WeFi operates within the cryptocurrency MLM area of interest.

WeFi operates within the cryptocurrency MLM area of interest.

WeFi’s web site tackle (“wefi.co”), was registered in January 2024. The non-public registration was final up to date on November thirtieth, 2024.

WeFi doesn’t present a company tackle on its web site. As an alternative, in only legible textual content, WeFi’s web site lists related shell firms registered in varied jurisdictions:

- WeFi Funds Restricted, a Canadian shell firm claimed to be “a registered cash providers enterprise”

- 3-102-939581 S.R.L., a Costa Rica shell firm

- Nordpal Holding Restricted, a Hong Kong shell firm

WeFi can also be related to WeChain, which it claims is a part of the “WeFi ecosystem”.

WeChain operates from the web site area “wechain.ai”, registered in Might 2024. WeChain’s non-public area registration was final up to date on April 2nd, 2025.

Within the footer of WeChain’s web site, once more in only legible textual content, we discover reference to:

- AppAtlas Applied sciences LLC, a St Vincent and Grenadines shell firm

- InfiniCore Tech LLC, a Saint Kitts and Nevis shell firm

All however one among WeFi’s shell firms is registered in a dodgy jurisdiction (i.e. little to no MLM associated regulation). This raises a pink flag for what needs to be apparent causes.

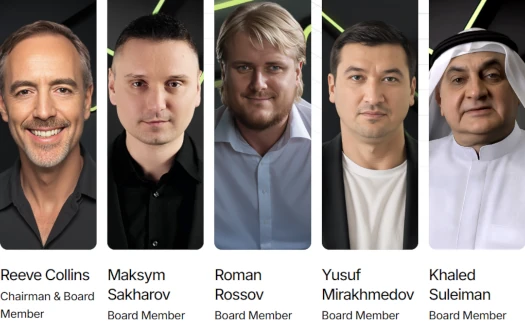

Heading up WeFi now we have:

- Reeve Collins – Chairman and Board Member

- Maksym Sakharov – Board Member

- Roman Rossov – Board Member

- Yusuf Mirakhmedov – Board Member

- Khaled Suleiman – Board Member

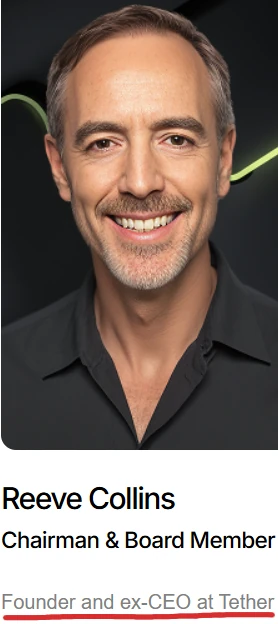

Reeve Collins cites himself because the founder and former CEO of Tether. Tether launched in 2014 and created and operates USDT, a cryptocurrency bearing the identical identify.

Collins and the opposite co-founders bought tether to the cryptocurrency change Bitfinex in 2015. Since then, USDT has grown to turn out to be the commonest cryptocurrency BehindMLM comes throughout in MLM associated fraud.

As of September 2025, Tether’s USDT marketcap sits at $170.04 billion. Up till 2019, Tether falsely claimed on its web site that

Each tether is all the time backed 1-to-1, by conventional foreign money held in our reserves. So 1 USDT is all the time equal to 1 USD.

Following authorized motion from the CFTC (2017) New York Lawyer Basic’s Workplace (2019), Tether modified its USD backed declare to:

Tether Tokens are 100% backed by Tether’s Reserves

In October 2021, Tether paid a $41.6 million high-quality for mendacity about USDT being backed by USD.

So far, it’s unknown what “Tether’s Reserves” is made up of or, extra importantly, whether or not it comes wherever close to to backing USDT’s present $170 billion market cap.

Tether has constantly refused to let a third-party auditor confirm its backing. This lends itself to suspicion Tether is likely one of the largest consumer-level monetary frauds in historical past.

To be clear, past co-founding Tether, Reeve Collins hasn’t had something to do with Tether’s fraud since 2015. I solely level this out as a result of Collins’ private model advertising and marketing appears to rely closely on his co-founding of Tether.

To be clear, past co-founding Tether, Reeve Collins hasn’t had something to do with Tether’s fraud since 2015. I solely level this out as a result of Collins’ private model advertising and marketing appears to rely closely on his co-founding of Tether.

WeFi is not any exception.

Affiliation with USDT might be not one thing I’d need on my resume, however I digress.

Khaled Suleiman’s LinkedIn profile locations him in Switzerland. Suleiman has a finance historical past so I’m assuming this makes him WeFi’s cash man.

Maksym Sakharov and Roman Rossov look like random Ukrainian crypto bros who are actually primarily based out of Dubai.

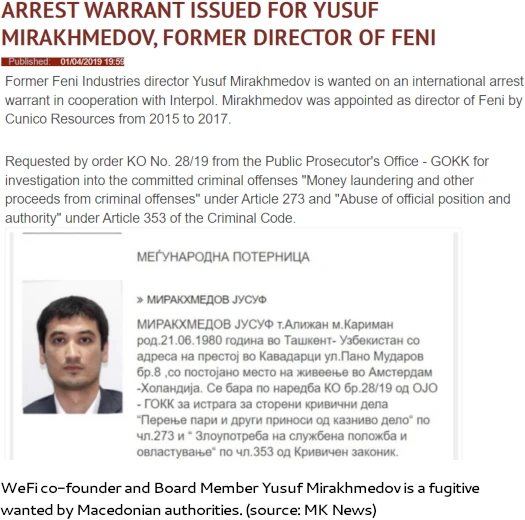

Yusuf Mirakhmedov, additionally primarily based out of Dubai, is a needed fugitive on the run from Macedonian authorities.

In 2015 Mirakhmedov (born in Uzbekistan as Јусуф Миракхмедов), was appointed Director of Ferronickel and CEO of Feni Industries. Each firms have been then owned by Cunico Assets, which Mirakhmedov was additionally CEO of.

Round mid 2017, Macedonian authorities filed felony fees in opposition to Mirakhmedov. Mirakhmedov was accused of misappropriating over $50 million.

The cash, based on the investigators, was embezzled by way of organized crime by “Cunico Useful resource”, the corporate that additionally owns “Ferronickel” in Kosovo.

In October 2017, Macedonian authorities confirmed Mirakhmedov had fled Macedonia for Uzbekistan.

In 2019 it was confirmed Mirakhmedov was nonetheless needed on a world arrest warrant.

Requested by order KO No. 28/19 from the Public Prosecutor’s Workplace – GOKK for investigation into the dedicated felony offenses “Cash laundering and different proceeds from felony offenses” below Article 273 and “Abuse of official place and authority” below Article 353 of the Felony Code.

In November 2017, the Monetary Police Division filed a felony grievance in opposition to Mirakhmedov, suspecting him of abuse of official place and authority.

Then, in the course of the investigation, the Monetary Police decided that Yusuf, the then director, illegally alienated reserves of ferronickel and different ore from the manufacturing unit.

In December of the identical yr, the division filed a second felony grievance in opposition to Mirakhmedov because of affordable suspicion of abuse of official place and authority.

Mirakhmedov made an unfounded write-off of Feni’s premature receivables, which is suspected of damaging the manufacturing unit by 51,505,526 US {dollars}.

It seems in some unspecified time in the future Mirakhmedov fled Uzbekistan for Dubai, the place he reinvented himself as a crypto bro.

Versus the assorted jurisdictions shell firms have been registered in, WeFi seems to be primarily based out of and operated from Dubai.

As a result of proliferation of scams and failure to implement securities fraud regulation, BehindMLM ranks Dubai because the MLM crime capital of the world.

BehindMLM’s tips for Dubai are:

- If somebody lives in Dubai and approaches you about an MLM alternative, they’re making an attempt to rip-off you.

- If an MLM firm relies out of or represents it has ties to Dubai, it’s a rip-off.

If you wish to know particularly how this is applicable to WeFi, learn on for a full assessment.

WeFi’s Merchandise

WeFi has no retailable services or products.

Promoters are solely in a position to market WeFi promoter membership itself.

WeFi’s Compensation Plan

WeFi pays referral commissions when recruited downline promoters spend money on ITO node positions.

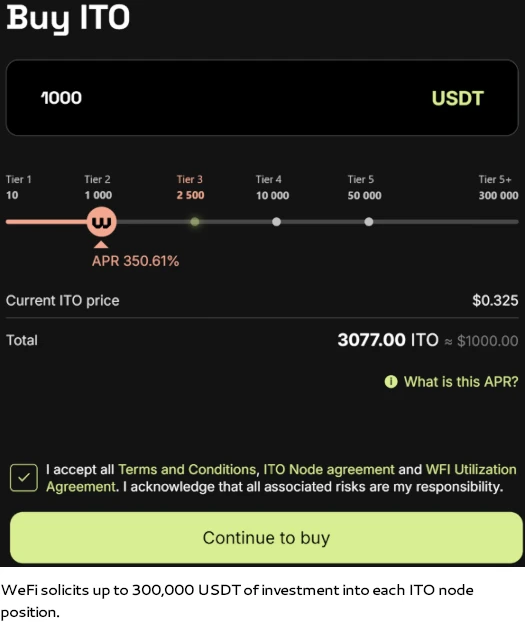

ITO node funding positions are bought in tether (USDT).

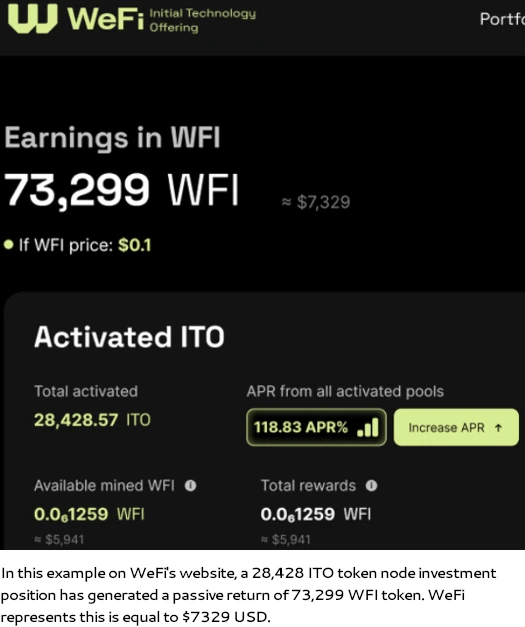

ITO node positions generate passive returns in WFI tokens. The extra a WeFi promoter invests, the upper the WFI token return.

An advertising and marketing instance supplied by WeFi pitches shoppers on a 350.61% annual ROI on a 1000 USDT ITO node funding.

It needs to be famous that is solely tier 2. The slide above goes as much as 300,000 USDT, though the corresponding annual return at that tier isn’t disclosed.

As soon as acquired by way of ITO node positions, WFI is then funneled right into a staking funding scheme:

- earn 15% yearly on WFI tokens invested for 180 days

- earn 20% yearly on WFI tokens invested for one year

- earn 25% yearly on WFI tokens invested for 730 days

WeFi pays referral commissions on WFI tokens invested into its staking scheme.

Referral commissions are paid down three ranges of recruitment (unilevel):

- stage 1 (personally recruited promoters) – 3%, unlocked with a 250 USDT ITO node place funding

- stage 2 – 5%, unlocked with a 500 USDT ITO node place funding

- stage 3 – 8%, unlocked with a 1000 USDT ITO node place funding

Word that WeFi pays referral commissions in WFI token, that are mechanically entered into WeFi’s staking funding scheme for one yr.

Becoming a member of WeFi

WeFi promoter membership is free.

Full participation within the connected revenue alternative requires a minimal 250 USDT funding.

Full participation in WeFi’s connected MLM alternative requires a minimal 1000 USDT funding.

WeFi Conclusion

The co-founder of tether, a bunch of Euro crypto bros hiding in Dubai, one among which is a needed fugitive, a finance man in Switzerland and shell firms out the wazoo… what may go incorrect?

Placing all of that apart for a second, WeFi is an easy “node” mannequin funding scheme coupled with a staking Ponzi.

New WeFi promoters are recruited and make investments USDT (ironic a lot?) into ITO node positions. The ITO node positions pay out a every day passive return in WeFi’s WFI token.

WFI tokens are then entered right into a typical crypto staking Ponzi. Via stated Ponzi, WeFi traders purchase passive returns in WFI token, all finished within the hope of cashing out greater than they initially invested in USDT.

WeFi’s ITO node funding scheme and WFI staking funding scheme are each securities choices. This requires WeFi to register with monetary regulators in each jurisdiction it solicits funding in.

As of August 2025, SimilarWeb was monitoring ~130,000 month-to-month visits to WeFi’s web site.

Prime sources of WeFi web site site visitors are Vietnam (24%), Ecuador (21%), France (15%), Thailand (9%) and Germany (9%). Prime sources of WeChain web site site visitors are Canada (54%), Brazil (29%), India (10%) and Thailand (7%).

WeFi fails to supply proof it has registered with monetary regulators in any jurisdiction.

WeFi additionally represents itself to be a financial institution:

Once more, WeFi doesn’t seem to carry banking licenses in any jurisdiction.

And simply in case you’re questioning what “ZK-KYC” is, it seems to tie into an awfully suspicious sounding “fee engine”;

WeChain’s ZK fee engine permits one person to show to a different {that a} assertion is real with out revealing extra data.

Our ZK fee engine paves the best way for extra privateness and safety throughout financial institution transfers, funds, and peer-to-peer transactions.

Feels like cash laundering to me however hey, that’s in all probability probably the most minor pink flag in relation to WeFi.

For its half, WeFi seems to remember it’s committing securities fraud and violating banking legal guidelines within the nations it’s promoted in.

This disclaimer is supplied on WeFi’s web site;

Please notice that the promotion and/or distribution of our merchandise and/or providers exterior Hong Kong might require a licence.

The content material of our web site is just addressed to Hong Kong residents, domiciled in Hong Kong.

If you’re a resident domiciled exterior Hong Kong and don’t want to go to our web site, please shut this web page.

In case you nonetheless need to go to our web site, click on Proceed and in doing so, you verify that you’ve learn and understood the above and that you’re accessing our web site by yourself initiative with out lively promotion or solicitation from WeFi.

Sadly for WeFi that’s not how securities and monetary regulation works. WeFi is answerable for registering its securities choices and acquiring banking licenses within the jurisdictions it operates in.

Why WeFi hasn’t registered its securities choices and obtained banking licenses needs to be apparent.

Because it stands, the one verifiable income getting into WeFi is new funding.

Utilizing new funding to pay WFI token withdrawals would make WeFi a Ponzi scheme.

As with all MLM Ponzi schemes, as soon as promoter recruitment inevitably dries up so too will new funding.

This can starve WeFi of ROI income, finally prompting a collapse.

Math ensures that when a Ponzi scheme collapses, nearly all of individuals lose cash.