![]() Axiom fails to offer possession or govt data on its web site.

Axiom fails to offer possession or govt data on its web site.

Axiom’s web site area (“axiom.commerce”), was privately registered in December 2024. The non-public registration was final up to date on November twenty fourth, 2025.

As at all times, if an MLM firm will not be brazenly upfront about who’s working or owns it, assume lengthy and onerous about becoming a member of and/or handing over any cash.

Axiom’s Merchandise

Axiom has no retailable services or products.

Promoters are solely capable of market Axiom promoter membership itself.

Axiom’s Compensation Plan

Axiom promoters make investments an undisclosed minimal quantity of the cryptocurrency solana (SOL).

That is completed on the promise of “as much as 15%” yearly.

Axiom pays a ROI Match down three ranges of recruitment (unilevel):

- stage 1 (personally recruited promoters) – 30% match

- stage 2 – 3% match

- stage 3 – 2% match

Be aware that Axiom promoters can improve these charges by as much as 500% by promoter rank development.

Axiom doesn’t disclose rank promotion standards on its web site.

Axiom promoters also can earn “axiom factors” by recruitment and funding. It’s unclear what axiom factors are for.

Becoming a member of Axiom

Axiom promoter membership is free.

Full participation within the hooked up revenue alternative requires a minimal undisclosed SOL funding.

Axiom Conclusion

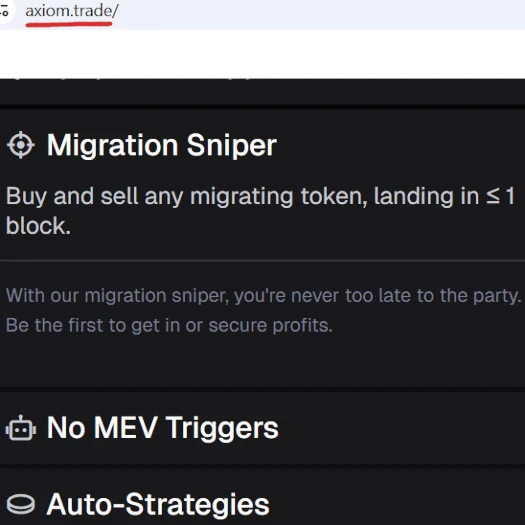

Axiom represents it generates exterior income by varied buying and selling ruses:

Along with failing to offer verifiable proof to show its claims (audited monetary reviews filed with regulators), Axiom’s enterprise mannequin fails the Ponzi logic take a look at.

If Axiom has varied buying and selling methods producing revenue on a constant foundation, what does it want your cash for?

Because it stands, the one verifiable income getting into Axiom is new funding.

Utilizing new funding to pay ROI withdrawals would make Axiom a Ponzi scheme.

Moreover, with nothing marketed or bought to retail prospects, the MLM facet of Axiom operates as a Ponzi scheme.

As with all MLM Ponzi schemes, as soon as promoter recruitment dries up so too will new funding.

This may starve Axiom of ROI income, ultimately prompting a collapse.

Math ensures that when a Ponzi scheme collapses, nearly all of contributors lose cash.