The worldwide grocery supply market simply hit $938.98 billion in 2025 and is racing towards $1.49 trillion by 2030 at a blistering 9.74% development fee. However the reality is – whereas many entrepreneurs are nonetheless debating whether or not to enter this house, new age companies are already delivering groceries to properties.

Take Zepto’s story. This Indian quick-commerce startup went from zero to $1B+ GMV with 75% of their darkish shops already EBITDA optimistic. In the meantime, BigBasket serves 8.5 million households throughout 300+ cities with 35,000 supply companions, proving that scale is completely achievable on this market.

The query isn’t whether or not grocery app improvement is an efficient alternative – it’s whether or not you’ll transfer quick sufficient to seize your share earlier than the market turns into oversaturated.

Market Alternative & Development Potential

The Numbers That Matter

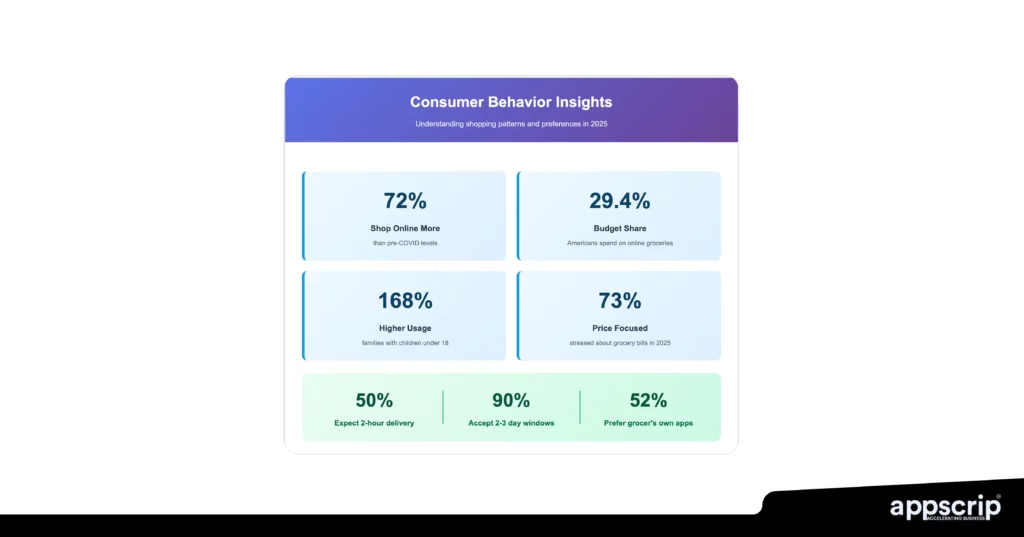

Let’s take a look at the numbers. 67% of customers now store for groceries on-line, with 40% ordering weekly. That is extra of a everlasting behavioral change whereas ordering grocery pushed by comfort and time financial savings.

The regional breakdown reveals the place the actual alternatives lie:

United States: $327.90 billion in 2024, rising to $452.30 billion by 2029 at 8.37% CAGR. With 138.3 million People (51.8% of adults 18+) buying groceries on-line in 2024, the market has reached mainstream adoption.

Asia-Pacific: This area dominates with 60% international market share and the quickest development at 27.8% CAGR. India’s fast commerce market alone reached $7.2M in FY25, rising at a 142% CAGR throughout FY22-FY25.

Europe: Exhibits sturdy potential with on-line grocery projected to succeed in 18-30% of the food-at-home market by 2030.

Why Timing Issues Extra Than Good Planning

Right here’s what entrepreneurs miss: 72% of world e-commerce gross sales are carried out by way of cell units, and grocery supply apps obtain 3x larger conversion charges than cell web sites with simply 20% cart abandonment versus 68% desktop charges.

The infrastructure is already there. Fee programs are mature. Shopper habits has shifted completely. The one query is execution pace.

When you’re planning the right app, corporations like Marvel simply raised $950 million in 2024, and Rohlik secured $171 million. Cash is flowing into this house, however it’s going to corporations that may execute shortly and effectively.

Important Options for Your Grocery App

After analyzing profitable platforms from Instacart to BigBasket, the patterns are clear – sure grocery app options instantly influence person retention and order worth, whereas others are costly distractions.

Buyer App Should-Haves

Core Income-Driving Options

Multi-Retailer Buying Cart: This isn’t simply handy – it’s worthwhile. Customers can order from a number of shops in a single checkout, growing common order values considerably. Instacart maintains over $100 AOV whereas processing 294 million orders producing $33.5 billion GTV in 2024.

AI-Powered Suggestions: Sensible entrepreneurs make investments right here first. AI delivers $136 billion projected worth unlock by 2030 for grocery platforms, distributed throughout provide chain optimization ($67.7B), merchandising ($25.7B), and advertising and marketing ($19.3B).

Actual-Time Stock Monitoring: Dwell inventory updates cut back customer support complaints and enhance retention. The info reveals that stock accuracy could make or break person belief in your platform.

Superior Search & Filters: ElasticSearch integration for lightning-fast outcomes. Product web page conversions method 50% for optimized grocery platforms versus business averages of 20-30%.

Fee & Comfort Options

A number of Fee Choices: Fee preferences are regional and generational. Debit playing cards account for 43% of cell grocery funds, adopted by bank cards at 28%. Fee technique availability instantly impacts conversion optimization – lacking fashionable fee choices means misplaced gross sales.

Dwell GPS Monitoring: Actual-time supply updates from pickup to doorstep. This characteristic alone can enhance buyer satisfaction scores by lowering anxiousness about order standing.

Modern Options That Create Aggressive Benefit

The grocery platforms profitable market share are these leveraging AI successfully:

Sensible Buying Lists: Auto-generate lists based mostly on previous purchases and consumption patterns. This reduces ordering friction and will increase repeat buy charges.

Value Prediction Alerts: Notify prospects when favourite objects go on sale. This characteristic drives each buyer loyalty and improves order frequency.

Recipe-to-Cart Integration: Scan recipes, mechanically add all elements to cart. This characteristic will increase basket measurement by encouraging meal planning reasonably than single-item purchases.

Product Freshness Scoring: AI-powered freshness rankings with harvest/manufacturing dates. 64% of Gen Z and 63% of millennials are prepared to pay extra for sustainable merchandise, making freshness and high quality key differentiators.

Picker High quality Scores: Charge particular person pickers for produce choice accuracy. This builds belief in your success high quality.

Photograph Affirmation Service: Pickers ship photographs of produce earlier than including to cart, guaranteeing buyer satisfaction with perishable objects.

Based mostly on profitable platform evaluation, prioritize options that enhance with utilization:

Voice Ordering Integration: “Alexa, add milk to my grocery cart.” Voice commerce integration is changing into important, enabling hands-free procuring experiences that busy households desperately want.

Predictive Reordering: Auto-suggest reorders based mostly on consumption patterns. This characteristic improves buyer lifetime worth by creating buying habits.

Sensible Doorstep Supply: IoT-enabled safe supply packing containers for contactless drop-off. As supply expectations evolve, comfort options like this create aggressive moats.

Superior Stock Administration: Crowd-sourced inventory updates the place prospects report out-of-stock objects for real-time accuracy. Demand forecasting to foretell stock wants based mostly on native occasions and climate patterns.

Driver Optimization: AI-powered supply route optimization and multi-temperature supply capabilities. Buyer desire studying that remembers supply preferences (doorstep location, contact technique).

Multi-Vendor Administration: For market fashions, sturdy programs that deal with a number of distributors with out efficiency degradation throughout peak demand.

Enterprise Fashions & Income Streams

The distinction between grocery platforms that generate sustainable income and those who burn via investor cash comes down to at least one factor: selecting the best enterprise mannequin from day one.

Core Enterprise Mannequin Choices

Single-Retailer Mannequin (The Walmart Method)

The way it works: You personal the stock in Walmart method and management all the expertise from choice to supply.

Income Construction: Direct product gross sales with markup + supply charges. Walmart’s cell app customers spend 40% greater than common buyers and make twice as many journeys to Walmart.

Greatest for: Current grocery chains increasing digital or well-funded startups with sturdy provider relationships.

Funding Actuality: Requires vital upfront capital for stock, warehousing, and provide chain administration. However when you obtain scale, margins enhance dramatically since you management all the worth chain.

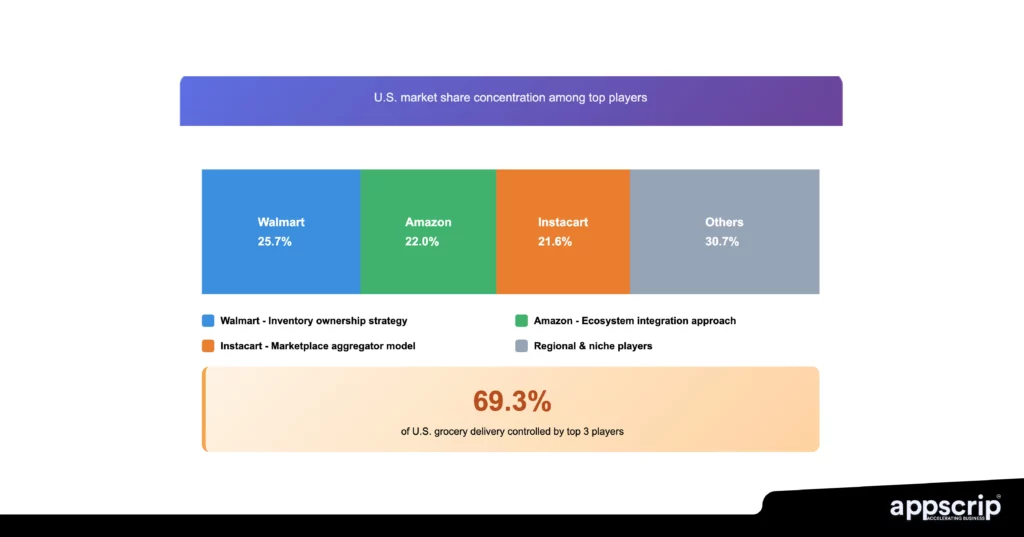

Multi-Retailer Aggregator Mannequin (The Instacart Method)

That is the place most entrepreneurs ought to begin. Join prospects with a number of grocery shops via your platform.

Income Streams:

- Retailer commissions: 15-30% of order worth (varies by quantity)

- Supply charges: $3-8 per order

- Service charges: 3-5% platform charge on whole order

- Promoting income from featured retailer placement

Success Proof: Instacart covers 5,500+ cities via strategic retailer partnerships and has almost 10 million lively customers, producing $3.38B income with 11% development in 2024.

Why This Works: Decrease barrier to entry, quicker scaling potential, and decreased operational complexity. You give attention to know-how and person expertise whereas companions deal with stock and success.

Hyperlocal Fast Commerce (The 15-30 Minute Mannequin)

The way it works: Restricted stock, ultra-fast grocery supply from strategically positioned micro-warehouses or darkish shops.

Income Premium: Clients pay 20-30% larger costs for pace comfort. India’s fast commerce market reached Rs 64,000 crore in FY25, rising at 142% CAGR throughout FY22-FY25.

Greatest for: Dense city markets with excessive inhabitants density and powerful demand for comfort.

Infrastructure Necessities: Community of darkish shops grew 71% year-over-year in FY25, whereas common income per retailer elevated 25%, demonstrating each growth and effectivity good points.

Income Stream Breakdown

Major Income Sources That Really Work

Fee Mannequin: 10-20% per transaction from accomplice shops. This scales superbly – extra orders imply extra income with out proportional value will increase.

Supply Charges: Vary from $3-$10 per order, typically waived for bigger orders or subscription members. The secret is discovering the candy spot the place charges cowl supply prices with out lowering order frequency.

Subscription Fashions: $10-15/month without cost supply and unique advantages. The info reveals subscription members persistently spend 40%+ greater than non-members throughout a number of platforms. Amazon Prime members account for almost two-thirds of on-line grocery gross sales and spend over 40% greater than non-members.

Secondary Income Alternatives

Promoting Income: Featured retailer placement and promoted merchandise. In-app promoting from suppliers and types generates $0.50-$2.00 per person month-to-month for established platforms.

Information Monetization: Market insights for grocery manufacturers (anonymized). This turns into beneficial when you attain vital scale and might present significant shopper habits insights.

White-Label Licensing: Expertise platform licensing to different markets. When you’ve confirmed your platform works, licensing it to different areas or vertical markets creates recurring income with minimal further improvement prices.

Income Optimization Methods

Subscription Fashions Drive Retention

Why They Work: Predictable recurring income streams and considerably improved buyer lifetime worth.

Proof: DashPass subscribers present 69% retention after 1 month declining to twenty-eight% after 12 months, whereas European leaders obtain 47-63% retention charges. The secret is delivering sufficient worth to justify the month-to-month charge.

Factors-Based mostly Methods: 79% of buyers use loyalty applications, with 45% preferring digital variations. Efficient loyalty applications enhance order frequency by encouraging prospects to consolidate their grocery procuring in your platform.

Dynamic Pricing Methods

Peak Hour Premiums: Cost larger supply charges throughout high-demand intervals (evenings, weekends) when supply capability is constrained.

Distance-Based mostly Pricing: Longer supply distances command larger charges, guaranteeing supply economics stay worthwhile throughout your service space.

Monetary Projections Framework

Based mostly on profitable platform evaluation, right here’s reasonable income development:

Yr 1: Concentrate on buyer acquisition and market validation

- Goal: 10,000-50,000 month-to-month lively customers

- Income: $100K-$500K yearly

- Major focus: Proving product-market match

Yr 2: Scaling and optimization

- Goal: 50,000-200,000 month-to-month lively customers

- Income: $500K-$2M yearly

- Focus: Bettering unit economics and increasing market protection

Yr 3+: Market management and profitability

- Goal: 200,000+ month-to-month lively customers

- Income: $2M+ yearly

- Focus: Sustainable development and market growth

Selecting Your Income Mannequin

For First-Time Entrepreneurs: Begin with the multi-store aggregator mannequin. Decrease upfront funding, quicker time to market, and confirmed scalability.

For Current Retailers: Think about the single-store mannequin to take care of management over buyer expertise and stock high quality.

For City Markets: Fast commerce fashions command premium pricing however require vital infrastructure funding.

Begin with one main mannequin, show it really works, then layer in further income streams as you scale.

Growth Prices, Timeline & Launch Technique

The distinction between launching efficiently and burning via your price range comes down to creating sensible trade-offs between pace, value, and options. Let me present you precisely what profitable grocery platforms really value to construct and why your method issues greater than your price range measurement.

Pre-Constructed Options: The Pace Benefit

Whole Funding: $20,000 – $70,000.

Timeline: 2-3 months to launch.

ROI Benefit: 6-9 months quicker income era.

Pre-built options provide accelerated entry at $20,000-$50,000 for template-based approaches or $30,000-$80,000 for white-label platforms. However right here’s the essential perception: hidden prices devour 25-40% of first-year funding, together with annual upkeep (15-25% of improvement value), internet hosting infrastructure ($500-$10,000+ month-to-month), and advertising and marketing ($50,000-$200,000 for preliminary campaigns).

Why This Works: You’re shopping for confirmed know-how that’s already processed thousands and thousands of orders. BigBasket and Instacart didn’t develop into profitable as a result of they constructed every part from scratch – they succeeded as a result of they targeted on execution reasonably than reinventing know-how.

Customized Growth: The Excessive-Threat Path

Whole Funding: $75,000 – $600,000+.

Timeline: 8-12 months minimal.

Increased Threat: Technical challenges and potential delays.

Grocery app improvement prices vary from $40,000 to $400,000, with enterprise apps reaching $600,000+. Growth usually requires 8-12 months for customized options.

Hidden Actuality: Customized improvement tasks have a 60-70% probability of going over price range and timeline. Whenever you’re competing in opposition to established gamers, delays can imply lacking your market window completely.

Price Breakdown Evaluation

| App Kind | Core Options | Funding Vary | Timeline | Success Likelihood |

| Fundamental MVP | Consumer login, product catalog, fundamental monitoring | $40,000 – $100,000 | 4-6 months | Excessive |

| Intermediate | Actual-time monitoring, presents, push notifications | $100,000 – $200,000 | 6-9 months | Medium |

| Superior | AI suggestions, voice search, multi-store | $200,000 – $400,000 | 9-12 months | Medium |

| Enterprise | AI/AR options, multi-region, IoT integration | $400,000 – $600,000+ | 12-18+ months | Low |

Grocery App Launch Roadmap

Section 1: Planning & Setup (4-6 weeks)

Market Analysis & Validation:

- Analyze native competitors and pricing methods

- Determine underserved buyer segments or geographic areas

- Survey potential prospects about supply preferences and ache factors

Partnership Growth:

- Safe relationships with 5-10 native grocery shops for market mannequin

- Negotiate fee buildings (usually 15-30% of order worth)

- Set up supply accomplice community or third-party logistics relationships

Authorized & Operational Setup:

- Enterprise licensing and meals dealing with permits

- Insurance coverage protection for supply operations

- Fee gateway integration and service provider accounts

Section 2: Growth & Testing (2-3 months pre-built / 8-12 months customized)

Platform Customization:

- Branding and person interface customization

- Integration with native fee strategies and supply companies

- Multi-language assist if serving various markets

High quality Assurance:

- Load testing to make sure platform handles peak demand

- Safety testing for fee processing and information safety

- Consumer acceptance testing with actual prospects

App Retailer Optimization:

- Key phrase analysis and app retailer itemizing optimization

- Screenshots and demo movies showcasing key options

- Evaluation technique for launch interval

Section 3: Go-to-Market Technique

Buyer Acquisition Ways:

- First-order reductions (20-30% off) to encourage trial

- Native website positioning and Google Advertisements concentrating on grocery supply key phrases

- Social media campaigns highlighting comfort and time financial savings

- Referral applications providing credit for profitable referrals

Launch Metrics to Observe:

- Buyer Acquisition Price (goal: $30-$80 per buyer)

- Common Order Worth (goal: $95-$112 based mostly on business benchmarks)

- Order frequency and buyer retention charges

- Supply satisfaction scores and completion charges

Hidden Prices That Kill Budgets

Ongoing Operational Bills

Annual Upkeep: 15-25% of improvement value yearly. A $100,000 platform requires $15,000-$25,000 yearly upkeep for safety updates, characteristic enhancements, and efficiency optimization.

Advertising Funding: Buyer acquisition prices common $30-$80 per buyer. Buying 10,000 prospects requires $300,000-$800,000 in advertising and marketing funding. Most entrepreneurs underestimate this by 50-75%.

Infrastructure Scaling: Internet hosting prices begin at $500 month-to-month however can exceed $10,000+ month-to-month for profitable platforms processing hundreds of day by day orders.

Authorized & Compliance Prices

Preliminary Authorized Setup: $5,000-$25,000 for enterprise licensing, meals dealing with permits, and information privateness compliance. Ongoing compliance prices add one other $3,000-$10,000 yearly.

Regional Concerns: GDPR compliance in Europe, state-specific privateness rules within the U.S., and native enterprise licensing necessities fluctuate considerably by location.

Expertise Stack Selections

Cloud Platform Choice: AWS, Firebase, or Google Cloud with microservices structure enabling enhanced scalability. The selection impacts each preliminary setup prices and long-term operational bills.

Database Structure: Choice between SQL and NoSQL databases impacts each efficiency and improvement complexity. Grocery platforms require programs dealing with real-time stock updates throughout hundreds of merchandise.

Integration Necessities: Fee processing, mapping companies, analytics, and communication instruments usually characterize $5,000-$100,000 in further improvement prices however present important performance.

Conclusion & Subsequent Steps

Whereas rivals spend 8-12 months constructing customized platforms, entrepreneurs utilizing Appscrip’s pre-built grocery app options launch in 2-3 months.

Key Success Elements

Pace Over Perfection: Instacart generated $3.38B income by specializing in market effectivity reasonably than customized improvement. Zepto reached $1B+ GMV by optimizing for execution over options.

Concentrate on Unit Economics: 73% of customers are harassed about grocery payments. Your platform should clear up actual issues – comfort, time financial savings, and worth.

Strategic Partnerships: Leverage present retail infrastructure reasonably than constructing from scratch. This reduces capital necessities and accelerates market entry.

Why Pre-Constructed Options Win

- 75% Quicker Time-to-Market: 2-3 months versus 8-12 months.

- Confirmed Expertise: Platforms processing thousands and thousands of orders have solved complicated challenges.

- Decrease Funding: $20,000-$70,000 versus $75,000-$600,000+.

- Diminished Threat: Remove 60-70% likelihood of customized tasks going over price range.

Able to launch your platform? Schedule a session with Appscrip to discover complete grocery supply options that speed up your market entry with full customization and ongoing assist.