Studying Time: 4 minutes

Cellular banking has reworked the monetary world. Right now, with a faucet, you’ll be able to handle your financial savings account, switch cash, and hundred different issues. Monetary apps have really made each side of banking easier and extra handy.

And consequently, the variety of customers utilizing finance apps has skyrocketed. In response to a current Google report, 60% of cell customers favor these apps over web sites on the subject of managing their funds.

Nonetheless, monetary establishments should maintain enhancing their app expertise to satisfy rising buyer expectations. And there’s nothing higher than leveraging real-time app personalization.

5 App Personalization Methods Monetary Establishments Can Execute Proper Away

Let’s have a look at completely different app personalization methods monetary establishments can leverage to supply a superior buyer expertise –

1. Drive Engagement by way of a Customized Homescreen Expertise

The house display is the very first thing clients have a look at after they open the applying. Whereas usually ignored, it’s an incredible place to advertise presents, upsell numerous monetary merchandise, and drive clicks to related classes.

To craft a tailor-made house display expertise, monetary establishments can simply get insights by tapping into buyer’s present monetary scenario, spending habits, and objectives. Moreover, they’ll additionally tweak relying on preferences clients set throughout onboarding.

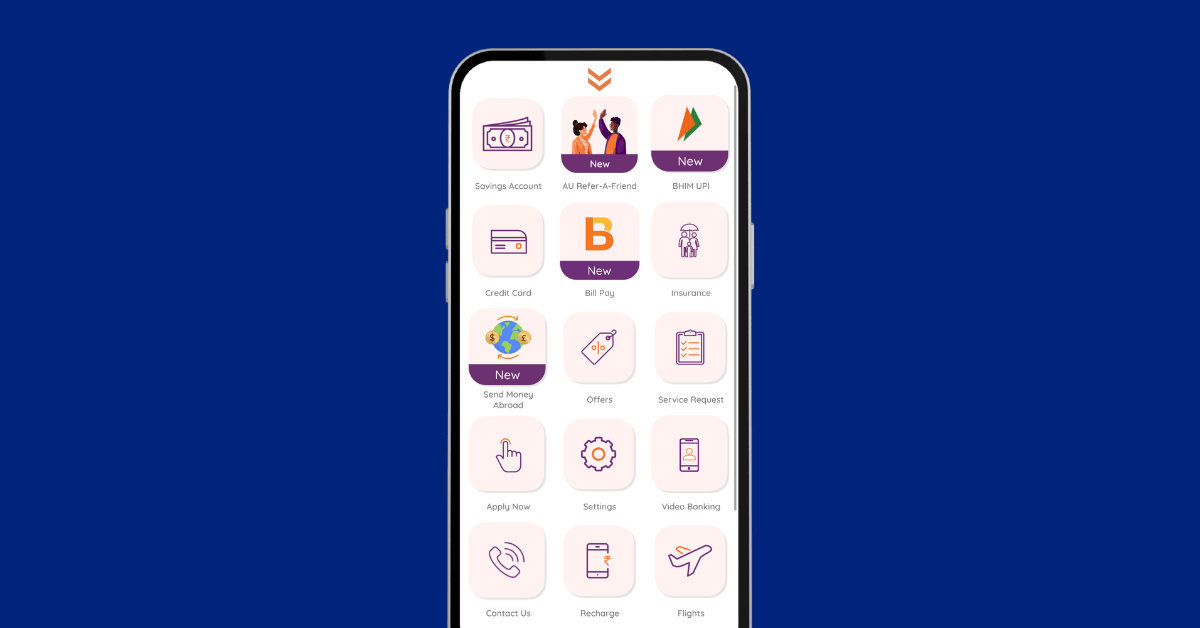

For instance, manufacturers can reorder classes or sections based mostly on buyer preferences. So, if clients commonly verify their bank card transactions and rewards, these tabs could be displayed prominently.

The identical applies when selling presents. For purchasers with excessive bank card utilization, manufacturers can prioritize card-specific presents and reductions on the house display.

The app house display can be utilized to immediate clients to carry out particular duties similar to finishing Know Your Buyer (KYC), ending onboarding processes, showcase fee reminders and extra.

Under is an instance of AU Financial institution’s house display. When you look carefully, you’ll be able to see how they’ve prioritized related classes and highlighted new ones.

2. Enhance Conversions Utilizing Customized Affords

Monetary establishments may also leverage buyer insights to tailor their presents. It’s widespread information that customized presents are inclined to convert higher than generic ones. Additionally, it ensures model preserve a superior buyer expertise. The very last thing you need is to bombard clients with irrelevant presents.

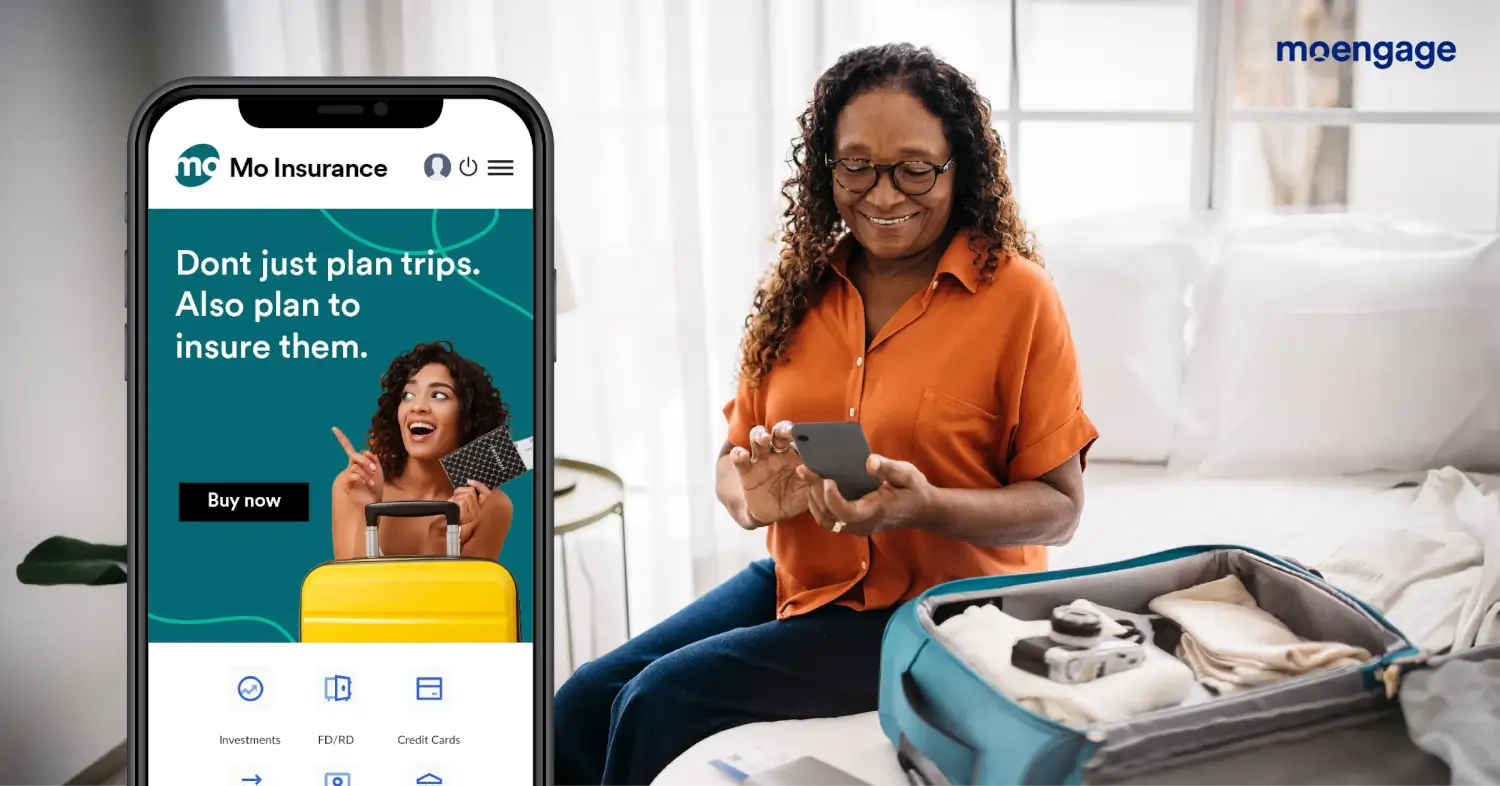

For example, BFSI apps know clients’s spending habits, credit score historical past, and credit score rating. They will use these insights, buyer preferences, and eligibility to indicate customized bank card presents. Equally, if a buyer travels regularly, monetary apps would possibly counsel a travel-related bank card or show journey insurance coverage presents. Alternatively, if clients spend their cash on groceries and utilities, they’ll promote a every day reward cashback card.

Moreover, fairly than bombarding these presents to all doable channels, manufacturers can set off the supply to solely these channels the place clients are most lively. This boosts engagement and attain considerably.

3. Upsell New Monetary Merchandise and Adoption By way of Customized Suggestions

BFSI manufacturers can solely succeed by way of efficient cross-selling and upselling. It’s crucial for his or her sustainable progress. With growing acquisition prices and competitors, most monetary establishments deal with growing buyer lifetime worth and retention. This isn’t doable with out efficient adoption and upselling of recent merchandise.

However on the similar time, manufacturers can’t afford to upsell irrelevant merchandise. It’s because product eligibility is dependent upon a number of components, particularly in retail banking. For instance, private loans can solely be provided to eligible clients with a sure credit score rating and revenue; the identical applies to mortgage loans.

Equally, BFSI manufacturers can supply extra premium bank cards to clients after monitoring their bank card utilization after a selected interval. They will additionally upsell car and private mortgage throughout the festive season.

In conclusion, manufacturers should leverage buyer insights to supply customized merchandise like bank cards, mortgage presents, and insurance coverage for greater conversions. They will simply do that by analyzing buyer’s credit score historical past, account steadiness, month-to-month money move, and extra.

4. Hold Clients Knowledgeable By way of Customized Push Notifications

Many monetary transactions are recurring, similar to EMIs, subscriptions, bank card invoice technology, or month-to-month deposits. Banks should guarantee they inform clients about these transactions particularly by way of push notifications and in-app messages.

Most banking apps additionally ship real-time notifications to alert clients in the event that they discover any suspicious exercise like a fraudulent transaction. For instance, once you log in from an new system or transact from a special location, BFSI apps will immediately notify you over a push notification and e-mail to confirm the login try.

5. Activate Clients Rapidly Utilizing Customized Onboarding

With ever-changing banking laws, onboarding has remained a continuing problem for monetary establishments. Nonetheless, for purchasers to start out utilizing their platforms, they should full the onboarding. It’s additionally an incredible alternative to grasp buyer’s monetary objectives and achieve beneficial insights into their wants and expectations.

And for banks to realize the above, they should present a customized onboarding expertise. For example, monetary establishments can simplify onboarding by offering incentives similar to cashback or rewards and supply customized suggestions. Equally, onboarding must be tweaked in accordance with the client phase, as each buyer approaches banking with completely different ranges of tech-savviness and objectives.

Total, offering customized onboarding helps manufacturers to have a aggressive edge and fosters stronger connections with clients.

What’s Subsequent?

There’s no denying that app personalization can be related in 2025 than ever, permitting monetary establishments to transform and retain most clients. We’ve already seen few examples of how app personalization can really rework the app expertise. With growing competitors and buyer wants, manufacturers should take real-time app personalization extremely significantly and add it to their buyer engagement technique.

When you’re seeking to tailor monetary internet experiences, you’ll be able to learn our newest information right here.