The BitNest Ponzi scheme has collapsed.

The BitNest Ponzi scheme has collapsed.

As a substitute of simply disappearing with everybody’s cash, over the previous fortnight BitNest has launched at least 4 reboots.

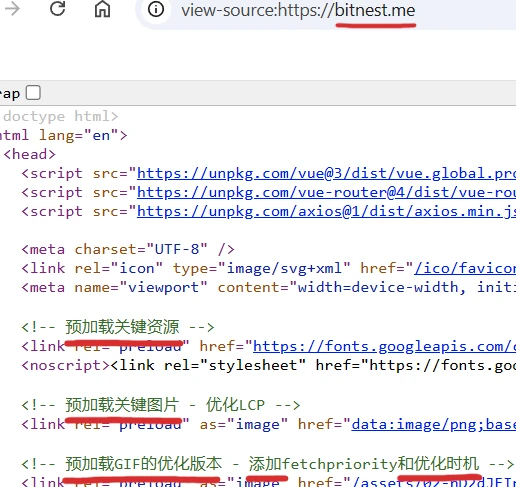

BitNest launched round mid 2024 after predecessor Yunis Loop collapsed. Each schemes are believed to be run by Chinese language scammers.

The unique BitNest Ponzi noticed the rip-off promote “BitLoop” positions in USDT, providing as much as 24% each 28 days.

On December twenty fourth, BitNest suggested it had terminated its authentic funding scheme;

As a consequence of a brief imbalance within the present liquidity construction, and the upcoming launch of the brand new BitNest model, there are logical conflicts between the previous and new mechanisms in the course of the transition interval.

To keep away from affecting extra customers or inflicting misguided operations in the course of the system improve, the platform has made the next choices:

BitLoop (Lending and Leasing Market) has been briefly closed.

“Short-term imbalance within the present liquidity construction” is crypto jargon for “Ponzi go increase”.

Within the lead as much as BitNest’s authentic Ponzi collapsing, “MEC node” funding positions have been being pushed.

MEC node positions have been focused at BitNest’s prime recruiters and value as much as 141,750 USDT per funding place.

On December twenty ninth BitNest rolled out “BitNest Loop C”, a substitute for its authentic collapsed Ponzi scheme.

BitNest Loop C is an expanded participation technique throughout the BitNest Loop system.

Whereas sustaining full consistency with the unique system logic, matching mechanism, and revenue construction, it gives customers with the choice to take part in circulation utilizing USDC.

BitNest Loop C doesn’t change the unique BitNest Loop, however reasonably extends its participation strategies.

Apparently suckers handed over sufficient new cash for BitNest to begin up its authentic Ponzi on January 4th.

Beginning at present, affected BitLoop orders have regularly resumed regular settlement processes, and funds will probably be returned and credited based on established guidelines.

“Regular settlement processes” for BitNest is placing withdrawal requests in a “processing queue” to be “settled regularly”.

On January sixth, BitNest introduced the launch of recent “DAO Section II” node funding positions.

The (fourth?) reboot in lower than a fortnite sees BitNest decide to its Mellion (MEC) shit token. Mellion has its personal web site up at “mellion.io”, privately registered on September 1st, 2025.

MEC itself is only a low-effort BEP-20 token. BEP-20 tokens might be created in only a few minutes at little to no value.

BitNest’s fourth reboot MEC node funding positions value as much as 157,889 USDT every.

Who remains to be dumping cash into BitNest is unclear. What is obvious is the scammers operating BitNest appear clear to exploit traders with new launches each few days.

Not anticipating any of those BitNest reboots to go wherever, we’ll examine again in later this month for an replace.