PTGR AG operates within the cryptocurrency MLM area of interest.

PTGR AG operates within the cryptocurrency MLM area of interest.

PTGR AG’s web site area (“ptgr.io”), was privately registered on January twenty sixth, 2025.

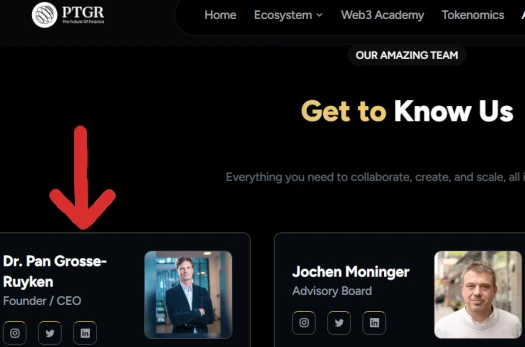

Heading up PTGR AG we now have founder and CEO Pan Gross-Ruyken.

Issues get slightly bit unusual right here. Along with operating PTGR AG, Gross-Ruyken can also be a professor on the Swiss Faculty of Administration (SSM), Barcelona:

Gross-Ruyken’s SSM bio acknowledges his position at PTGR AG;

At present serving because the CEO of PTGR AG in Zug, Switzerland, Dr. Grosse-Ruyken spearheads the corporate’s give attention to digital finance options for personal and institutional shoppers.

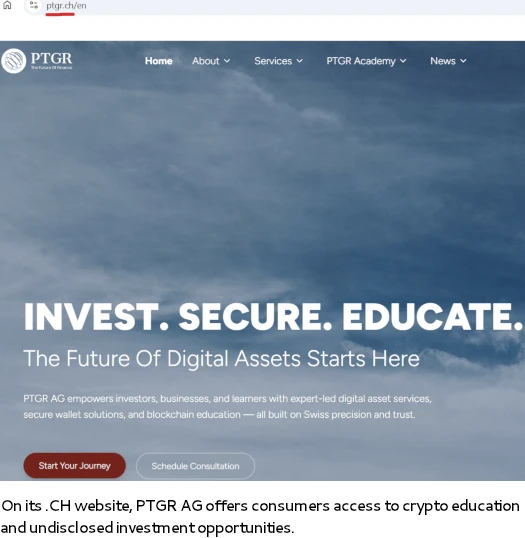

This doesn’t match up with PTGR AG as offered on its .IO area – however it does match what PTGR AG presents on a second area, “ptgr.ch”.

PTGR AG on the .CH area does supply investing companies, however its by session solely. Moreover, basic crypto companies and consultancy is obtainable.

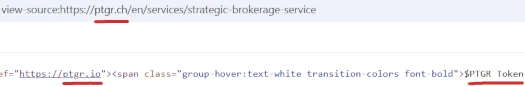

I assumed somebody might need hijacked the PTGR AG identify however, should you click on on the “$PTGR token” hyperlink on the prime proper of the PTGR AG .CH web site, you get redirected to the .IO area.

PTGR AG’s .CH web site area was privately registered on June ninth, 2021. The corporate is known as after its founder, Pan Theo Gross-Ruyken.

Placing all of this collectively, it seems Pan Gross-Ruyken reinvented himself as a crypto bro circa 2021 however continued to work as an instructional.

PTGR AG was the same old failed crypto bro scheme (might need even been a COVID-19 undertaking), so now Grosse-Ruyken has added a PTGR token funding scheme.

We’ll delve into the legalities of this within the conclusion of the overview.

Learn on for a full overview of PTGR AG’s MLM alternative.

PTGR AG’s Merchandise

PTGR AG has no retailable services or products.

Promoters are solely capable of market PTGR AG promoter membership itself.

PTGR AG’s Compensation Plan

PTGR AG promoters purchase PTGR token from PTGR AG. PTGR AG doesn’t disclose how a lot it’s promoting PTGR tokens for to customers.

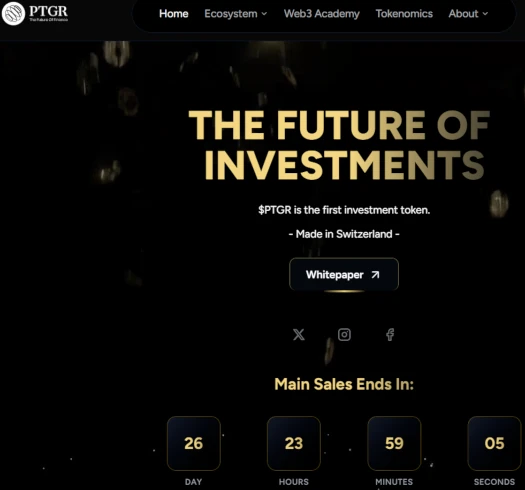

At time of publication, PTGR AG’s web site shows a 26 day timer for a PTGR token “essential sale”:

As soon as acquired, PTGR AG promoters make investments PTGR right into a staking mannequin funding scheme.

That is finished on the promise of a passive return, decided for the way a lot a PTGR AG promoter invests:

- make investments 5000 to 10,000 PTGR and obtain 1% to 2.5% yearly

- make investments 10,001 to 50,000 PTGR and obtain 2% to five% yearly

- make investments 50,001 to 100,000 PTGR and obtain 3% to 7.5% yearly

- make investments 100,001 to 250,000 PTGR and obtain 4% to 10% yearly

- make investments 250,001 to 500,000 PTGR and obtain 5% to 12.5% yearly

- make investments 500,001 or extra PTGR and obtain 6% to fifteen% yearly

PTGR AG’s MLM alternative pays on recruitment of promoter traders.

Sadly PTGR AG hides its MLM compensation plan specifics from customers. That is all that’s disclosed on PTGR AG’s web site;

Earn rewards every time a direct referral makes a purchase order or participates in staking.

Proceed incomes as your referrals invite others (multi-level rewards).

Becoming a member of PTGR AG

PTGR AG promoter membership is free.

Full participation within the hooked up revenue alternative requires a minimal 5000 PTGR token funding.

The price of buying 5000 PTGR tokens is hidden from customers.

PTGR AG Conclusion

PTGR AG presents a easy “staking” mannequin Ponzi, riddled with problematic disclosure failures.

PTGR token itself seems to be an ERC-20 shit token. These might be created in a couple of minutes at little to no price. It’s a give that PTGR is nugatory outdoors of PTGR AG itself.

To that finish PTGR AG represents it generates exterior income by way of its PTGR AG crypto companies and “strategic investments”:

5% of revenues generated from PTGR AG’s academic companies instantly gasoline our tokens Purchase & Burn mechanism.

25% of earnings from $PTGR AG’s strategic investments are distributed on to $PTGR Neighborhood.

As of September 2025, SimilarWeb was monitoring ~140,000 month-to-month visits to PTGR AG’s .CH web site. This sounds promising however 100% of that site visitors originates from Ethiopia.

PTGR AG doesn’t seem to have any direct hyperlinks to Ethiopia. Nor does it strike me as a rustic that might be that enthusiastic about what PTGR AG presents on its .CH web site.

I can’t definitively say what however one thing fishy might be occurring there.

As for PTGR AG’s “strategic investments”, PTGR AG fails to offer any verifiable proof of such investments.

Such verifiable proof could be audited monetary studies filed with regulators. In Switzerland that is could be the Swiss Monetary Market Supervisory Authority (FINMA).

SimilarWeb additionally tracked 100% of PTGR AG’s .IO web site site visitors from Ethiopia as of September 2025. Securities in Ethiopia are regulated by the Ethiopian Capital Market Authority.

By failing to register with monetary regulators in jurisdictions it operates and is soliciting funding in, PTGR AG is committing verifiable securities fraud.

Disclosure failures, together with what PTGR token is being bought for and MLM compensation particulars, might also violate shopper safety legal guidelines.

Whether or not the Swiss Faculty of Administration are conscious considered one of their professors is operating an unregistered fraudulent funding scheme is unclear.

PTGR AG represents SSM is considered one of its “trusted companions” on its web site:

Because it stands, the one verifiable income coming into PTGR AG is new funding.

Utilizing new funding to pay PTGR token withdrawals would make PTGR AG a Ponzi scheme.

As with all MLM Ponzi schemes, as soon as promoter recruitment dries up so too will new funding.

This can starve PTGR AG of ROI income, ultimately prompting a collapse.

Math ensures that when a Ponzi scheme collapses, nearly all of members lose cash.