Studying Time: 15 minutes

Banking isn’t restricted to a department workplace, a cellular app, or a web site anymore. As omnichannel banking traits proceed to reshape buyer experiences and expectations, prospects now demand seamless motion inside the banking ecosystem.

For instance, an SMS integration helps the shopper with their inquiries, and e mail follow-ups nudge them to maneuver forward within the buyer journey. That’s how omnichannel advertising works in banking.

To remain forward within the sport, banks should join their brick-and-mortar areas to seamless digital experiences throughout channels. The precedence must be to create omnichannel buyer experiences the place each touchpoint is aware of the shopper’s progress and communicates with them primarily based on the unified information of the shopper.

On this put up, we’ll focus on the newest omnichannel banking traits and the rising applied sciences that empower them.

8 Omnichannel Banking Tendencies to Keep on Prime of

At present, omnichannel banking is an opportunity for contemporary banks to win buyer loyalty. From tremendous apps to AI-fueled personalization, banks are reinventing how prospects work together with and expertise monetary providers. The problem is to maintain up with the fast improvements defining this area.

That will help you reduce by the noise, we’ve grouped these omnichannel banking traits into totally different classes, highlighting the place banking is heading and what’s reshaping the trade in the present day. So seize a espresso and let’s dig into the way forward for omnichannel banking.

Cell Apps are Changing into Banking Superheroes

Cell apps have developed into rather more than digital wallets or transaction hubs. They’re the nerve heart of banking experiences, the one-stop store the place prospects count on banks to do the whole lot seamlessly. From monetary planning instruments to built-in funds, cellular apps are the place the way forward for banking resides.

1. The Rise of Tremendous Apps

Cell apps are shifting towards the “tremendous app” mannequin, creating ecosystems for patrons to handle the whole lot from banking to investments, rewards, and even invoice funds.

Why is that this vital? As a result of cellular banking, whereas handy, is just the highest channel in an omnichannel advertising technique, not the one channel.

Clients might want cellular for its accessibility. In response to the American Banking Affiliation (ABA), 55% of customers now want cellular banking over conventional strategies. However on the finish of the day, they demand consistency. A transaction they begin within the cellular banking app ought to really feel interconnected with different channels they work together with, reminiscent of e mail, SMS, and even in-branch visits.

As an illustration, if a buyer units up a financial savings reminder inside the app, that information ought to affect follow-up communication. Ship an SMS congratulating them after they attain a milestone, or e mail them a progress report towards their monetary objectives.

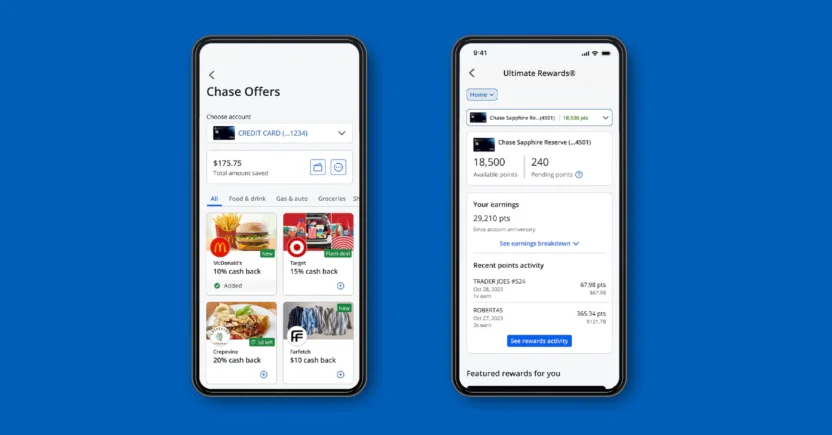

Take a look at trendsetters like JPMorgan. Past normal banking options, their Chase Cell® app integrates budgeting instruments and rewards platforms that permit prospects to redeem factors for journey or cashback. However those self same options are promoted through e mail campaigns and SMS alerts, guaranteeing prospects uncover app advantages irrespective of the place they’re partaking with the model.

Supply: https://www.chase.com/digital/mobile-banking

For banks, the message is obvious: Cease considering of cellular apps as standalone platforms. As an alternative, weave them into the bigger omnichannel ecosystem to amplify their energy.

2. Actual-time Personalization By means of Cell Apps

Each faucet, swipe, and scroll in a banking app tells a narrative a couple of buyer’s wants, habits, and objectives; and if you happen to’re listening fastidiously, you may flip these tales into personalised, omnichannel experiences.

As a matter of reality, prospects need their monetary interactions to really feel linked, irrespective of which gadget, platform, or channel they’re utilizing on the time. And there are omnichannel banking statistics to again up this development. Accenture’s Banking Shopper Examine 2025 states that 72% of shoppers think about personalization a significant component when selecting a financial institution.

Which means that in the present day’s prospects will not accept generic messaging. Personalization connects the dots between your app’s real-time insights and your e mail, SMS, and even in-person methods. So, as a marketer, you might want to ask your self:

- Are you utilizing your app information to tailor content material throughout all channels?

- Do your push notifications align along with your e mail campaigns?

- Can a buyer’s app exercise set off dynamic, cross-channel engagements?

For instance, let’s suppose your banking app delivers real-time reminders about due payments. Develop that by sending push notifications to your prospects, suggesting the best way to keep away from late charges. Then, complement these with an e mail summarizing their month-to-month spending habits, and comply with up with an SMS highlighting monetary habits they’ll enhance. This holistic method not solely works to retain your prospects, but additionally actively reinforces your omnichannel advertising technique.

Buyer Expertise is a Battlefield

Buyer expertise (CX) wins hearts, wallets, and market share. Interval. Whether or not it’s seamless onboarding or frictionless buyer assist, the aim is to simplify the whole lot for patrons to the purpose that banking simply works.

3. Frictionless Onboarding

If prospects must fax paperwork or sit in infinite queues to open an account (sure, it nonetheless occurs…), you’ve formally misplaced the race.

Fashionable buyer onboarding must be frictionless and quick, incorporating instruments like biometric verification, digital signatures, and gamified micro-steps. However finally, this expertise must replicate throughout channels for it to actually resonate with prospects.

Why? As a result of life occurs.

A buyer might start their onboarding journey on a cellular app throughout their lunch break however get interrupted earlier than finishing it. Later, they could want to complete the identical course of on their desktop after they’re residence and have entry to their monetary paperwork. Right here lies the omnichannel problem: does your onboarding course of allow them to decide up proper the place they left off? If not, frustration kicks in, and it could actually price you hard-earned signups.

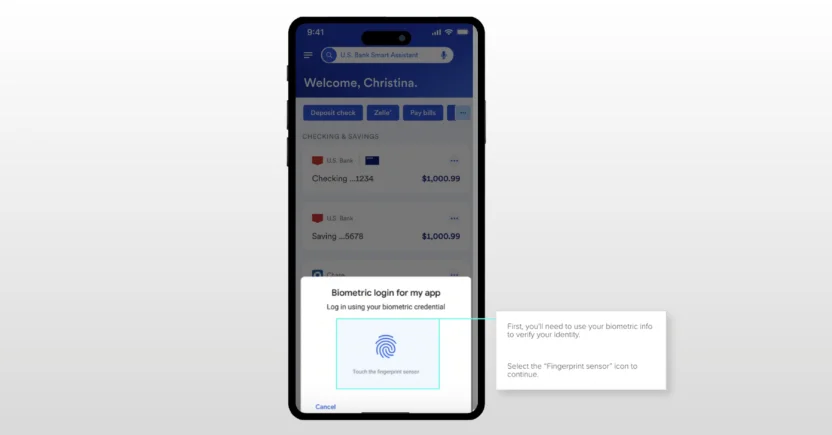

US Financial institution, as an example, provides an interactive onboarding expertise to new prospects, guiding them on a desktop by the biometric verification setup course of of their cellular app. Clients discover (and admire) after they can begin signing up in a cellular app, decide it again up on their desktop with out resetting their progress, and even affirm sure steps in-branch if wanted. This cross-device consistency creates a “begin anyplace, end anyplace” expertise that prospects affiliate not simply with comfort, however with belief.

Supply: https://digitalexplorer.usbank.com/content material/125/how-to-set-up-biometrics-for-android

The way forward for onboarding isn’t nearly pace, but additionally about consistency throughout channels. Clients must really feel like your model is with them each step of the way in which, from one gadget (or location) to a different. Inform your prospects that beginning on cellular doesn’t imply they’ll’t end on one other channel, and also you’re already one step nearer to incomes their loyalty.

4. Proactive Buyer Assist Utilizing AI

Banks, Monetary Providers and Insurance coverage (BFSI) manufacturers are fueling buyer progress by AI-driven personalization, together with buyer assist brokers and chatbots. The trick right here is to combine AI-led assist inside an omnichannel ecosystem that values buyer comfort above all else.

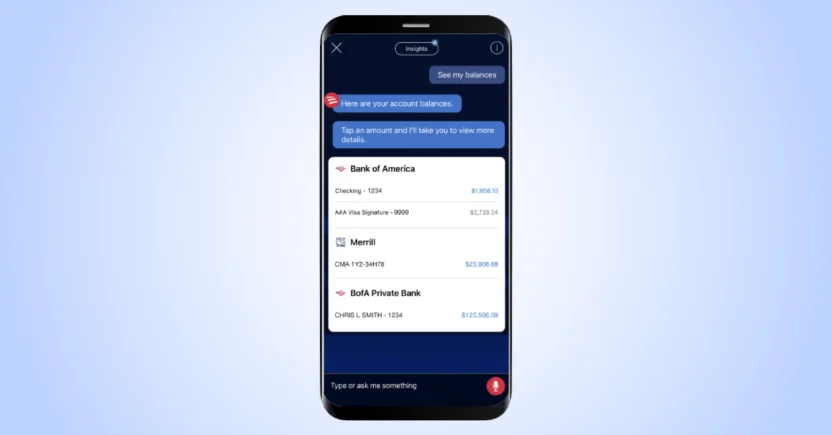

AI brokers and AI-powered buyer assist instruments, like Financial institution of America’s Erica, should turn into one other layer in your omnichannel framework. Erica doesn’t simply wait for patrons to ask questions. It proactively warns them about upcoming payments, suggests budgeting objectives, and even highlights unutilized rewards.

In actual fact, Erica handles over 1.5 million interactions daily, efficiently fixing over 98% of them with out human intervention. Nevertheless, it’s not simply in regards to the chatbot itself; it’s about how Erica integrates throughout BofA’s e mail, cellular, and notification methods to make sure prospects keep knowledgeable in a seamless, omnichannel approach.

Supply: https://data.bankofamerica.com/en/digital-banking/erica

For banks, this opens up numerous alternatives. Use insights from chatbot interactions, as an example, to craft follow-up campaigns that tackle frequent ache factors or remind prospects about actionable steps. If a chatbot detects uncommon account exercise and sends an alert through app notification, this could set off a follow-up message through e mail or SMS, reinforcing the identical motion (e.g., “We observed uncommon exercise in your checking account; affirm if this cost is legitimate”).

You may as well phase prospects primarily based on their assist historical past and ship personalised suggestions by omnichannel campaigns. For instance, if a buyer inquires a couple of mortgage through chatbot, comply with up with an SMS or e mail sharing tailor-made mortgage provides.

The Artificially Clever Takeover

Synthetic intelligence is the current, and it’s obliterating inefficiencies in methods we couldn’t have imagined a decade in the past. From predictive analytics to fraud detection, AI is changing into the silent superhero of omnichannel banking traits. Let’s see how.

5. Predictive Banking Experiences

AI-powered predictive fashions let banks anticipate buyer wants earlier than they even come up. However in the case of omnichannel methods, predictive analytics doesn’t simply inform what message to ship or when to ship it; it tells you the place to ship it.

Let’s take the instance of overspending. Your banking app may analyze a buyer’s spending habits and ship them a push notification that reads, “You are likely to overspend within the final week of the month. Right here’s how one can save $150 this time!” Easy and impactful. However that very same predictive perception might be leveraged to determine whether or not sending a push notification, an e mail, and even an SMS could be more practical for this buyer.

Not each buyer responds to the identical kind of communication, you see. Predictive analytics can assist you match the best message with the best channel, dynamically deciding on the one most definitely to drive motion. For a buyer who’s unlikely to open push notifications, the identical overspending alert might be despatched as an e mail as an alternative, and even as an SMS if the state of affairs requires urgency.

BFSI entrepreneurs can take this a step additional with platforms like MoEngage (shameless plug right here!). With its Most Most well-liked Channel (MPC) function, you may attain out to prospects on the channels they’ve engaged with earlier than. That is how one can grasp the artwork of sending the best message on the best channel on the proper time.

Giants like Financial institution of America are pioneering predictive insights with AI algorithms (BofA’s CashPro Forecasting) that analyze spending habits and ship recommendation to prospects. This sort of proactive engagement powers greater adoption charges for monetary merchandise, too. Should you can predict a necessity throughout a number of touchpoints, you may resolve it (and upsell alongside the way in which).

6. Fraud Detection and Prevention in Actual-Time

What’s worse than shedding cash to fraud? Realizing your financial institution didn’t notify you on time to cease it.

Fashionable fraud detection programs use AI to establish suspicious exercise and ship real-time alerts synced on a number of channels, serving to prospects stop large losses. However not all alerts are created equal, and the place messages are despatched issues simply as a lot as after they’re despatched.

Right here’s how this works in an omnichannel system:

- Essential Alerts: If a buyer’s bank card is being utilized in a suspicious location, ship an pressing SMS or push notification instantly — channels that demand consideration in actual time.

- Low-risk Suspicious Exercise: For minor anomalies, an e mail may be sufficient, particularly if it contains detailed steps for verifying the legitimacy of a transaction.

This isn’t simply theoretical. By partnering with Google, HSBC makes use of an AI-driven Dynamic Danger Evaluation system that displays 1.35 billion transactions throughout 40 million buyer accounts.

We’re discovering two to 4 occasions extra monetary crime than we did beforehand, with a lot higher accuracy. Traditionally, we had a excessive variety of false positives, which means that we had been calling prospects unnecessarily to ask them about what turned out to be utterly professional exercise. Now, we have now 60% fewer false optimistic circumstances.

— Jennifer Calvery, Group Head of Monetary Crime Danger and Compliance at HSBC

This reveals that prospects aren’t simply evaluating your financial institution primarily based on how briskly you detect fraud. They’re listening to the way you talk it and while you intervene.

As a BFSI marketer, you may combine messages triggered by fraud detection programs into your omnichannel campaigns. Comply with up a important fraud alert with a customized e mail ‘subsequent steps guidelines’ that guides prospects by securing their account. Use SMS to supply hotline assist for patrons flagged with high-risk alerts, guaranteeing a direct line of decision.

Cross-selling is Smarter (and Cooler)

At present, gross sales focuses on anticipating wants and fixing buyer issues with out feeling pushy or invasive. Within the omnichannel period, smarter cross-selling drives natural income progress whereas enhancing the shopper journey.

However what units the neatest cross-sellers aside? They know the best way to leverage information, tailor messaging to people, and most significantly, ship it by the best channels on the proper time.

7. Contextual Cross-Promoting with Information

Let’s begin with the fundamentals: cross-selling within the banking trade means providing complementary merchandise that align with a buyer’s profile and monetary objectives.

Think about a buyer with a financial savings account whose spending and behavioral information recommend they’re prepared to begin investing. As an alternative of blasting generic marketing campaign emails to each account holder, you employ danger profile information to suggest mutual funds tailor-made to their preferences. And in the event that they’ve proven curiosity in ESG (environmental, social, and governance) initiatives, you may recommend sustainable funds that echo their values. This isn’t simply cross-selling; it’s contextual cross-selling.

Now, the way you ship these suggestions issues as a lot because the suggestions themselves. Executing this efficiently requires an omnichannel method.

Let’s say a buyer makes a one-time monetary product buy, like a certificates of deposit (CD). You should utilize SMS or push notifications to tell them about bundled providers or loyalty advantages. Body the messaging to recommend the best way to maximize the worth of their present funding.

Right here’s a extra full-fledged instance of this omnichannel banking development. Suppose a buyer applies for a house mortgage through your web site. As an alternative of cluttering their mortgage software expertise with upselling suggestions, your back-end programs register this transaction as a set off in your omnichannel banking platform. From there, the shopper receives a follow-up e mail highlighting associated merchandise like residence insurance coverage or renovation loans. This alignment amongst information seize, buyer habits, and channel technique ensures that cross-selling feels useful.

8. Monetary Wellness Ecosystems

Right here’s a daring prediction: The way forward for cross-selling is about positioning your financial institution on the heart of your buyer’s monetary wellness journey. What does that imply? Properly, as an alternative of simply pushing options, banks want to supply the whole lot prospects want for built-in monetary planning.

Take Royal Financial institution of Canada (RBC)’s NOMI Insights for instance. NOMI helps prospects establish financial savings alternatives, set budgets, forecast money circulate, and keep away from overspending. Every part is deeply built-in into their major banking channels, guaranteeing prospects obtain ideas and actionable intelligence the place they’re already managing their funds.

Why is that this a game-changer for BFSI entrepreneurs? As a result of it creates an enormous alternative to fine-tune cross-sell methods inside an omnichannel framework.

To begin with, sending monetary wellness-related messaging by context-appropriate channels is essential. Clients don’t need push notifications interrupting their evenings to pitch heavy monetary recommendation. As an alternative, reserve push notifications for real-time finances warnings or financial savings objectives reminders, whereas detailed budgeting instruments and insights might be despatched through e mail or featured prominently inside your app’s dashboard.

Secondly, monetary wellness ecosystems thrive on belief. Use omnichannel content material methods, like e mail newsletters, app-based tutorials, and even in-branch seminars, to teach prospects on matters like retirement financial savings plans. Then construct in delicate cross-sell alternatives that really feel natural and related to the context. As an illustration, after a buyer interacts with in-app budgeting ideas, dynamically recommend higher-yield financial savings accounts or funding choices that align with their spending patterns.

Such omnichannel approaches place your financial institution as a accomplice in your buyer’s monetary well-being. Companions information, educate, and resolve issues. And in doing so, they generate cross-sell alternatives organically.

Rising Applied sciences Empowering Omnichannel Banking Tendencies

Omnichannel banking stitches a number of touchpoints collectively seamlessly, turning what was once a scattered patchwork into one cohesive buyer expertise.

In fact, this type of magic doesn’t occur by itself. Behind the scenes, a handful of rising applied sciences are doing the heavy lifting, empowering omnichannel banking traits to anticipate buyer wants, personalize engagements, and scale smarter.

Prepared? Let’s break down the important thing applied sciences you must learn about.

1. Predictive Analytics

AI-powered predictive analytics makes use of historic and behavioral information to forecast what a buyer may do subsequent. In consequence, banks can predict buyer habits, slice and cube information into actionable insights, and form personalised experiences that truly make sense.

For instance, say a buyer incessantly transfers cash abroad. AI picks up this habits and flags it as a cross-sell alternative for a lower-fee worldwide fee gateway. The omnichannel element is available in while you need to know the place to ship the message.

Suppose your analytics flag a buyer liable to leaving for a competitor. With predictive analytics built-in into your Buyer Engagement Platform (CEP), you may analyze their preferences, channel interactions, and habits to piece collectively the right technique. You ship an e mail marketing campaign that includes incentives like fee-free account administration, paired with an app alert providing personalised monetary recommendation. This precision is about crafting the best message for the best channel, maximizing your efforts to retain buyer loyalty.

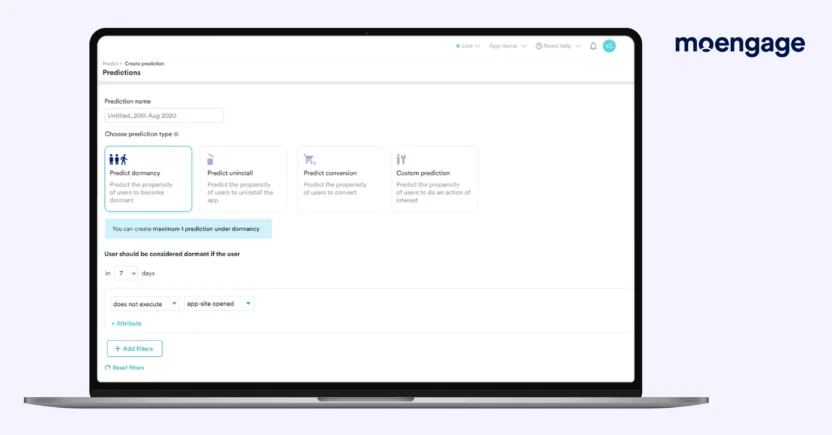

Platforms like MoEngage’s Predictions assist you phase prospects into hyper-targeted teams, reminiscent of these more likely to change banks or prospects nearing a spending threshold.

The end result? Extremely strategic omnichannel messaging that feels private and engages the shopper, wherever they’re.

2. Journey Orchestration Platforms: Seamless Transitions Throughout Each Channel

The challenges of omnichannel buyer journeys in banking are infinite. For one factor, you might want to make prospects really feel like each step within the journey is linked, no matter whether or not it begins in a cellular app, continues through e mail, and ends in a department. And that’s no straightforward feat in a company that handles the funds of hundreds of shoppers.

Enter buyer journey orchestration platforms. They make sure that irrespective of how prospects work together (app, department, web site, and even SMS), the messaging feels constant, well timed, and personalised. These platforms monitor the place a buyer is of their engagement journey and make sure the transitions are easy as silk.

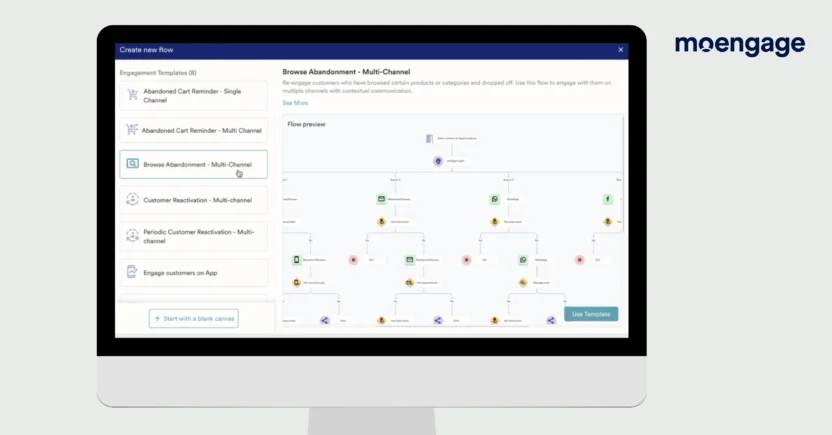

MoEngage Flows takes this one step additional. It’s a buyer journey builder that lets banks simply design, automate, and optimize these omnichannel buyer experiences.

For instance, let’s say a buyer will get caught halfway by a bank card software in your banking app. MoEngage detects the drop-off and triggers a follow-up: an SMS reminder inside an hour, an e mail outlining subsequent steps later that day, and a last in-app pop-up the following time they register. All synchronized like clockwork, so prospects by no means really feel misplaced within the shuffle.

3. Actual-Time Notification Platforms

If AI-powered analytics is the mind of omnichannel banking, then real-time notification engines are its voice. These programs ship hyper-relevant messages to prospects on the actual proper second, making interactions really feel well timed and pure as an alternative of pressured.

Need proof? Let’s circle again to Financial institution of America’s Erica AI assistant. It leverages real-time notifications to warn prospects about overspending or ship reminders about billing deadlines. Instruments like MoEngage allow banks to entry this similar type of personalization energy, with no need BofA’s billion-dollar growth budgets.

MoEngage’s real-time notification function integrates throughout push, e mail, in-app, and SMS, guaranteeing your message comes by on the channels your prospects use most. Did somebody miss their bank card fee? Notify them immediately with choices to pay now. Did prospects full onboarding? Set off a ‘welcome’ message that highlights financial savings plans in seconds.

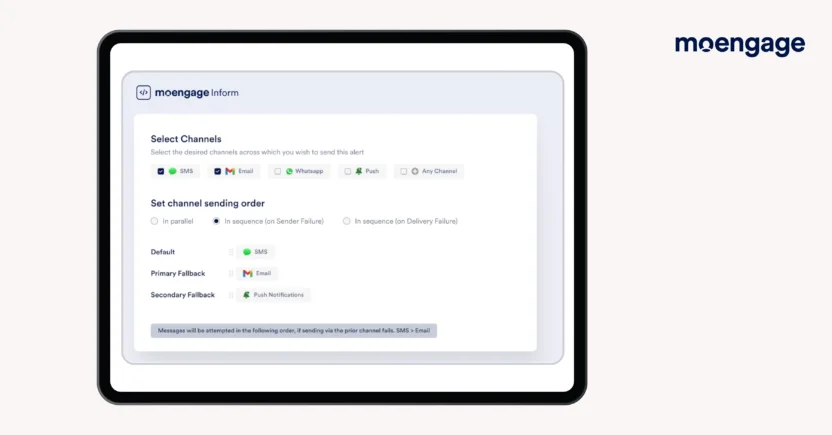

Banks can use MoEngage Inform to ship real-time transactional alerts in lower than 3 seconds. Fintech startup Beem, as an example, unified their buyer information throughout numerous touchpoints utilizing MoEngage, resulting in 38% extra CTR from SMS messages and 34% common e mail open charges. And because of MoEngage Inform, Payactiv achieved 9x extra conversions from e mail notifications.

4. CDPs (Buyer Information Platforms): The Supply of Fact for Personalization

Fast query: What’s an even bigger mess—your junk drawer stuffed with previous telephone chargers, or buyer information unfold throughout disconnected programs? Should you mentioned the latter, congrats, you get it.

To unlock the complete potential of omnichannel banking traits, you might want to combine your Buyer Engagement Platform (CEP) with a Buyer Information Platform (CDP). CDPs provide a unified repository for buyer insights from all of your channels. It’s a 360-degree view of every buyer, guaranteeing interactions throughout cellular apps, branches, and emails really feel seamless (and personalised).

Let’s say a department supervisor speaks to a buyer about refinancing their mortgage. Later, the identical buyer checks their financial institution app and sees a focused suggestion for a lower-rate mortgage product, completely aligned with the sooner department dialog. That’s CDP-fueled omnichannel perfection.

Nevertheless it doesn’t cease there. CEPs built-in with CDPs assist BFSI entrepreneurs make smarter selections about the place to ship messages. For instance, must re-engage a buyer who deserted their on-line mortgage software? Predictive information out of your CEP-cum-CDP may suggest a push notification first. Or do you could have a high-value buyer celebrating a serious monetary milestone? Your CEP and CDP information may recommend a customized e mail thanking them for his or her loyalty and showcasing provides on premium banking providers.

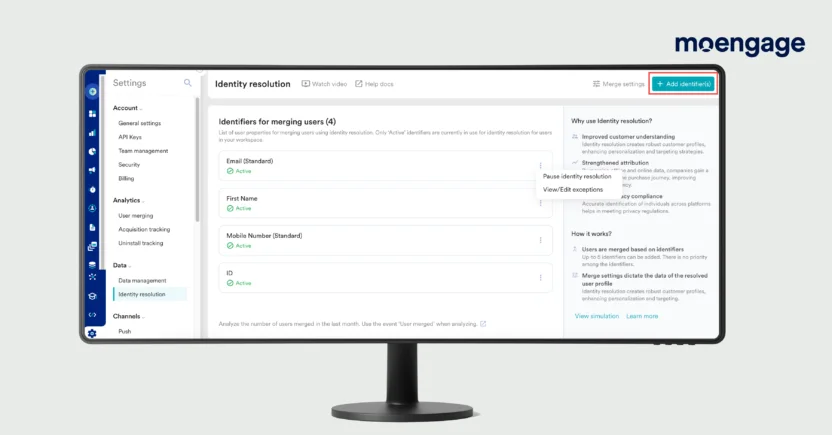

With MoEngage’s Unified Identification and seamless integrations with quite a few CDPs, banks can unify buyer information from apps, emails, SMS campaigns, and even offline channels. This central view ensures that each interplay seems like a pure continuation of the shopper’s earlier expertise, irrespective of the place it occurs.

5. AI-Pushed Personalization Engines

Generic messaging in 2025 is unforgivable.

Clients count on each interplay to really feel designed particularly for them, whether or not it’s a push notification, an in-app message, or a suggestion inside an e mail. Enter AI-powered personalization engines. They analyze spending patterns, click on behaviors, and life-style affinities to ship messaging, provides, and proposals that align completely with buyer preferences.

However right here’s the catch: true omnichannel personalization requires that these engines optimize content material for each channel you’re utilizing.

Let’s say a buyer is looking for bank cards in your web site. Your personalization engine can recommend related bank card comparisons primarily based on their historical past (“In search of cashback? We’ve bought you lined”) whereas saving the info to be used on different channels. Later, when that buyer logs into their cellular app, they need to see the identical contextual solutions, making it really feel like a continuation of their earlier net journey.

Related ideas apply when a buyer persistently engages with budgeting instruments in your app. The AI engine may spotlight financial savings accounts that align with their monetary objectives. This suggestion may seem as an in-app banner, and if unclicked, may set off a follow-up e mail to drive motion.

Channel-specific optimization issues, too. It is advisable to ship the best product in a approach that resonates with the medium. That’s why AI-powered engines ought to think about the most effective practices for every channel. A push notification, for instance, may function concise, time-sensitive language (“Act now to avoid wasting $50 in your first bank card spend!”). In the meantime, the e-mail follow-up can go deeper, together with detailed advantages, a comparability desk, and wealthy imagery.

MoEngage’s AI-driven personalization ensures the best merchandise hit the best channel on the proper time. It makes certain that channel-aware content material appears to be like and performs its greatest, whether or not it’s a cellular notification, app provide, or desktop e mail. It’s about making buyer interactions smarter and contextual by constructing on omnichannel banking traits, which is strictly the place AI personalization wins the day.

Achieve the Edge on Your Competitors with MoEngage

There’s little question that fast-emerging omnichannel banking traits are reshaping buyer experiences and expectations at lightning pace. In such a situation, embracing omnichannel banking methods is important. Banks that create hyper-personalized, constant, and tech-enabled experiences throughout a number of touchpoints are the one ones that may foster buyer loyalty and progress.

MoEngage’s Cross-Channel Advertising and marketing Platform boosts buyer retention by offering AI-powered constant experiences throughout all channels. Schedule a demo to see how your financial institution can profit.