargebacks and unauthorized transactions.

- Meet Compliance Necessities – Comply with PCI DSS requirements and adjust to laws like GDPR, PSD2, and native monetary legal guidelines.

- Common Safety Audits – Periodic safety checks and updates will help stop points initially itself.

Step 5 – Testing & Deployment

Earlier than launching, rigorous testing is important.

- Efficiency & Stress Testing – Take a look at for top site visitors and huge transaction volumes.

- Safety Penetration Testing – Establish attainable safety dangers and repair them.

- Beta Testing – Verify efficiency with a small group for suggestions earlier than complete deployment.

Step 6 – Integration with Third-Get together Platforms

A fee gateway should combine with different platforms simply for broader adoption.

- E-commerce Platforms – Guarantee compatibility with on-line shops like Shopify, WooCommerce, Magento, and others.

- Banking APIs & Monetary Networks – Maintain banks and monetary establishments within the loop to allow clean transactions.

Step 7 – Publish-Launch Assist & Upkeep

Steady monitoring and enchancment are key.

- Common Software program Updates – Repair bugs, enhance safety, and add new options.

- Buyer Assist Infrastructure – Supply 24/7 help to resolve transaction points.

- Scalability Issues – Optimize infrastructure as transaction volumes develop.

How A lot Does It Price to Develop a Cost Gateway?

Estimated Improvement Prices

| Class | Description | Price Vary |

| Fundamental MVP | Core fee processing, primary safety, easy UI. | $30,000 – $50,000 |

| Full-Fledged Gateway | Multi-currency, fraud detection, analytics, polish. | $100,000 – $250,000+ |

| Breakdown by Part | ||

| – Improvement | Coding frontend, backend, APIs (40-50% of your complete quantity). | $12,000-$25,000 (MVP) / $40,000-$125,000 (Full) |

| – Compliance | PCI-DSS audits, authorized must-haves (15-20%). | $5,000-$10,000 (MVP) / $15,000-$50,000+ (Full) |

| – Safety | Encryption, tokenization, fraud instruments (15-20%). | $5,000-$10,000 (MVP) / $20,000-$50,000 (Full) |

| – UI/UX | Person-friendly design (10-15%). | $3,000-$7,500 (MVP) / $10,000-$37,500 (Full) |

| – Testing | QA for bug-free launch (10-15%). | $3,000-$7,500 (MVP) / $15,000-$37,500 (Full) |

Key Price Components to Think about

| Issue | Description | Price Impression |

| In-Home vs. Outsourced | In-house: salaries ($80K-$120K/12 months/dev). Outsourced: $20-$100 / hour by area. | $50,000 (Outsource) / $80K+/yr (In-Home) |

| Upkeep & Compliance Updates | Updates, server charges, PCI-DSS renewals. | $5,000-$20,000/yr (MVP) / $20,000-$50,000+ (Full) |

| Transaction Charges & Operational | 1-3% per transaction, internet hosting ($100 – $1,000 / month). | Varies by quantity + $1,200-$12,000/yr |

| Estimated Prices (Breakdown) | MVP construct + maintenance vs. full-scale + maintenance. | $35K-$60K (MVP complete) / $120K-$300K+ (Full complete) |

| Compliance & Safety Certs | PCI-DSS ($10K-$30K), SOC 2/ISO 27001 ($10K – $20K every). | $15,000-$50,000+ upfront, $5K-$15K/yr |

| Third-Get together Integrations | Fraud instruments, analytics, SMS (Sift, Twilio, and many others). | $2,000-$10,000 every + $500-$5K/yr |

Challenges in Cost Gateway Improvement

Regulatory Compliance & Safety Dangers

Growing a fee gateway is a mix of expertise and laws. Staying compliant with the principles of each area calls for fixed consideration to element. Rules like GDPR in Europe, PCI-DSS globally, and even native monetary laws—provides to the complexity.

Safety can also be an enormous problem. With hackers at all times in your heels trying to break into each system, it’s essential be vigilant. Encryption, tokenization, and fraud detection are important, implement these, however don’t curb consumer expertise.

Competitors & Market Differentiation

There are lots of gamers within the fee gateway market providing comparable options, therefore implement distinctive options. The options you current needs to be dependable, your course of fast, and supply higher buyer help.

Reliability is the testomony of a fee gateway. Lack of service even for a couple of minutes can price companies financial loss and injury your fame. Buyer help can also be an crucial differentiator.

Scalability & Future Traits

A fee gateway must be future proof and will be capable of deal with future calls for. Transaction volumes develop with the enterprise. Your system ought to be capable of deal with site visitors with out slowing or crashing.

Newer fee strategies like Cryptocurrency, AI-driven funds, and buy-now-pay-later choices are foraying into the market. Integrating these options is crucial to remain related. When you don’t you would lose your clientele to opponents who adapt quicker.

Enterprise Fashions & Monetization Methods

Making an environment friendly fee gateway isn’t nearly constructing it, however about being a favorite amongst retailers in addition to to maintain your checking account comfortable. Right here’s how you are able to do it:

| Mannequin | Key Particulars | Execs | Cons |

| Fee primarily based mannequin | |||

| Methods to Set Charges | 2.9% + $0.30 per transaction, tweak by quantity (e.g., 2.5% for $1M+/month) or danger (3.5% high-risk). | Scales with utilization, no upfront price. | Low margins on small volumes, aggressive stress. |

| Execs & Cons | Business norm (Visa, Stripe-like), adjustable tiers for large/small retailers. | Fast service provider adoption, predictable. | Danger of undercutting consuming earnings. |

| Subscription primarily based mannequin | |||

| Pricing | $20-$200/month (limitless or $50K/month cap), annual $200/yr with 10-20% low cost, tiered by dimension. | Regular income, builds loyalty. | Wants sturdy options to justify charges. |

| Case Research | Shopify ($29-$299/month bundles), Braintree ($49/month Vault + commissions)—steady money + upsells. | Predictable revenue, premium enchantment. | Might deter cost-sensitive startups. |

| Hybrid Mannequin | |||

| When to Use | Supreme for combined retailers (small + massive), premium options (e.g., fraud AI), balanced money circulation. | Combines regular money + development upside. | Complicated to pitch and handle tiers. |

| Examples | PayPal (2.9% + $0.30 + $30/month Professional), Stripe (2.9% + $0.30 + $10-$500/month), Sq. (2.6% + $0.10 + $29-$60/month). | Versatile, broad enchantment, confirmed wins. | Balancing each can confuse customers. |

Notes:

- Fee: It’s greatest to start at 2.9% + $0.30 after which you possibly can modify for scale or danger to remain aggressive.

- Subscription: $20-$200/month is ideal if you may also present analytics; Shopify and Braintree show it.

- Hybrid: PayPal, Stripe, and Sq. mix each features and earn in billions. Introduce new perks to seize the market.

Case Research & Actual-World Examples

Analyzing real-world success tales will at all times have classes that present helpful insights. Their greatest practices and challenges confronted will aid you construct an environment friendly fee gateway.

- Stripe’s Enlargement Technique – Regardless that Stripe launched as a developer-friendly fee gateway, the rationale why they may scale globally was on account of clean API integration and powerful safety features.

- PayPal’s Aggressive Edge – Whereas PayPal had the benefit of being one of many early gamers available in the market. Additionally their sturdy fraud prevention mechanisms helped to dominate the market.

- Sq.’s Innovation in SMB Funds – Every had their very own set of execs and cons. Sq. aimed toward serving small companies for fee processing with transportable card readers and easy pricing constructions. This led to their success.

Classes from Failed Cost Options

On analysing how some fee gateways didn’t succeed, we discovered a number of causes corresponding to lack of compliance, poor consumer expertise, or safety breaches. We offer you a couple of examples:

- Lack of Compliance – Firms like Wirecard collapsed on account of regulatory violations and monetary misconduct. Guaranteeing strict adherence to monetary laws is essential.

- Poor Person Expertise – Many failed gateways had overly advanced interfaces, resulting in consumer drop-offs. A easy, intuitive checkout expertise is important.

- Safety Breaches – Cost gateways that suffered main knowledge breaches, like Payza, misplaced consumer belief. Investing in top-tier safety measures is non-negotiable.

- Lack of Market Match – Some platforms failed as a result of they didn’t differentiate sufficient from opponents. Understanding buyer wants and providing distinctive worth is important.