Digital transformation has forayed into many domains, even logistics. As provide chains develop advanced and buyer expectations soar, companies more and more depend on logistics software program improvement firms to ship cutting-edge options that hold them aggressive.

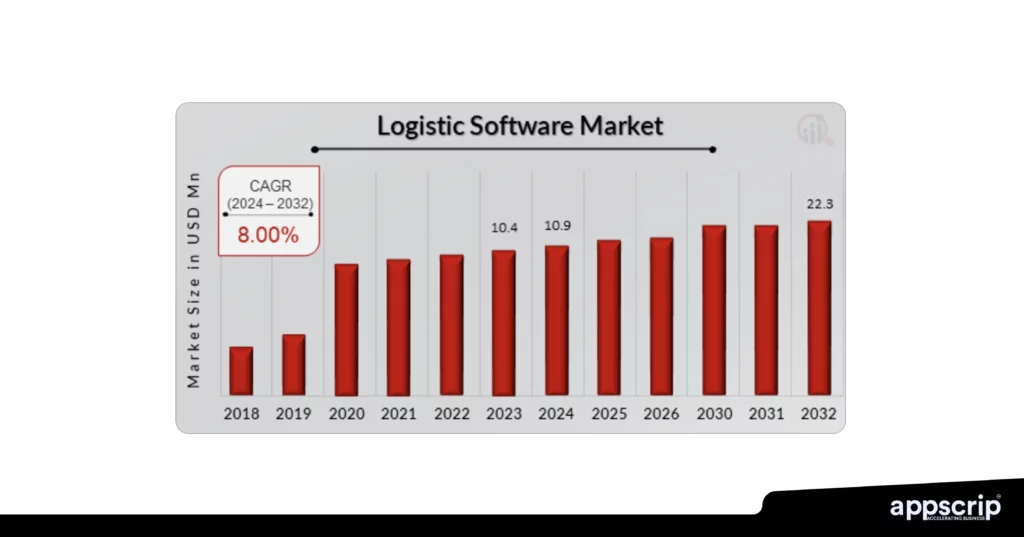

The worldwide logistics software program market, valued at $10.9 billion in 2024, is projected to achieve $22.3 billion by 2032, rising at a CAGR of 8.1%. This explosive progress displays the {industry}’s pressing want for classy transportation administration programs (TMS), warehouse administration options, and built-in provide chain platforms.

The COVID-19 pandemic additional accelerated this shift, with e-commerce gross sales hitting $5.7 trillion in 2022 and anticipated to achieve $8.1 trillion by 2025, fueling demand for software program able to dealing with advanced, multi-channel operations.

Market Overview: Key Progress Drivers

Expertise Integration Tendencies:

• AI and Machine Studying: IBM studies that AI-driven options can enhance forecasting precision by as much as 50% and lower stock prices by half

• IoT Implementation: Berg Perception studies that lively IoT gadgets in provide chains will surge to 1.1 billion items by 2025

• Cloud-Native Options: Enhanced scalability and real-time visibility throughout international operations

This information examines 15 main logistics software program improvement firms throughout three key areas: North America (with its know-how innovation management), Europe (recognized for compliance and integration experience), and international gamers driving worldwide logistics transformation.

Prime 8 Logistics Software program Improvement Corporations in the USA

North America stays the dominant area within the logistics software program market, with the most important market share of over 34% in 2024. The area’s energy lies in its focus of know-how giants, mature e-commerce ecosystem, and important funding in logistics innovation.

1. Appscrip

Appscrip focuses on pre-built transportation administration programs and digital freight brokerage platforms, providing complete TMS options with cell and internet interfaces. The corporate focuses on fast deployment and customization for logistics operations.

Key Companies:

• Transportation Administration Techniques (TMS) with full-featured truck dispatch

• Digital freight dealer software program with built-in load boards

• Cell and internet functions for iOS and Android platforms

• White-label logistics options for fast market entry

Expertise Stack:

• Cloud-native microservices structure

• SSL-certified APIs with JWT/JWE encryption

• WebRTC for safe communications

• Load balancer assist for scaling operations

Why We Stand Out: Appscrip affords versatile pricing beginning at $15,000 with 100% IP possession on fee completion, making enterprise-grade logistics software program accessible to rising companies whereas sustaining enterprise safety requirements.

2. Oracle Company

Oracle’s Transportation Administration Cloud combines easy-to-use interfaces with superior capabilities to streamline logistics operations, optimize service ranges, and cut back freight prices. As a part of Oracle’s broader SCM suite, it serves enterprise purchasers worldwide.

Key Companies:

• SCM Cloud options with built-in TMS

• Fleet administration and operational planning

• Machine learning-powered route optimization

• Automated billing and compliance administration

Why They Stand Out: Oracle’s energy lies in its enterprise integration capabilities and AI-powered optimization engine that robotically identifies probably the most applicable logistics options for advanced provide chain necessities.

3. SAP SE

SAP Transportation Administration (SAP TM) enhances logistics technique with superior routing proposals, useful resource administration, and security compliance for harmful items supply. The platform leverages SAP HANA for real-time analytics.

Key Companies:

• Built-in logistics platforms with AI-driven optimization

• Superior analytical dashboards for strategic decision-making

• Useful resource allocation and utilization optimization

• Complete compliance and security administration

Expertise Benefit: SAP TM gives superior analytical dashboards powered by SAP HANA, delivering real-time insights and complete knowledge evaluation for proactive transportation administration.

4. Manhattan Associates

Manhattan Associates reported annual income of $1.042 billion in 2024, becoming a member of the choose group of provide chain software program suppliers producing over $1 billion yearly. The corporate leads in warehouse administration programs and omnichannel options.

Key Companies:

• Omnichannel provide chain options

• Manhattan Energetic platform with microservices structure

• Warehouse administration experience

• Provide chain planning and execution integration

Market Place: Manhattan is a pacesetter in two markets: warehouse administration programs and omnichannel programs, with all merchandise now on their cloud-native Energetic Platform.

5. Blue Yonder (previously JDA Software program)

Blue Yonder, owned by Panasonic, affords AI-powered end-to-end provide chain options and reported “terribly sturdy” efficiency in 2024 with record-breaking software program bookings.

Key Companies:

• AI-powered provide chain planning and forecasting

• Transportation administration with community capabilities

• Warehouse administration with robotic integration

• Demand forecasting and stock optimization

Progress Metrics: Blue Yonder’s Cloud TMS grew from 10 million month-to-month shipments to 45 million shipments per thirty days in 2024, demonstrating important market adoption.

6. Logility

Logility gives provide chain administration options centered on cognitive planning programs that leverage algorithmic planning to mannequin and analyze enterprise alternatives whereas mitigating dangers.

Key Companies:

• Provide chain administration and demand planning

• Algorithmic planning with machine studying

• Demand sensing for short-term refinement

• IoT sensor integration for automated actions

7. FreightWaves

FreightWaves serves as a transportation intelligence platform offering market knowledge and analytics to assist logistics firms make knowledgeable choices about freight markets and capability planning.

Key Companies:

• Transportation intelligence and market knowledge

• Freight market analytics and forecasting

• Capability planning instruments

• Actual-time market insights

8. Descartes Techniques Group

Descartes stands out as a strong TMS platform for enterprises managing advanced, worldwide, and multi-modal provide chains, with specific energy in international logistics execution.

Key Companies:

• World logistics execution platforms

• Multi-modal transportation administration

• Worldwide provide chain coordination

• Customs and compliance administration

| Firm | Main Focus | Market Energy | 2024 Progress Indicator |

| Appscrip | TMS & Digital Freight | SMB-Enterprise | Versatile pricing mannequin |

| Oracle | Enterprise SCM | World Integration | AI-powered optimization |

| SAP | Built-in Logistics | Enterprise Scale | HANA-powered analytics |

| Manhattan | WMS & Omnichannel | $1B+ Income | Cloud platform migration |

| Blue Yonder | AI Provide Chain | Finish-to-end Options | 350% TMS progress |

| Logility | Demand Planning | Cognitive Techniques | ML integration |

| FreightWaves | Market Intelligence | Information Analytics | Transportation insights |

| Descartes | World Logistics | Multi-modal | Worldwide experience |

Main European Logistics Software program Improvement Corporations

Europe’s logistics software program market is characterised by sturdy regulatory compliance experience, multi-language assist, and deep integration with advanced worldwide commerce necessities. The area emphasizes sustainability, GDPR compliance, and cross-border logistics optimization.

1. WiseTech World (CargoWise)

WiseTech World is a number one developer of software program options for the logistics execution {industry} globally, with clients together with over 7,000 logistics firms throughout greater than 125 international locations. Their CargoWise platform executes over 44 billion knowledge transactions yearly.

Key Companies:

• CargoWise One built-in provide chain platform

• Customs automation and compliance administration

• Freight forwarding software program options

• Cross-border logistics execution

Regional Strengths:

• GDPR Compliance: Native European knowledge safety integration

• Multi-language Help: Localized options throughout European markets

• EU Regulatory Experience: Latest acquisitions in Belgium, Netherlands, Eire, Germany, Italy, and France strengthen European customs capabilities

Expertise Stack:

• Cloud-based built-in platform structure

• API connectivity for seamless integrations

• Actual-time processing throughout a number of currencies

• Complete customs automation programs

Why They Stand Out: WiseTech’s flagship product, CargoWise One, varieties an integral hyperlink within the international provide chain and permits logistics service suppliers to execute extremely advanced transactions throughout a number of customers, capabilities, international locations, languages and currencies.

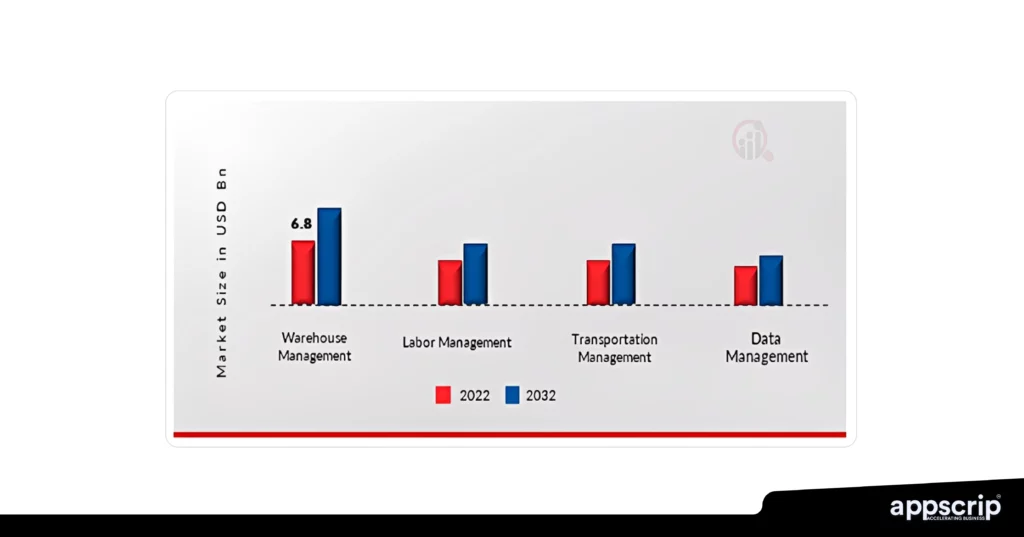

Logistic Software program Market, by Software program Sort, 2022 & 2032 (USD Billion)

2. Transporeon

Transporeon is the Transportation Administration Platform for shippers, forwarders, carriers and retailers, with over 20 years of expertise digitizing and reworking logistics. The platform powers the most important community of shippers and carriers in Europe.

Key Companies:

• AI-driven spot freight optimization with Autonomous Procurement

• Cloud-based transportation administration software program

• Dock and yard administration options

• Freight audit and fee automation

European Market Management:

• Collaboration Platform: Connects hundreds of shippers, suppliers, and retailers each day

• AI Integration: Options AI-powered freight quoting, predictive ETAs, and market improvement predictions

• Community Results: Largest European shipper/service ecosystem

Expertise Innovation: Superior automation instruments, AI brokers for service onboarding, and real-time visibility throughout your complete European transport community.

3. impltech (Germany)

Primarily based in Berlin, impltech brings over 10 years of specialised expertise within the European logistics market, specializing in automation options and regulatory compliance for German-speaking areas.

Key Companies:

• Logistics automation platforms

• European market-specific options

• German regulatory compliance programs

• Customized logistics utility improvement

Regional Experience:

• German Market Focus: Deep understanding of DACH area necessities

• Automation Specialization: Superior workflow automation capabilities

• Compliance Integration: Constructed-in German and EU regulatory frameworks

4. WEZOM

WEZOM focuses on transportation administration programs with specific experience in Jap European markets, providing fleet administration options and logistics optimization platforms.

Key Companies:

• Transportation administration programs

• Fleet administration options

• Jap European market experience

• Customized logistics platform improvement

Regional Strengths:

• Jap Europe Experience: Specialised data of rising European markets

• Fleet Optimization: Superior automobile routing and fleet administration

• Native Integration: Sturdy partnerships with regional carriers and repair suppliers

| European Firm | Headquarters | Specialization | Key Differentiator |

| WiseTech World | Australia (EU Operations) | World Logistics Platform | 44B+ transactions yearly |

| Transporeon | Germany | Transportation Administration | Largest EU shipper community |

| impltech | Germany | Logistics Automation | German market experience |

| WEZOM | Jap Europe | Fleet Administration | Regional specialization |

Worldwide Logistics Software program Improvement Powerhouses

World logistics firms are driving innovation in cross-border commerce, multi-modal transportation, and rising market logistics. These firms convey distinctive regional experience whereas serving worldwide markets.

1. Geotab (Canada)

Geotab leads the worldwide telematics and IoT options market, serving transportation firms worldwide with complete fleet administration platforms designed for numerous operational environments.

Key Companies:

• Fleet administration and GPS monitoring programs

• IoT sensors and telematics options

• Route optimization and gasoline administration

• Compliance reporting and security administration

World Strengths:

• Multi-regional Presence: Operations throughout North America, Europe, and Asia-Pacific

• Harsh Climate Experience: Specialised options for difficult operational environments

• Sustainability Focus: Superior emissions monitoring and environmental compliance

Expertise Stack:

• IoT sensors with machine studying integration

• Cloud-based analytics platform

• Actual-time automobile diagnostics

• Superior reporting and compliance instruments

Why They Stand Out: Geotab’s industry-leading telematics platform combines sturdy {hardware} with subtle software program analytics, enabling companies to optimize fleet efficiency whereas sustaining complete security and compliance requirements.

2. Locus (World with Center East Presence)

Locus advanced from a ladies’s security utility to a number one AI-powered logistics optimization platform, acknowledged as a Consultant Vendor within the 2024 Gartner Market Information for Multicarrier Parcel Administration Options.

Key Companies:

• AI-driven dispatch administration platform

• Multi-carrier parcel administration (ShipFlex)

• Actual-time route optimization

• Final-mile supply optimization

World Capabilities:

• Community Attain: Connects to 160+ carriers globally via a single dashboard

• AI Integration: Machine learning-powered logistics decision-making

• Scalable Platform: Options for retail, FMCG/CPG, and manufacturing

Innovation Focus: Locus’ MCPMS ShipFlex automates multi-carrier deliveries tailor-made to customized enterprise constraints round value, velocity, and effectivity.

3. 99Minutos (Latin America)

99Minutos has advanced from last-mile supply to a complete logistics operator overlaying your complete provide chain, with $128.7 million in complete funding and operations throughout Mexico, Colombia, Chile, and Peru.

Key Companies:

• Finish-to-end logistics ecosystem

• Categorical parcel supply and specialised deliveries

• Cross-border logistics (Cross 99)

• Freight forwarding (Freight 99)

Market Efficiency:

• Income Progress: Income grew thrice YoY with over 120,000 B2B clients

• Operational Scale: Greater than 1,000 personal items, 10,000 outsourced collaborators, and seven,000 sq. meters of storage capability

• Geographic Enlargement: Cross 99 reached 48-50 each day operations in its first six months

Complete Companies: The corporate operates six logistics verticals: specific parcel supply, specialised deliveries (Tailor 99), achievement (Fulfill 99), community of bodily factors (Punto 99), cargo transportation (Freight 99) and worldwide logistics (Cross 99).

4. PackageX

PackageX gives complete bundle and mailroom administration options designed for enterprise services, universities, and huge campuses coping with rising supply volumes.

Key Companies:

• Actual-time bundle monitoring and administration

• Digital mailroom options

• Route optimization for inner logistics

• Scalable options for SMBs and enterprises

Market Alternative: The worldwide digital mailroom providers market was estimated at $1.38 billion in 2024 and projected to achieve $2.8 billion by 2033, with important progress in college and company campus deliveries.

Expertise Focus:

• Doc Processing: Superior clever doc processing capabilities

• Integration APIs: The API administration market is projected to develop from $8.86 billion in 2025 to $19.28 billion by 2030

• Campus Options: Specialised in high-volume institutional supply administration

| World Firm | Area | Main Market | Key Metric |

| Geotab | Canada | Fleet Telematics | World IoT management |

| Locus | World/Center East | AI Dispatch | 160+ service community |

| 99Minutos | Latin America | E-commerce Logistics | $128.7M funding |

| PackageX | North America | Digital Mailroom | Campus specialization |

Key Expertise Tendencies Shaping 2025

AI Integration

• AI & Machine Studying: Predictive fashions now anticipate demand spikes, optimize dynamic routing, and cut back empty miles by as much as 15% .

• IoT Integration: Sensor-based telematics present real-time temperature, shock, and site knowledge, reducing spoilage and enabling predictive-maintenance alerts .

• Blockchain: Permissioned ledgers create immutable data for end-to-end provenance, easing customs clearance and ESG compliance audits .

• Cloud-First Structure: Micro-services and server-less deployments give 3PLs elastic scalability throughout peak seasons whereas decreasing complete value of possession by 25–40% in contrast with on-premise stacks.

Cloud-Native Platforms

Advantages:

• Enhanced scalability for international operations

• Actual-time visibility throughout provide chains

• Diminished infrastructure prices

• Improved collaboration capabilities

IoT and Sensor Expertise

Functions:

• IoT-enabled track-and-trace options cut back cargo theft by 40% and lower chilly chain failures by 35%

• Actual-time temperature and humidity monitoring

• Predictive upkeep for fleet automobiles

• Automated stock administration

Sustainability Focus

Trade Priorities:

• Carbon footprint monitoring and reporting

• Route optimization for gasoline effectivity

• Sustainable transportation mode choice

• Regulatory compliance for environmental requirements

Regional Regulatory Issues

North America: DOT Hours-of-Service guidelines and impending cross-border e-manifest mandates require TMS platforms to embed real-time HOS clocks and automatic ACE/ACI filings.

Europe: GDPR data-sovereignty clauses and the EU’s forthcoming “Match for 55” carbon laws are pushing distributors to localize knowledge facilities and embed CO₂-calculation engines.

Center East: Harmonized GCC commerce agreements and extreme-heat logistics drive demand for refrigerated IoT tags and Arabic-first cell interfaces.

Latin America: Fragmented customs programs and poor last-mile infrastructure push builders towards offline-capable apps and blockchain-enabled single-window clearance instruments.

Selecting the Proper Logistics Software program Improvement Companion

Important Choice Standards

Technical Experience Evaluation:

• Confirmed observe document with related {industry} challenges

• Expertise stack alignment with enterprise necessities

• Scalability for future progress wants

• Integration capabilities with current programs

Market Understanding:

• Regional compliance and regulatory data

• Trade-specific experience and greatest practices

• Native market dynamics and necessities

• Buyer assist and repair ranges

Monetary Issues:

• Complete value of possession evaluation

• ROI projections

• Versatile pricing fashions and fee phrases

• Hidden prices and ongoing upkeep charges

Future-Proofing Your Funding

Structure Necessities:

• API-First Design: Seamless integration capabilities for ecosystem connectivity

• Cloud-Native Options: World scalability and accessibility

• Cell-First Strategy: Help for contemporary workforce and real-time operations

• AI/ML Capabilities: Aggressive benefit via clever automation

Analysis Course of:

- Hole Evaluation: Assess present know-how limitations and operational inefficiencies

- Necessities Definition: Doc particular operational wants and compliance necessities

- Supplier Analysis: Evaluate distributors based mostly on {industry} experience and know-how capabilities

- Pilot Implementation: Check options with restricted scope earlier than full deployment

Implementation Finest Practices

Phased Strategy:

• Begin with core TMS performance

• Regularly combine extra modules

• Monitor efficiency and consumer adoption

• Scale based mostly on confirmed outcomes

Change Administration:

• Complete employees coaching applications

• Clear communication of advantages and adjustments

• Ongoing assist throughout transition interval

• Efficiency measurement and optimization

Conclusion: Logistics Software program Improvement Corporations

The logistics software program improvement panorama is marked for unprecedented innovation and progress alternatives in 2025. With the market projected to achieve $22.3 billion by 2032, firms that spend money on the fitting know-how partnerships will achieve important aggressive benefits.

Key Takeaways:

• Regional Experience Issues: US firms lead in innovation, European companies excel in compliance, and international gamers convey market-specific data

• Expertise Integration: AI, IoT, and cloud platforms have gotten commonplace necessities, not non-obligatory options

• Scalability is Important: Select options that may develop with what you are promoting and adapt to altering market situations

• Partnership Strategy: Search for distributors who act as strategic companions, not simply software program suppliers

Whether or not you want complete TMS options, white-label freight dealer platforms, or customized logistics functions, choosing the fitting improvement associate is essential for sustaining aggressive benefit in right now’s quickly evolving provide chain panorama.

The businesses featured on this information symbolize the best-in-class choices throughout completely different markets and specializations. By fastidiously evaluating your particular wants towards their capabilities, you may make an knowledgeable choice that can drive operational excellence and enterprise progress for years to come back.

Prepared to remodel your logistics operations? Get in contact.