Skilled providers corporations have two major paths to development. They will develop organically, progressively increasing their consumer base and territory over time. Or they’ll develop by buying different companies that complement theirs.

Every strategy has its upsides and disadvantages.

Natural development normally comes with decrease monetary danger and permits you to construct a tight-knit staff—so you may benefit from the fruits of the model fairness and goodwill you’ve cultivated over time. However it may be sluggish and geographically limiting. Buying different companies, however, can rapidly add new workplaces, income and headcount, as effectively present entry to new markets and hard-to-find expertise, IP and ability units. Nonetheless, an acquisition development technique comes with severe challenges, as effectively.

On this article, we discover 5 of those challenges. If in case you have questioned if an acquisition development technique is correct to your agency, think about how a lot danger you might be keen to tackle. Should you put together for the challenges forward, nevertheless, your possibilities of success are far higher.

Earlier than we dive in, let’s take a fast take a look at the analysis.

Many Excessive-Development Companies Interact in M&A

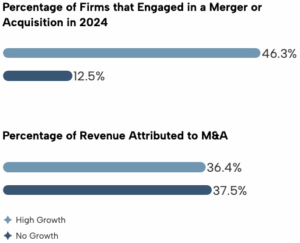

At Hinge, we research probably the most profitable corporations to grasp what works and doesn’t work in the true world. After we checked out M&A, nearly half of high-growth corporations—those who obtain a minimum of 20% income development over a consecutive three-year interval—have been a part of a merger or acquisition in 2024.

We additionally checked out what proportion of income was attributed to M&A. In 2024, that amounted to greater than a 3rd of income at each high-growth and no-growth corporations.

Whereas 54% high-growth corporations didn’t interact in M&A in 2024, the truth that 46% did ought to make you sit up and take discover.

However rising by way of acquisitions isn’t proper for each agency. Beneath are 5 widespread challenges to consider and put together for earlier than you make the leap.

5 Challenges When Buying a Agency

1. Monetary Burdens

There are a lot of methods to finance an acquisition, from tapping a agency’s or homeowners’ financial savings to financial institution loans to retained fairness to earnouts. Nonetheless you construction the deal, it can require capital, and that may pressure a enterprise’ funds, particularly in an unsure economic system. If the deal incurs a substantial amount of debt, it will possibly put large stress on either side to generate further income to cowl the curiosity funds whereas additionally hitting monetary targets.

2. Incompatible Cultures

In my work with skilled providers corporations, that is the problem I hear about most frequently. Shopping for a agency is the simple half. Merging two disparate cultures may be devilishly tough. I’ve encountered corporations that run beneath totally totally different enterprise fashions, and integrating groups that function beneath very totally different rulebooks can look like an not possible job. I’ve additionally seen the previous homeowners of the acquired agency—retained in the course of the transition—conflict with the brand new management. And if morale crumbles on the acquired agency, priceless expertise can head for the door.

Now, tradition will not be all the time a big problem. If the 2 corporations are comparable (reminiscent of two conventional accounting corporations coming collectively), or if the buying agency gives extra flexibility and advantages than the acquired agency, it may be a comparatively seamless transition. However even in these instances, integrating everybody right into a unified group can take endurance and empathy.

3. Model Confusion

A agency that acquires one other has to make a basic determination: do they roll the agency into group, or do they permit the acquired group to retain its title and model? Both means, the transaction can generate confusion and nervousness within the market. If the acquired agency is sucked into the mom ship, the previous agency’s purchasers—who might know little in regards to the acquirer—usually fear that the connection and belief they’ve constructed over all these years will probably be misplaced. They could start to marvel “Who is that this new agency that’s been thrust on us?” They could start to go searching at their choices.

If, however, the acquired agency retains its model, the acquirer receives comparatively few advertising and marketing advantages. It gained’t be significantly better identified within the acquired agency’s market. And it should help and market two manufacturers fairly than one. On prime of that, individuals within the market who know in regards to the transaction might marvel what’s modified beneath the hood.

4. Anticipated Synergies By no means Emerge

Whereas the buzzword “synergy” isn’t as ubiquitous because it was twenty-five years in the past, the idea lives on. Suppose you purchase a agency that guarantees so as to add new capabilities to yours—say, a brand new space of experience or a brand new know-how—you would possibly moderately anticipate the mixed forces to create highly effective new alternatives. The sum to be higher than the elements. However issues don’t all the time work out the way in which you deliberate. Your purchasers may not be as excited as you might be about this shiny new addition. Or the brand new efficiencies you anticipated might by no means emerge. Any variety of issues can flip “aha!” into “uh-oh!”

5. Expensive Distraction

The acquisition course of is advanced. It requires a substantial amount of consideration from prime administration. And a transaction can take 6 to 12 months or extra to finish. Within the meantime, if you happen to take your eyes off your personal enterprise it’s possible you’ll uncover that new alternatives decline, supply issues go unaddressed or your staff grows resentful as it’s loaded with further duties.

Plan for Success

These challenges are usually not insurmountable, because the excessive proportion of M&A exercise at high-growth corporations bears out. The secret’s to anticipate them and consider every potential acquisition with every in thoughts. You may keep away from most pitfalls you probably have a transparent plan to deal with them.

Do the Due Diligence—It’s all too straightforward to succumb to wishful considering and assume the whole lot will work out as a result of, for instance, you and the opposite agency’s homeowners like one another. Dig into the funds, ask uncomfortable questions and attempt to uncover the whole lot you may in regards to the agency earlier than you enter right into a deal.

Talk Clearly—Many offers are performed in secret. Whereas it might make sense to maintain issues confidential in the course of the exploratory stage, conserving the proceedings secret too lengthy can create issues. Workers, notably on the acquired agency, hardly ever recognize a shock. In the event that they be taught on the final minute that they’re being purchased, they might bounce to conclusions—and bounce ship. As a substitute, let each groups know as early within the course of as practicable, even when the deal isn’t sure to shut. Clarify why it’s taking place and the way it will create new alternatives for them. Maintain Q&A classes. Be open and candid. You should still lose a couple of individuals, however most will recognize the honesty and advance warning. The longer a staff has to get used to the concept, the better the precise transition will probably be.

You additionally want to speak along with your purchasers. On this case, the timing is much less essential, however when you’re able to announce the change, clarify how the acquisition will profit them: New providers. Deeper experience. A much bigger staff. Extra flexibility.

The acquired agency may even must guarantee their purchasers what’s going to and gained’t change. Relying on the association, which may embrace messages like these: “Your engagement staff won’t change”; “The standard of our work will get even higher”; or “We are able to now offer you entry to specialised experience we didn’t have earlier than.”

Plan for Contingencies—What issues would possibly you encounter when merging the 2 cultures? How will you sort out them? What if the hoped-for synergies don’t seem? What are the ramifications and the way will you deal with them? What are your monetary dangers, and what’s going to you do if you happen to expertise monetary pressure? Pondering forward permits you to react rapidly earlier than a fireplace blows uncontrolled.

An acquisition development technique isn’t for everybody. However for corporations that wish to develop rapidly, enter new markets the place they’re unknown or achieve entry to new individuals and expertise, a well-executed acquisition may be the quickest, most effective path to their vacation spot.