A Short-term Receiver has taken management of property hidden by Iyovia husband-and-wife co-founders, Chris and Isis Terry.

A Short-term Receiver has taken management of property hidden by Iyovia husband-and-wife co-founders, Chris and Isis Terry.

Courtroom filings reveal “an unlimited internet of corporations and actual property holdings” used to cover over $100 million in property. Funds to Chris Terry’s “live-in girlfriend” and different girls to maintain them “loyal” are additionally alleged.

Following earlier accusations of Chris Terry draining over $9 million from a checking account and hiding property behind a belief firm, the FTC filed an emergency movement for a preliminary injunction on October sixteenth.

The FTC and Nevada secured a preliminary injunction in opposition to Iyovia as a company defendant in August.

As a part of that injunction, the Terrys had been ordered to protect their property.

This included prohibition from transferring “substantial sums of cash” and transferring “any property abroad”. To make sure compliance, the court docket appointed a monitor.

As alleged by the FTC and Nevada of their October sixteenth movement to change the beforehand granted injunction;

Because the preliminary injunction has been entered, Plaintiffs and the Monitor have uncovered an unlimited internet of corporations and actual property holdings engineered by the Terrys to cover their property from legislation enforcement.

Though the Defendants’ scheme introduced in over $1.3 billion in income, the Courtroom-appointed Monitor on this case has discovered that the Company Defendants’ financial institution accounts are almost empty.

The FTC and Nevada go on to allege Christ Terry has been working to cover his property for years.

The Terrys have been working assiduously to cover their property from legislation enforcement motion for years.

Chris Terry admitted as a lot in a textual content message change with IML vp and former defendant Jason Brown.

In March 2021, Chris Terry knowledgeable Brown that the Terrys had moved property into “LLCs…so it’s hidden…Off grid…$12_14m…no taxes…no govt or anybody can search me on. By no means know.

Think about I get sued…I’m dest[it]ute…We now have asset safety throughout [the] board.”

In February 2019, the Terrys created the Auspicious Belief (“Belief”). Additionally they started to create an array of LLCs, into and thru which they moved funds that they had obtained from customers deceived by the IML scheme.

They used customers’ funds to build up luxurious actual property, yachts, and automobiles—partially by transferring cryptocurrency that customers paid to IML into Chris Terry’s private cryptocurrency wallets.

In reality, the Monitor concludes that Chris Terry took “considerably greater than $50 million of cryptocurrency [alone] from IML.”

Chris Terry testified at his deposition that he used these funds to buy “20-plus” properties within the Las Vegas space. He then titled most of the properties within the title of Dominant Consulting Group.

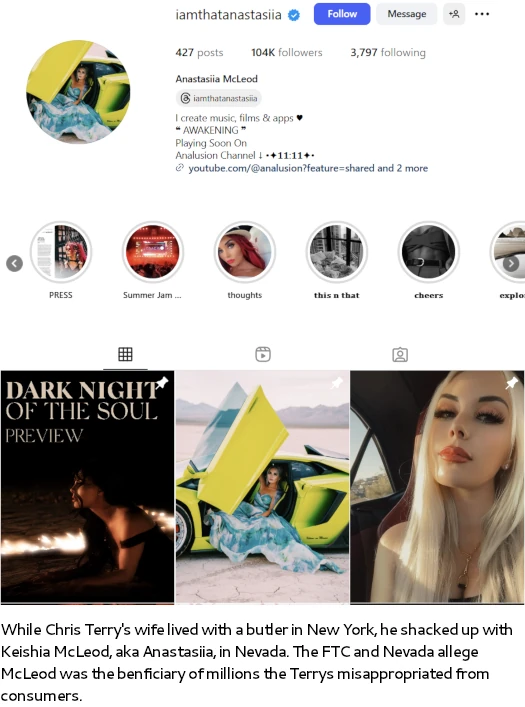

He additionally used customers’ funds to buy a mansion in Henderson, Nevada for his “girlfriend,” Keishia McLeod. He ensured that the mansion was titled within the title of an LLC of which Ms. McLeod is the only real member.

Along with the Las Vegas-area actual property and a number of luxurious properties in Florida, the Terrys additionally bought two luxurious condominiums in Dubai and a Midtown Manhattan condominium for roughly $20.5 million — partially by transferring over $2.2 million out of an IML company checking account.

The Terrys additionally used cryptocurrency derived from the IML scheme to fund the acquisition of the Dubai properties.

The Monitor has discovered that the Terrys extracted “considerably greater than $100 million” from the IML scheme to fund their extravagant life-style and to purchase “greater than $94 million in elite actual property properties.”

Noting that Terry “bragged about hiding his property from authorities oversight”, the FTC and Nevada observe “the property situated so far … are probably materially incomplete”.

Because the Iyovia preliminary injunction was granted in August, the FTC and Nevada allege “the Terrys preserve attempting to position their

property outdoors the attain of the Courtroom.”

The Defendants have been dilatory in offering required monetary disclosure statements and supporting paperwork to the Monitor and Plaintiffs, and the statements they’ve supplied fail to reveal main property they personal or grossly misrepresent their worth.

The Monitor stories that the Terrys supplied deposition testimony that “demonstrates a disrespect for this Courtroom’s orders and, it seems, an obstinate refusal to abide by them.”

Isis Terry, for instance, claimed that her engagement ring, which has been appraised at almost $3 million by a jewellery appraiser, was value solely $10,000 on her monetary disclosure assertion.

Solely after the Monitor caught her on this lie at her deposition did she replace her monetary disclosure assertion and acknowledge the worth of the ring.

Neither of the Terrys has disclosed transfers of property over $5,000, which is required by the monetary disclosure type.

Nor have they disclosed the Auspicious Belief, which seems to carry property valued at over $57 million, on their monetary disclosure statements, regardless that there is no such thing as a dispute that they’re beneficiaries of the belief, have complete management over it, and the disclosure type particularly seeks details about trusts.

The Monitor has additionally discovered that the Defendants have failed to offer International Asset Disclosures required by the PI.

Additional, the [Iyovia] Company Defendants haven’t submitted any monetary disclosure statements in any respect, regardless that they had been due August 26, 2025.

Up to now, Defendants’ counsel has refused to offer any date sure by which the Company Defendants would supply their monetary disclosure statements.

Nor have they supplied a date by which the Terrys’ monetary disclosure statements could be precisely accomplished.

One definitive instance of the Terrys trying to cover property is putting a yacht underneath management of Seaside Music LLC, an organization registered in Delaware in 2019.

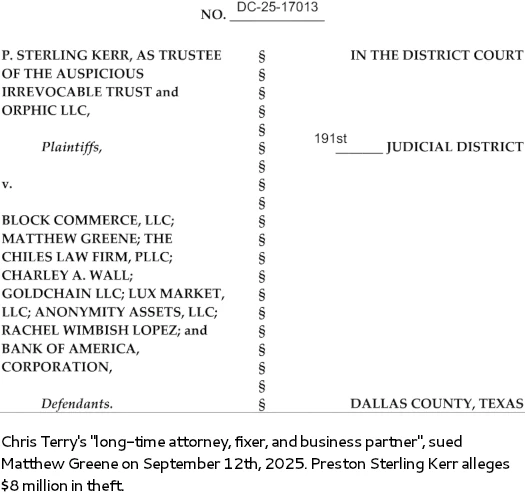

Seaside Music LLC is 50% owned by Preston Sterling Kerr (proper), who the FTC and Nevada cite because the Terrys “long-time lawyer, fixer, and enterprise accomplice”.

Seaside Music LLC is 50% owned by Preston Sterling Kerr (proper), who the FTC and Nevada cite because the Terrys “long-time lawyer, fixer, and enterprise accomplice”.

The opposite 50% of Seaside Music LLC is owned by Tera Firma Improvement LLC, a Nevada registered firm.

In opposition to the FTC’s sought preliminary injunction modification and appointment of a Receiver, Kerr filed an emergency movement to intervene on October twentieth.

Seaside Music is a manager-managed Delaware LLC whose sole asset is a 57-foot McKinna motor yacht.

Mr. Kerr acquired the corporate in 2019 and manages the corporate and personally pays all working bills.

In 2023, Mr. Kerr assigned a 50% membership curiosity to Terra Firma Improvement, LLC, a Nevada limited-liability firm owned by a belief established for Christopher Terry.

Neither Terra Firma nor Terry has any administration rights or operational management underneath Seaside Music’s Working Settlement.

The FTC’s movement for a receiver extends far past its authority. Beneath Delaware legislation, a creditor of an LLC member is restricted to a charging order in opposition to that member’s financial curiosity.

The FTC can not circumvent that statutory restriction by seizing the entity itself. Seaside Music is just not a celebration to this motion and has not been accused of any misconduct.

The court docket denied Kerr’s movement on October twenty fourth. Firstly discovering the matter didn’t qualify as an emergency, and secondly;

To be clear, the court docket requires greater than a selfserving assertion from Kerr to just accept that Seaside Music’s solely asset is a ship, or the illustration Seaside Music is just not, nor has ever been, in receipt of property associated to the enterprise scheme set forth within the criticism.

The necessity for greater than self-serving statements is revealed by the Monitor’s stories. The stories present that funds from the alleged scheme had been used to buy a yacht in 2021.

It’s unclear whether or not this is similar yacht that Kerr references in his declaration, however different proof means that it may be.

Widespread sense dictates that that is the type of info that the court docket wants to find out if Kerr is entitled to the reduction he calls for.

The Monitor’s stories reveal that Isis Terry transferred roughly $5 million into Terra Firma, from one other LLC owned by Isis, in 2021.

Thus, based mostly on assessment of the preliminary info earlier than the court docket, Seaside Music certainly obtained property from exercise that’s the topic of this case, so it’s lined by the PI.

With a call on the FTC’s movement for a preliminary injunction modification and appointment of a Receiver pending, the court-appointed Monitor filed a Standing Report on October twentieth.

The report went into additional element concerning the Terrys’ alleged efforts to hide property.

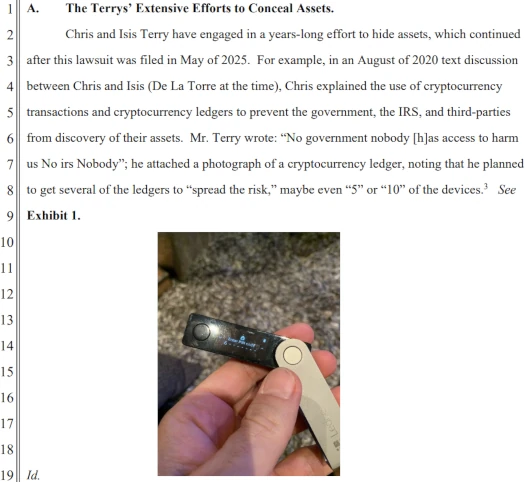

Chris and Isis Terry have engaged in a years-long effort to cover property, which continued after this lawsuit was filed in Could of 2025.

For instance, in an August of 2020 textual content dialogue between Chris and Isis (De La Torre on the time), Chris defined the usage of cryptocurrency transactions and cryptocurrency ledgers to forestall the federal government, the IRS, and third-parties from discovery of their property.

Mr. Terry wrote: “No authorities no person [h]as entry to hurt us No irs No person”; he hooked up {a photograph} of a cryptocurrency ledger, noting that he deliberate to get a number of of the ledgers to “unfold the chance,” possibly even “5” or “10” of the gadgets.

In response, Isis requested Mr. Terry: “However promise no person is aware of about this however you and me.”

He reassured her in response, indicating that he was capable of preserve offers “off report” with “0 audits threat” utilizing “[h]ouse and design and renovation off grid[.]”

Mr. Terry then texted Isis Terry, “IRS 0 information[.]”

Isis Terry responded: “F*** the IRS!”

It’s unclear whether or not the IRS has opened an investigation into the Terrys. Reveals within the Iyovia FTC case definitely seem to hyperlink the Terrys to numerous cases of tax associated fraud.

As a current instance, we discovered a January 2025 screenshot of a textual content from Chris to Isis Terry (which Chris despatched to a 3rd get together) wherein he mentioned transferring funds in anticipation of a lawsuit by the FTC.

Within the textual content, Chris informed Isis he was transferring $1 million to lawyer Sterling Kerr’s IOLTA account and the majority of the funds to abroad financial institution accounts.

Kerr’s alleged conduct seems to warrant his inclusion in an IRS investigation pertaining to the Terrys.

Pursuant to monetary fraud, the Monitor gives perception into Chris and Isis’ marriage.

The Terrys had been married in March of 2021. However by all appearances, the wedding is just not an actual marriage.

Mr. Terry doesn’t co-habitate with Isis Terry, however as an alternative lives together with his girlfriend Keisha McLeod, in a home he bought within the title of an entity purportedly managed by McLeod.

The current means to examine Mr. Terry’s texts left no doubts that the wedding was entered for enterprise and asset safety.

Since marrying, Mr. Terry has said to a number of girls that his marriage together with his “enterprise accomplice” was accomplished for enterprise causes merely to guard their property.

As an illustration, on September 25, 2022, Mr. Terry admitted in a textual content change that he “was married however [we] do our personal factor. Married for property[,]” explaining that he truly lived together with his girlfriend Ms. McLeod (who goes by Anastasiia).

Equally, on November 7, 2021, Mr. Terry texted one other feminine, jokingly proposing to marry her and her pal after seeing an image of the 2 of them; he went on to explain that he was not “[n]ot married,” explaining “isis is biz accomplice we was collectively however for biz is story we made.

We personal tons of property we biz collectively 25 years It appears good biz.”

Certainly, across the identical time, Chris Terry referred to Isis Terry as “my cfo” after which mentioned that he and Ms. Terry had been “exes” however she was “at all times protected.”

Particular to Keisha McLeod, the Monitor wrote;

[McLeod] was additionally a main beneficiary of tens of millions of {dollars} in transfers from IML. [Terry] even shared together with her plans to maintain his and her property out of the federal government’s attain by way of his skilled understanding of asset safety legal guidelines.

In April 2023 texts, after Ms. McLeod mentioned she dreamed of getting many properties together with ones in Scotland and France, Mr. Terry defined how he had particularly chosen locations to purchase actual property the place he might defend property.

He wished to “Defend[s] property no person can management lol”; he defined the homestead legal guidelines of Florida and Nevada and eve pulled up ChatGPT to help in his clarification of his asset safety efforts.

[Terry] went on to elucidate how he might buy worldwide actual property that might not be touched by US authorities:

“In France US has 0 jurisdiction over it so UR protected alw[a]ys

I do know the sport to…defend…”

Mr. Terry additionally defined how his purchases of actual property in america had been additionally part of his plan.

Mr. Terry even said that he was dwelling in Las Vegas due to the favorable legal guidelines, and “Not c[a]use love Vegas I can provide a s**t. Is asset safety and fla identical[.]”

The texts additionally reveal that along with Ms. McLeod, Mr. Terry was routinely concerned in relationships with different girls, whom he claimed he paid for “loyalty”.

As [Terry] personally described it, he directed tens of millions of do,llars of [iMarketsLive] proceeds within the type of “automobiles, rings, condos, payroll, and journey,” for these girls, typically utilizing cryptocurrency.

Mr. Terry endeavored to maintain these transactions undiscoverable.

As an illustration, when one of many girls requested whether or not she ought to use Coinbase to obtain funds, Mr. Terry reacted strongly:

“No …. I’m not sending you your Coinbase or Coinbase goes to name the federals IRS and I’m gonna be up your ass.

Coinbase is related to the IRS. That’s why I’ve issues cease utilizing Coinbase I informed you the 12 months in the past.”

In one other occasion, a girl, who understood Mr. Terry’s strategy, requested funds be despatched to her through “BITMAIN in Dubai,” slightly than Binance as a result of Binance would require an evidence of the “reward” to the girl.

Chris Terry additionally apparently paid $250,000 for a Vanuatu passport … for a lady he was thinking about however who couldn’t enter the U.S. on her personal passport.

Whereas Chris Terry was dwelling with a girlfriend in Nevada and spending tens of millions on “loyal” whores, Isis Terry was busy blowing million in Iyovia consumer funds on paintings for her New York residence.

Ms. Terry claimed underneath oath that she has by no means bought paintings. However that isn’t true.

As only one instance, we situated a textual content from Ms. Terry (copying her butler) to an artist to coordinate the supply and mounting of paintings which she commissioned for her New York house.

Supported by displays, the Monitor’s Standing Report additionally detailed the Terrys “rout[ing] tens of millions in cryptocurrency to Dubai”.

The Preliminary Report supplied the small print recognized on the time a couple of mysterious cryptocurrency dealer based mostly in Dubai, referred to by Isis Terry in her texts solely as “Bitman.”

Ms. Terry supplied no additional info at her deposition and claimed to know nearly nothing in regards to the Bitman transactions in her deposition.

As mentioned within the report, Bitman was paid 5% to transform tens of millions in crypto to United Arab Emirates foreign money, which the Terrys then used to buy luxurious actual property and international (Republic of Vanuata) passports by way of money exchanges.

Mr. Terry’s texts point out he had a more in-depth relationship with Bitman, to whom he despatched Bitcoin for a wide range of functions, together with to route money to different girls in Dubai.

In February 16, 2024 texts with Bitman, Mr. Terry defined he wished to make use of Bitman as his conduit to direct IML buyer subscription cryptocurrency into Bitman’s accounts after which wire them into the Terrys’ Dubai financial institution accounts.

Within the textual content chain, Mr. Terry indicated that he wished to keep away from US fee processors or banks.

In his texting with Bitman, Mr. Terry indicated that he was planning to maneuver his complete enterprise over to Dubai: “Finally, I’m transferring all the pieces out right here this 12 months and increasing with new different companies, which I ought to have an enormous quantity coming in with that alone as a result of I’ve an enormous buyer base.”

Terry brazenly laundering property by way of the UAE is yet one more instance of why BehindMLM classifies Dubai because the MLM crime capital of the world.

The “trusted up” reference seems to be [a reference] to the Auspicious Belief.

Our current assessment of the texts and emails confirms the Terrys’ common use of the supposedly “irrevocable” Auspicious Belief as their private piggybank.

The trouble to get “trusted up” together with his “title nowhere close to” the Belief, as Mr. Terry described it to Bitman, was a deliberate however infirm try to preserve Terrys’ property away from the attain of the federal government.

The Monitor additionally gives a curious replace into the beforehand cited over $9 million asset dissipation by Terry.

It seems Chris Terry was the sufferer of a rip-off. At this stage, we perceive $8 million is frozen in a checking account in Texas.

The truth that $8 million was frozen by Financial institution of America seems to have prevented the dissipation of those funds through the Belief.

On September twelfth, 2025, Kerr, as Trustee of Auspicious, filed a Texas District lawsuit alleging, maybe satirically, that “$9 million belonging to the Auspicious Irrevocable Belief” had been “spirited away by way of a daisy-chain of law-firm and shell-company accounts”.

On the illustration that the Terry’s don’t have any management over Auspicious Belief, the Monitor wrote with respect to $8 million of the $9 million Terry laundered winding up in Texas;

We now have discovered no proof that Mr. Kerr exercised any impartial judgment concerning this troubling Belief worldwide transaction; as an alternative, the proof is that he merely did as he was informed by Mr. Terry.

The intention to route the cash by way of Ms. Terry’s private cryptocurrency pockets (which, once more, has not been recognized or turned over by the Defendants) seems to be one of many many efforts to protect the funds from the federal government.

We do not need entry but to the Belief’s inside paperwork; nevertheless, we have now situated a screenshot exhibiting a partial spreadsheet itemizing transactions in Mr. Kerr’s IOLTA account, which is used to function the Auspicious Belief.

The partial spreadsheet exhibits different transfers from the Belief in summer time of 2025 that had been clearly for the Terrys’ private use – and directed by the Terrys.

These weren’t sound investments of any type made by Mr. Kerr appearing in his capability as a fiduciary working the Belief independently from its trustors and beneficiaries, the Terrys.

Furthermore, the truth that an lawyer’s IOLTA belief fund could be used to deposit and disburse funds belonging to a consumer’s

personal irrevocable belief is puzzling at a minimal.This IOLTA spreadsheet displays a $100,000 switch to Analusion LLC on July 23, 2025.

Analusion is an entity within the title of, and alluding to, Mr. Terry’s girlfriend, Ms. McLeod, who modified her title to Anastasiia.

Second, there’s a fee of roughly $408,000 to US Mortgage, which we perceive based mostly on Mr. Terry’s contemporaneous texts was used to repay a mortgage for a property on Feathertree Lane in Henderson.

Mr. Terry admitted at his deposition that he bought the Feathertree property for his girlfriend, Ms. McLeod.

The property is owned by QCS1 LLC, an entity the Mr. Terry organized to be fashioned in Ms. McLeod’s title. Mr. Terry lives on the property with Ms. McLeod.

QCS1 is just not owned by the Auspicious Belief; slightly, it’s owned on paper by Ms. McLeod.

Nevertheless, in a textual content chain with a enterprise affiliate, Mr. Terry circled this $408,000 switch from the Belief transaction and highlighted it for example of his investing prowess in actual property. He additionally indicated that he owned the home with no point out of Ms. McLeod.

The Belief’s conversion of property on to Mr. Terry’s girlfriend (or extra probably on to Mr. Terry because it seems Ms. McLeod is a entrance proprietor) is additional proof that it isn’t working as an impartial irrevocable belief that isn’t managed by Mr. Terry.

Chris Terry’s brother, Donald, is cited because the recipient of $200,000 used to buy a “watch or jewellery”.

Moreover, after the FTC filed for a preliminary injunction, Donald allegedly helped Chris unload property.

In June of 2025 … Mr. Terry by way of his brother Donald agreed to promote 12 automobiles for a complete of over $2.35 million to a neighborhood car vendor in Las Vegas.

A assessment of Mr. Terry’s texts signifies he deliberate to make use of Matthew Greene, his enterprise accomplice … to “convert $1.5 to $2 million” into cryptocurrency, as a result of Mr. Terry wished to “take away” the “publicity”.

This is similar Matthew Greene that Preston Kerr sued final month.

In reviewing his texts with the purchaser of the automobiles, Mr. Terry requested the proceeds be despatched someplace aside from the Belief’s checking account.

He requested the vendor if he might ship the wire to a different account.

When the vendor mentioned that he most well-liked to ship it to Sterlin Kerr’s [trust] account or to chop a verify, Mr. Terry responded:

“OK, let me know when the wire I used to be simply informed [sic], I simply informed Sterling relating to deposit in one other account.”

We now have no perception but the place the $2 million plus from the sale of the automobiles went.

What is evident is that Mr. Terry absolutely managed these supposed property of the Belief and routed the proceeds as he noticed match, giving Mr. Kerr orders to maneuver the funds whereas letting Kerr know that Terry meant to maneuver the funds to harder-to-detect cryptocurrency – regardless of the pending [preliminary injunction] movement.

When grilled on transactions that passed off after the FTC filed for an injunction throughout a deposition, Terry claimed he had

a extreme studying incapacity which all however prevented him from studying and understanding paperwork, together with the [preliminary injunction] which had been entered in opposition to him.

The Monitor famous that

Mr. Terry is nearly continuously engaged in written communication and routinely consists of substantiative paperwork within the exchanges.

As on the time of submitting (October twentieth), the Monitor concluded by moreover noting the Terry’s “monetary disclosures stay incomplete”.

There was no compliance by any Defendant concerning transfers to 3rd events.

As to the sworn disclosure of private property, in step with the above, there have been quite a few omissions and false statements within the sworn monetary statements and in asset depositions about property, which haven’t been corrected.

Put one other means, the Terrys have quite a few property that they knowingly haven’t disclosed – and we have now seen no indication they ever intend to reveal these property.

The court docket granted the FTC’s and Nevada’s request for a preliminary injunction modification on October twenty first.

As a part of the order, the court docket transformed the Monitorship to a Short-term Receiver to supervise the Terrys’ private property.

The Courtroom units listening to on November 5, 2025 … wherein the Courtroom will take into account whether or not or not a everlasting injunction shall be modified to mirror appointment of a everlasting receiver as opposed a short lived receiver.

Within the leadup to the November fifth listening to, the FTC and Nevada filed a memorandum in assist of a preliminary injunction on October twenty eighth.

A everlasting receiver is plainly essential, given the Terrys’ intensive report of deliberate asset dissipation and scorn for the Courtroom’s orders.

Previously 12 days, much more proof of the Terrys’ monetary misconduct has been uncovered.

Cited examples of newly uncovered monetary conduct had been as follows;

In January 2025, after reviewing Plaintiff’s draft criticism, Chris Terry knowledgeable Isis Terry that to “defend us” he ws transferring $1 million in funds into Preston Sterling Kerr’s [Trust] account, to then be transferred to the Terrys’ “Dubai financial institution accounts”.

This was as a result of, in keeping with Chris Terry, the “FTC is exhibiting they could trigger threat of their up to date criticism.”

The Terrys’ marriage is a sham, entered into to protect their property.

Within the phrases of Mr. Terry, Isis Terry is merely his “enterprise accomplice” and so they “married for property”.

The Terrys moved tens of millions of {dollars} in cryptocurrency from customers deceived … by way of “Bitman,” a shadowy character in Dubai, to evade taxes and authorities oversight.

The Short-term Receiver discovered that “Bitman was paid 5% to transform tens of millions in crypto to United Arab Emirates foreign money, which the Terrys then used to buy luxurious actual property and international (Republic of Vanuatu) passports by way of money exchanges.”

As described by Kerr, the Terrys employed him for years to cover their property from authorities oversight, together with by way of use of the Auspicious Belief.

However the Short-term Receiver has decided that “the Terrys management each facet of the Belief, together with dictating how the property held within the Belief title are deployed.”

Of their zeal to squirrel away ill-gotten funds from deceived customers, the Terrys have did not pay company taxes that their firm owed to the IRS.

On October 20, 2025, the IRS despatched discover to IML, stating that the corporate had not paid $12,706,283.15 in taxes for the tax 12 months ending December 31, 2021, and that the corporate additional owed $475,331.12 in penalties and $1,219340.03 in curiosity: $14,400,954.73 in complete.

Even worse, it seems that these unpaid taxes probably signify solely a portion of the entire taxes Defendants have so far evaded.

The Terrys engaged for years in complicated maneuvers to cover their property from the tax authorities, together with the shuttling of shopper’s funds by way of cryptocurrency “chilly” wallets.

After Mr. Terry defined to Mrs. Terry how funds could possibly be moved surreptitiously by way of chilly wallets to keep away from authorities oversight, Mrs. Terry responded: “FUCK the IRS.”

Beneath the [preliminary injunction], Defendants’ monetary disclosures had been due over two months in the past, on August 26, 2025.

FTC counsel despatched emails to Defendants’ counsel on October 15 and 22, requesting a meet and confer in regards to the lacking monetary info.

Defendants’ counsel have but to comply with make themselves obtainable for a gathering.

On the final meet and check with Plaintiffs held with Defendants’ counsel, on October 7, 2025, Defendants’ counsel refused to offer a date sure by which Plaintiffs would obtain the finished monetary disclosure.

Defendants’ actions exhibit that they’ve a whole disregard for the legislation and have actively acted to thwart legislation enforcement motion in opposition to them.

On October twenty eighth, the court-appointed Short-term Receiver filed a report detailing much more alleged injunction violations.

Chris Terry testified there was roughly $2,000 remaining in cryptocurrency on his two wallets he turned over, regardless of proof that tens of tens of millions of IML cryptocurrency went to the wallets.

We had been supplied with two chilly wallets however had been unable to entry them, based mostly on the passwords Chris Terry supplied.

Whereas Mr. Terry was capable of open one of many wallets at his deposition, he saved the second and it was delivered to us on October 1, 2025; nevertheless, we had been nonetheless not capable of open it up till October ninth.

Within the meantime, on October 4 two transfers out of the pockets had been made, transferring $354.54 in bitcoin and $1,449.95 in ethereum to a different blockchain deal with.

These are very small quantities; nevertheless, they nonetheless look like figuring out transfers in violation of the [preliminary injunction].

And Chris Terry was the one individual whom we’re conscious of who had the flexibility to take away the crypto from the pockets.

In the meantime in Dubai;

The Terrys fialed to reveal that they rented certainly one of their Dubai condominiums in early August 2025.

In reference to a one-year lease of the unit, the Terrys obtained a “cheque” within the quantity of $880,000 AED (equal to roughly $237,000 USD) in August 2025 and are attributable to obtain a second fee of roughly $237,000 USD In February of 2026.

We now have not gotten readability about what occurred to the primary fee. It’s potential the preliminary fee was deposited in Isis Terry’s ADIB checking account, which Ms. Terry indicated held roughly $390,000 in keeping with her monetary disclosure.

We now have been requesting the ADIB financial institution statements for August and September from the Terrys with no success.

In an in depth July 26, 2025 change of texts with somebody who seems to be a possible enterprise accomplice, Mr. Terry boasted in regards to the current rental of this residence to a brand new enterprise colleague, whom he was educating on tips on how to turn into rich.

Terry first mentioned his efforts to evade the attain of the federal authorities:

“The perfect is [the FTC] illegally went to Terrafirma account which surprisingly had 5 {dollars} in it. As a result of you have got a really good pal… my title isn’t even on it and so they had been silly sufficient to place it in a criticism only in the near past

I would like you to do that Fake you’re a federal authorities Flip the water on in your faucet. Attempt to catch it. I’m water.

So I’ll preserve us protected However you simply gotta comply with my lead no extra these outdated nickel gun video games. I’m gonna run actually quick the opposite course.”

Mr. Terry went on to say:

“My precise actual earnings of a 5000 per hour curiosity 24 hours a day seven days per week 12 months a 12 months…” After which he gave the precise instance of his current rental of his Bulgari residence, noting:

“That is one residence earnings it’s been closed already 500,000 a 12 months. Rental. And I personal it price me 3 million so I’ve been receiving this sort of cash.

That is truly a brand new renter. Folks want they may make that at the job full-time That proper there’s tax free cash that’s certainly one of 47 residences.”

Because the listening to, counsel for the Terrys additionally disclosed for the primary time one other company account, often called a PEX Expense Account.

Counsel additionally indicated that in violation of the PI, Ms. Terry has continued to entry this company account to pay for a wide range of private bills totaling roughly $4,700.

Whereas the quantity is just not significantly giant, Ms. Terry’s figuring out determination to make use of an IML expense account debit card to pay for private purchases after the issuance of the PI is troubling.

Past issues in regards to the Terrys’ direct management and use of the Monitor Entities to cover property, and their use of it on this case to avoid the [preliminary injunction], we even have issues in regards to the troubling use of the Mr. Kerr’s IOLTA Belief account to conduct the enterprise of the Auspicious Belief.

We do not need all of the details right here, and supply this info with that caveat in thoughts.

Certainly, we have now not had all the supporting paperwork supplied to us … however, as demonstrated within the displays to the Monitor’s Complement Report, Chris Terry’s contemporaneous communications clarify he routinely used Kerr’s IOLTA account to cover property.

As an extra instance we have now just lately situated, on June 1, 2025, after the plaintiffs had moved for a preliminary injunction, Mr. Terry wrote his brother Donald:

“I’m getting a deposit round 400,000 for some property tomorrow. And I might ship it from Sterling‘s account so it’s clear …”

Pending the end result of the November fifth Iyovia everlasting injunction listening to, keep tuned.