On April tenth, 2024, BehindMLM turned fifteen. MLM information stored me from publishing this earlier however in the present day we’re having a look again on the previous twelve months.

On April tenth, 2024, BehindMLM turned fifteen. MLM information stored me from publishing this earlier however in the present day we’re having a look again on the previous twelve months.

Welcome to BehindMLM’s State of the Rip-off 2025.

MLM crypto scams

The decline of the MLM crypto rip-off area of interest, first noticed round This autumn 2023, continued all through 2024.

All of the crypto ruses are principally lifeless (not less than to the purpose no person actually believes them any extra). “AI buying and selling bots” is getting lengthy within the tooth and there hasn’t been a “shiny new object” follow-up shortly.

The one exception has been the nonsensical Chinese language “click on a button” app Ponzis. Though “large hits” have been far and few between.

Elevated regulatory response throughout Asia has thrown Chinese language-run rip-off factories into mainstream discourse, however there’s nonetheless a lot to be carried out.

As for the scams themselves, we appear to have settled into low-effort app scams that come and go weekly. Unsure what the revenue margin is there however evidently it’s sufficient for the crime gangs to persist.

Exterior of the Chinese language apps we haven’t seen any main MLM crypto frauds stand up during the last 12 months. Making an allowance for your entire crypto “trade” is a musical chairs con recreation, I’d prefer to say that’s resulting from client consciousness. It may simply as simply be resulting from tightening of wallets although (or a mix of each).

Total we’re in a reasonably good place so far as MLM crypto scams failing to realize traction. However wanting ahead what issues me is for the way lengthy?

Politics isn’t actually one thing we get into right here on BehindMLM and that’s as a result of, in very best circumstances, politics has nothing to do with regulation of fraud. Administrations come and go, the underlying legislation and enforcement stays the identical.

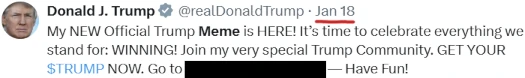

I can provide the exact date that each one modified although: January 18th, 2025.

Yeah, apparent rip-off (wire fraud, securities fraud, potential cash laundering, overseas corruption and so on.), however what it means for regulation of MLM crypto fraud has but to play out.

The intertwining of politics with crypto associated monetary fraud is problematic in that regulators charged with investigating and implementing the legislation are additionally a part of the federal government.

There’s an clearly broad inherent battle of curiosity.

To that finish we’ve seen the DOJ disband its crypto enforcement group on direct order of President Trump.

Established in 2022;

the Nationwide Cryptocurrency Enforcement Workforce (NCET) was established in February 2022 to deal with the problem posed by the legal misuse of cryptocurrencies and digital belongings.

The group is comprised of attorneys from throughout the Division, together with prosecutors with backgrounds in cryptocurrency, cybercrime, cash laundering and forfeiture.

It’s in all probability not a coincidence NCET ramping up over the previous few years corresponds with a basic decline in MLM associated crypto fraud based mostly within the US.

Over on the SEC, its dropping crypto fraud associated circumstances like hotcakes. Instances in opposition to Ripple Labs, Kraken and Coinbase have all been dropped, fortunately none of that are MLM associated.

Nonetheless, what does that say about current MLM associated fraud circumstances. Or worse nonetheless pending circumstances concentrating on MLM associated crypto fraud over the previous few years?

Typically talking, a lot of the current motion on the SEC has centered on cryptocurrency in a broad sense. That’s past the scope of this text and, if I’m being sincere, not likely related to MLM crypto.

Regulation of MLM crypto schemes ties into the identification of an funding contract (utilizing the Howey Take a look at). By their very nature all MLM crypto schemes supply funding contracts, requiring them to register with the SEC.

None of them do as a result of, regardless of the exterior income ruse is, none of them do what they declare to be doing. It’s at all times a advertising and marketing ruse, which having to file third-party audited with regulators turns into much more tough to drag off.

What did catch my eye was a current SEC “roundtable” on crypto buying and selling.

Crypto buying and selling is in fact some of the frequent MLM crypto fraud ruses (“we’re crypto buying and selling!” advertising and marketing on the frontend, traditional Ponzi on the backend).

The SEC’s Division of Company Finance seems to grasp the significance of funding contracts with respect to crypto schemes – not less than because it pertains to “crypto asset markets”.

Appearing SEC Chairman Mark Uyeda’s statements nevertheless are a bit regarding. In his printed remarks following the roundtable, Uyeda lays the inspiration for why crypto schemes must be exempt from present securities legislation.

Federal securities legal guidelines and laws could current challenges for broker-dealers and nationwide securities exchanges searching for to supply buying and selling in tokenized securities.

For instance, nationwide securities exchanges can solely listing registered securities and most tokenized securities available in the market in the present day are unregistered.

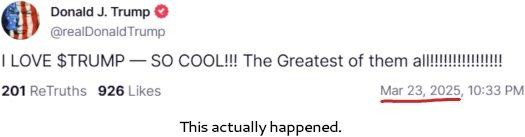

The explanation they’re unregistered is as a result of they’re scams that primarily facilitate fraud. We now have complete “memecoin” marketplaces set as much as facilitate this – with as of but no response from US authorities.

As of February 2025, 810,000 crypto wallets have misplaced over $2 billion to Trump Coin. Trump himself has pocketed round $100 million.

Once more, we’re talking in broader phrases right here. However the additional crypto regulation strays from established US securities legislation, the higher the likelihood loopholes will emerge. And these will be exploited by unhealthy actors.

A few of these unhealthy actors shall be MLM crypto scammers.

Mixed with diminished enforcement (worldwide enforcement of crypto associated fraud outdoors of the US is already abysmal), it’s a recipe for a return to the OneCoin period.

Strictly talking so far as MLM crypto schemes go, current legal guidelines are greater than ample. Current civil and legal legal guidelines adequately tackle wire fraud, securities fraud, conspiracy to commit each and cash laundering. Enforcement is ever the issue.

I hate to be all doom and gloom about this however, given every part else, it actually feels like a Howey Take a look at exemption for crypto schemes is on the playing cards.

That probably places BehindMLM in a precarious place. The underlying fraud continues to be there, but when legalized to the purpose of non-enforcement, civilian journalists akin to myself can’t be the tip of the spear with nothing in the best way of regulatory help behind us.

Finest to not sound alarm bells over what hasn’t occurred but but it surely’s actually one thing I’m conserving at the back of my thoughts because the now each day circus of US “flood the zone with shit” type politics performs out.

I’ll proceed to look at but it surely’s tough at occasions to not simply give in to outright pessimism. Correlation doesn’t indicate causation, but it surely’s getting actual arduous to not view developments as a way to facilitate monetary fraud from the highest down.

On the intense facet there’s been nothing from the CFTC. Assuming nothing has modified there with respect to MLM crypto regulation.

Additionally as an apart, if you happen to’re questioning why there’s no “non-crypto MLM rip-off” part, just about each MLM rip-off is run in crypto as of late. There’s no level.

The MLM trade normally

The contraction of the MLM trade has additionally continued over the previous 12 months.

Amid the inevitably MLM Ponzi and pyramid collapses, we’ve additionally seen Awakend, Tupperware, Epicure, Modere and Natural Alchemy chunk the bullet. There have additionally been a variety of acquisitions and mergers.

A basic recurring theme appears to be shifting client habits. A few of that’s little doubt the price of residing disaster but additionally maybe how customers are shopping for items – notably the youthful generations.

When you took the MLM trade as a complete, there’s in all probability some similarities between it and international locations grappling with growing older populations.

Nonetheless, we’re fairly clearly removed from bottoming out. BehindMLM’s pending MLM assessment listing presently sits at round thirty firms. I haven’t gotten to emails over the previous few days so there’s in all probability one other 5 to 10 additions ready.

We’ll in all probability see extra closures all year long however aside from that I’m not anticipating any important developments. Moreso given the FTC is presently limping together with simply two “loyal” Commissioners.

Authorized proceedings have been initiated to problem the allegedly unlawful conduct however who is aware of how lengthy that’ll play out.

All to the continued detriment of US customers sadly. Talking of which the Client Monetary Safety Bureau and Overseas Corrupt Practices Act are additionally gone.

The latter particularly has been used to reign in overseas corruption by Avon, Nu Pores and skin, HerbaLife and NewAge (alleged).

BehindMLM Housekeeping

I’m blissful to report that the consequences of the MLM trade downturn this previous 12 months weren’t as important because the earlier 12 months. We’ve kind of reached a baseline with reader curiosity, spiking when one thing important occurs (Modere collapsing being a current instance).

The largest problem BehindMLM confronted over the previous 12 months was getting Josip Heit’s GSB subpoena quashed within the New York Supreme Courtroom.

Primarily resulting from an absence of supporting proof and due course of failure, we overturned the granted subpoena on attraction in Could 2024.

As of April 2025, Heit’s regulatory authorized troubles within the US proceed to play out. Fruitlessly attacking journalists seems to have taken a backseat to (allegedly) attempting to drag a quick one over US authorities.

Apart from that it’s been a reasonably straight-forward 12 months. This let’s me get on with analysis and reporting on the MLM trade, which is in any case what you’re all right here for.

Following some private challenges final 12 months I’m in a little bit of a greater spot. As anybody who works on-line will let you know, balancing life with on-line work will be tough. Even fifteen years in I’m nonetheless making changes.

I haven’t misplaced any drive however I’d be mendacity if the continued assault on non-immigration associated legislation and order within the US wasn’t disheartening. Reflecting on that, I’m type of torn between “what’s the purpose?” and “properly, somebody’s gotta do it”.

I don’t wish to rehash what I’ve already written however I suppose what I’m attempting to say is I’m taking part in it by ear. Such as you I don’t know daily what’s going to occur, not to mention how BehindMLM suits into altering authorized and regulatory frameworks.

With BusinessForHome offered off a number of months in the past to an MLM firm proprietor, I’m conscious about BehindMLM’s impartial standing greater than ever. It’s a duty I’m at occasions not completely comfy with but additionally type of the entire level.

To not take something away from the AntiMLM subreddit or varied creators on YouTube.

The query of why there aren’t extra “BehindMLMs” since we launched fifteen years in the past inadvertently places to mattress a variety of the conspiracy theories scammers give you.

Total BehindMLM is in place to proceed offering customers with the most recent on the MLM trade. Going into 12 months fifteen we additionally now have a catalog of 10,469 articles and over 185,000 feedback to help with analysis.

Thanks for studying for an additional 12 months!